Smith & Nephew plc ADR (SNN)

Smith & Nephew (SNN), HOPCo to Enhance Musculoskeletal Care

Smith & Nephew (SNN) announces a collaboration with HOPCo to focus on enhancing solutions for ASC customers, physicians, and patients through the latter's digital health and analytics platforms.

Smith & Nephew shares rise as profit beats market forecast

Smith & Nephew's shares rose 9% on Thursday after the British medical equipment maker's half-year profit beat market forecast, helped by a strong performance in its orthopaedics segment.

Should Value Investors Buy Smith & Nephew SNATS (SNN) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Smith & Nephew's (SNN) CATALYSTEM System Gets FDA Clearance

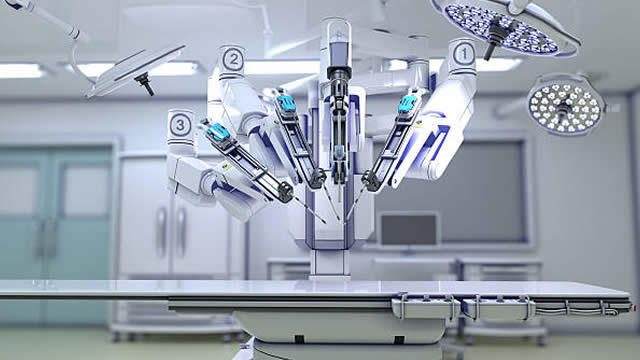

Smith & Nephew (SNN) announces the receipt of FDA clearance for its new CATALYSTEM Primary Hip System, which is intended to address the demands of primary hip surgery.

Activist Cevian has a stake in medical device company Smith & Nephew. How it may help improve margins

British company Smith & Nephew is already a global leader in medical tech. Cevian could help it boost its profitability.

Smith & Nephew's (SNN) 5% Stake Acquired by Cevian Capital

Smith & Nephew (SNN) eyes future growth as Cevian Capital purchases a 5% stake in the company.

Activist Investor Takes Stake In Sports Medicine Player Smith & Nephew, Shares Surge

Shares of Smith & Nephew Plc SNN are trading higher on Friday. Smith+Nephew offers a medical technology portfolio across orthopedics, sports medicine, ENT, and advanced wound management.

Smith & Nephew shares surge as activist Cevian Capital reveals 5% stake

Activist investor Cevian Capital on Thursday revealed it has built up a 5% stake in British medical equipment seller Smith & Nephew, causing shares in the struggling FTSE-100 company to surge.

Smith & Nephew's (SNN) CORIOGRAPH to Aid Arthroplasty Procedure

Smith & Nephew (SNN) announces the launch of its new CORIOGRAPH Pre-Operative Planning and Modeling Services, exclusively for use with the CORI Surgical System.

Smith & Nephew: Work To Be Done But Still Long-Term Potential

Smith & Nephew's share price has increased by 14% since September 2022, indicating undervaluation. The company showed decent top line growth with a 6.4% increase in revenue last year. While the company's growth plans are transforming the business, there are concerns about the actual performance and management quality.

National Bank of Canada FI Has $53,000 Stake in Smith & Nephew plc (NYSE:SNN)

National Bank of Canada FI lifted its position in shares of Smith & Nephew plc (NYSE:SNN – Free Report) by 36.0% in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,967 shares of the medical equipment provider’s stock after buying an additional 521 shares during the period. National Bank of Canada FI’s holdings in Smith & Nephew were worth $53,000 at the end of the most recent quarter. Other institutional investors and hedge funds also recently modified their holdings of the company. Scharf Investments LLC boosted its position in shares of Smith & Nephew by 20.5% during the fourth quarter. Scharf Investments LLC now owns 2,980,334 shares of the medical equipment provider’s stock worth $81,304,000 after buying an additional 506,474 shares during the period. PNC Financial Services Group Inc. grew its stake in Smith & Nephew by 17.4% in the third quarter. PNC Financial Services Group Inc. now owns 36,315 shares of the medical equipment provider’s stock valued at $900,000 after purchasing an additional 5,384 shares in the last quarter. Seed Wealth Management Inc. acquired a new position in shares of Smith & Nephew during the 4th quarter worth approximately $213,000. London & Capital Asset Management Ltd bought a new stake in shares of Smith & Nephew during the 4th quarter worth approximately $1,054,000. Finally, Kornitzer Capital Management Inc. KS raised its stake in shares of Smith & Nephew by 38.8% during the 4th quarter. Kornitzer Capital Management Inc. KS now owns 245,609 shares of the medical equipment provider’s stock worth $6,700,000 after purchasing an additional 68,609 shares in the last quarter. 25.64% of the stock is owned by institutional investors and hedge funds. Smith & Nephew Stock Up 0.9 % Shares of NYSE:SNN opened at $26.09 on Monday. Smith & Nephew plc has a 52-week low of $21.52 and a 52-week high of $32.36. The company has a current ratio of 1.77, a quick ratio of 0.72 and a debt-to-equity ratio of 0.44. The company has a 50-day simple moving average of $25.21 and a 200 day simple moving average of $26.29. Smith & Nephew Dividend Announcement The firm also recently disclosed a semi-annual dividend, which will be paid on Wednesday, May 22nd. Stockholders of record on Tuesday, April 2nd will be given a $0.462 dividend. The ex-dividend date of this dividend is Monday, April 1st. This represents a dividend yield of 2.8%. Wall Street Analyst Weigh In Separately, StockNews.com downgraded shares of Smith & Nephew from a “strong-buy” rating to a “buy” rating in a report on Monday, May 13th. Three investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of “Moderate Buy”. View Our Latest Stock Analysis on Smith & Nephew About Smith & Nephew (Free Report) Smith & Nephew plc, together with its subsidiaries, develops, manufactures, markets, and sells medical devices and services in the United Kingdom and internationally. It operates through three segments: Orthopaedics, Sports Medicine & ENT, and Advanced Wound Management. The company offers knee implant products for knee replacement procedures; hip implants for revision procedures; trauma and extremities products that include internal and external devices used in the stabilization of severe fractures and deformity correction procedures; and other reconstruction products. Read More Five stocks we like better than Smith & Nephew Canada Bond Market Holiday: How to Invest and Trade MarketBeat Week in Review – 5/13 – 5/17 What is a Special Dividend? Take-Two Interactive Software Offers 2nd Chance for Investors Are These Liquid Natural Gas Stocks Ready For An Upside Bounce? Deere & Company’s Q2 Report: Strong Revenue, Cautious Outlook