Texas Instruments Inc (TXN)

Here is What to Know Beyond Why Texas Instruments Incorporated (TXN) is a Trending Stock

Zacks.com users have recently been watching Texas Instruments (TXN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Here's Why Texas Instruments (TXN) is a Strong Growth Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Texas Instruments (TXN) Reliance on International Sales: What Investors Need to Know

Explore how Texas Instruments' (TXN) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

Texas Instruments Executes a $7.5B Deal and an AI Strategy Pivot

Semiconductor investors have spent much of the last year waiting for the cycle to turn, but Texas Instruments NASDAQ: TXN has decided not to wait any longer. In early February 2026, the Dallas-based chipmaker signaled a massive shift in its corporate strategy.

Is Trending Stock Texas Instruments Incorporated (TXN) a Buy Now?

Texas Instruments (TXN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Texas Instruments: Cautiously Optimistic From Here

Texas Instruments (TXN) posted in-line Q4 results, with gross margin upside and a modestly above-seasonal revenue guide supporting a cautious recovery narrative. TXN's data center segment is now formalized, growing ~70% YoY to a $450M quarterly run rate, while industrial and automotive remain key but incremental drivers. Capex intensity remains a headwind, but management signals 2026 capex could drop to $2–3B, potentially shifting focus back to free cash flow generation.

Texas Instruments: The Long Game Is Finally Taking Shape

Texas Instruments: The Long Game Is Finally Taking Shape

Why Texas Instruments (TXN) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Why Texas Instruments' 2026 Outlook Has Wall Street Re-Rating It

Texas Instruments NASDAQ: TXN is on track to break out of a long-term trading range, set a new high, and embark on a significant rally. The company's Q4 2025 earnings release and 2026 outlook not only affirmed the recovery in analog semiconductor markets but also the importance of those markets with regard to AI.

What Makes Texas Instruments (TXN) a Strong Momentum Stock: Buy Now?

Does Texas Instruments (TXN) have what it takes to be a top stock pick for momentum investors? Let's find out.

Texas Instruments Q4 2025 Update

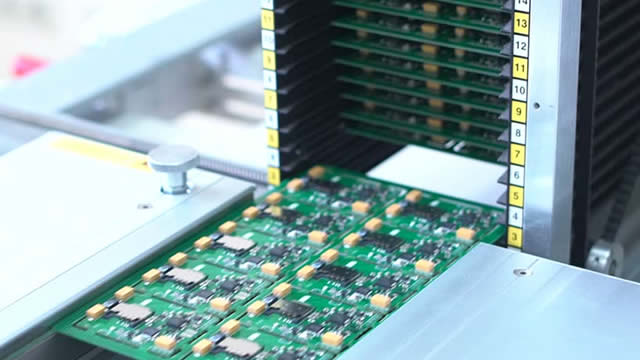

Texas Instruments' revenue from data center which includes sectors related to data center compute, data center networking, rack power, and thermal management. Data center has been growing for 7 consecutive quarters, and looking at their estimate of eventual size of data center business, it is likely to continue to grow in the coming years. Gross margin was down both QoQ and YoY; however, operating margin improved by ~86 bps YoY in 4Q'25.

Texas Instruments Q4 Review: Free Cash Flow Growth Signals A Major Inflection Point

Texas Instruments Incorporated delivered lackluster Q4 results, but strong Q1 guidance and surging data center demand drove shares up over 8%. TXN's free cash flow nearly doubled year-over-year to $2.94B, fueled by lower CapEx and CHIPS Act incentives, positioning the company for enhanced shareholder returns. Data center revenue grew 70% year-over-year, now comprising 9% of total revenue, with management expecting continued momentum and above-average margins.