Sensata Technologies Holding plc (ST)

Sensata's Q2 Earnings & Revenues Surpass Estimates, Decrease Y/Y

ST's Q2 revenues fall 8.9% but top forecasts, as growth in Sensing Solutions helps soften weakness in Performance Sensing.

Sensata Technologies Holding PLC (ST) Q2 2025 Earnings Call Transcript

Sensata Technologies Holding PLC (NYSE:ST ) Q2 2025 Earnings Conference Call July 29, 2025 5:00 PM ET Company Participants R - Corporate Participant a - Corporate Participant h - Corporate Participant e - Corporate Participant Andrew Charles Lynch - CFO & Executive VP James Entwistle - Corporate Participant Stephan Von Schuckmann - CEO & Director Conference Call Participants Christopher D. Glynn - Oppenheimer & Co. Inc., Research Division Joseph Craig Giordano - TD Cowen, Research Division Joseph Robert Spak - UBS Investment Bank, Research Division Konstandinos Evangelos Tasoulis - Wells Fargo Securities, LLC, Research Division Luke L.

Sensata (ST) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for Sensata (ST) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Sensata (ST) Q2 Earnings and Revenues Beat Estimates

Sensata (ST) came out with quarterly earnings of $0.87 per share, beating the Zacks Consensus Estimate of $0.84 per share. This compares to earnings of $0.93 per share a year ago.

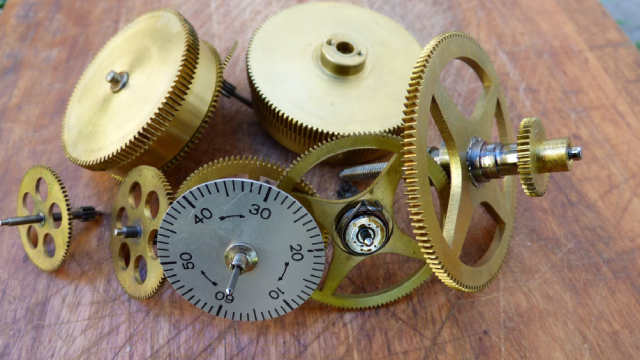

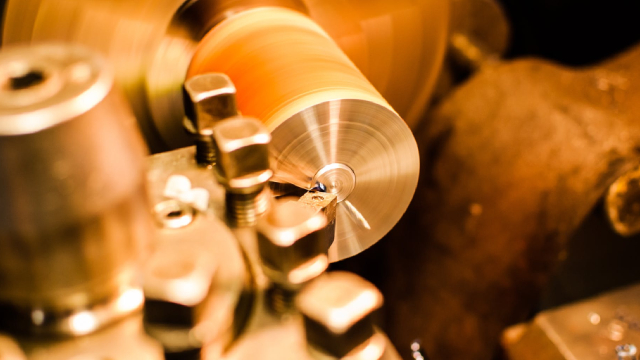

3 Instruments Stocks Set to Benefit From Industrial Automation

The increasing adoption of industrial automation, focus on higher energy efficiency and optimum resource utilization should drive the Zacks Instruments - Control industry. WTS, ST and THR are well-positioned to gain from the evolving market dynamics.

Should Value Investors Buy Sensata Technologies Holding (ST) Stock?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Sensata (ST) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

Sensata (ST) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

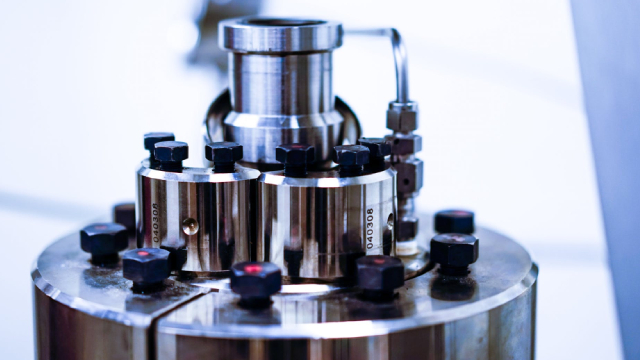

ST Unveils High-Efficiency Contactor for Smooth EV Voltage Transition

Sensata's new High Efficiency Contactor tackles EV charging challenges with seamless 400V/800V switching and top-tier safety.

Should You Buy Sensata (ST) After Golden Cross?

Sensata Technologies Holding N.V. (ST) is looking like an interesting pick from a technical perspective, as the company reached a key level of support.

Are Investors Undervaluing Sensata Technologies Holding (ST) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Sensata Technologies Holding: Margin Strength And EV Exposure At Value Price

Sensata is focused on long-term growth in EVs, industrial automation, and aerospace, despite current revenue headwinds in the auto and HVOR markets. Operational improvements, cost discipline, and a shift to higher-margin segments like Sensing Solutions are supporting margins and cash flow. The stock trades at a steep discount (14x forward P/E, 10x EV/EBITDA), offering a margin of safety and 20–50% potential upside if demand rebounds.

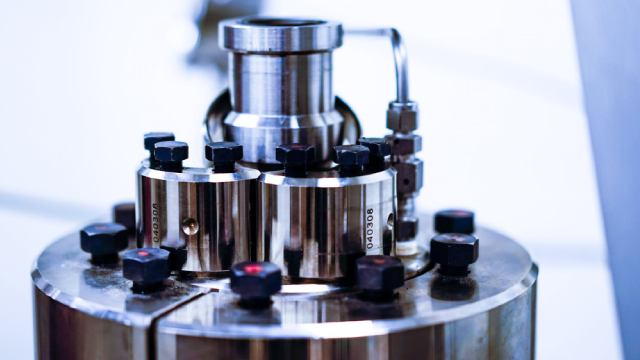

Sensata's Dynapower Unveils MV Integrated PowerSkid: Stock to Gain?

ST's Dynapower launches the MV Integrated PowerSkid to meet soaring demand for flexible, high-voltage energy solutions.