Southern Company (SO)

Analysts Estimate Southern Co. (SO) to Report a Decline in Earnings: What to Look Out for

Southern Co. (SO) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Southern Co. (SO) Exceeds Market Returns: Some Facts to Consider

Southern Co. (SO) closed the most recent trading day at $95.85, moving +1.12% from the previous trading session.

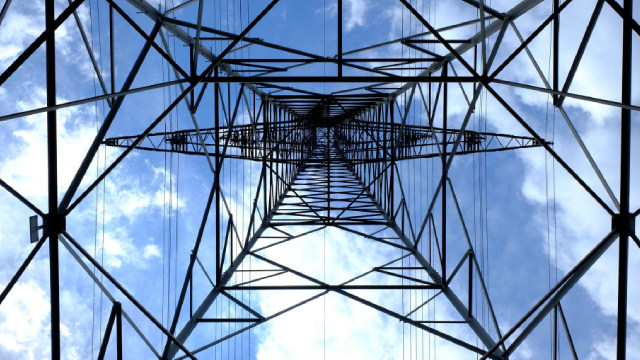

Southern Company's Power Plan Gets a Nod to Meet Surging AI Demand

SO's forward-looking power plan gets approval from the Georgia regulator to expand capacity, enhance reliability and boost renewables amid AI growth drive.

Here's Why Holding Southern Company Is Justified for Now

SO offers dividend stability and load growth potential, but faces risks from tariffs, execution delays and rising interest costs.

Southern Company's Georgia Power Freezes Base Rates Through 2028

SO's Georgia Power is set to provide stable base rates to customers through 2028, as the Georgia PSC approved a plan supporting affordable energy across the state.

Southern's Units Expand RNG Portfolio, Boost Clean Energy Goals

SO's subsidiaries boost clean energy push with new RNG buys, preventing 18,978 metric tons of Carbon dioxide equivalent emissions.

A Pair Trade Opportunity By The Southern Company Baby Bonds

Rising global tensions make defensive, low-credit-risk pair trades attractive; Southern Company's baby bonds, SOJE and SOJF, present such an opportunity. Southern Company's strong regulated business, stable credit rating, and consistent dividend growth make its baby bonds attractive for pair trading. SOJE offers better upside potential and less downside risk than SOJF; current pricing creates a credit risk-free opportunity for savvy investors.

Final Trades: Southern Company, Uber, the IEO and the IYM

The Investment Committee give you their top stocks to watch for the second half.

Southern's Unit Achieves 50% Hydrogen Blend in Natural Gas Turbine

SO's unit, Georgia Power, in partnership with Mitsubishi Power, hits a milestone with the world's largest 50% hydrogen blend test on a gas turbine.

Southern Co. (SO) Stock Drops Despite Market Gains: Important Facts to Note

Southern Co. (SO) closed the most recent trading day at $88.94, moving 1.56% from the previous trading session.

Southern Company: Data Center Expansion Is Strong Catalyst; Initiate With 'Strong Buy'

I initiate a 'Strong Buy' on Southern Company, with a fair value estimate of $104 per share, citing robust business growth prospects. Southern's diversified energy mix and strategic shift toward renewables position it well for long-term stability and sustainability. Surging electricity demand from data centers and AI-driven hyperscalers in the Southeast underpins strong revenue and EPS growth outlook.

Southern Copper Corporation: Downside Risk Too High To Justify A Buy. I'll Pass For Now

Southern Copper's financials are strong, with record revenue and cash flow, but the stock trades at very high multiples for a commodity company. Copper's long-term demand outlook is positive, yet current high prices and cyclical risks make buying at these levels unattractive. Grupo México's dominant ownership of SCCO poses governance risks for minority shareholders, including limited influence and potential for privatization at lower prices.