Vistra Corp (VST)

Vistra to Release Q4 Earnings: How Will the Stock Perform This Season?

VST heads into Q4 earnings with revenues seen up 32% and EPS up 120%, but a negative ESP clouds chances of a surprise beat.

Unlocking Q4 Potential of Vistra (VST): Exploring Wall Street Estimates for Key Metrics

Get a deeper insight into the potential performance of Vistra (VST) for the quarter ended December 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Vistra Corp. (VST) Reports Next Week: Wall Street Expects Earnings Growth

Vistra (VST) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Vistra Corp. (VST) Stock Drops Despite Market Gains: Important Facts to Note

Vistra Corp. (VST) closed the most recent trading day at $170.57, moving 1.79% from the previous trading session.

Investors Heavily Search Vistra Corp. (VST): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Vistra (VST). This makes it worthwhile to examine what the stock has in store.

Vistra Stock Looks Ready to Topple Technical Resistance

Vistra Corp (NYSE:VST) stock is up 1.4% to trade at $173.87 at last glance, while sporting a 10.9% nine-month lead.

Vistra Corp. (VST) Falls More Steeply Than Broader Market: What Investors Need to Know

The latest trading day saw Vistra Corp. (VST) settling at $142.52, representing a -6.85% change from its previous close.

Here is What to Know Beyond Why Vistra Corp. (VST) is a Trending Stock

Vistra (VST) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Vistra vs. Public Service Enterprise: Which Utility Stock Stands Out?

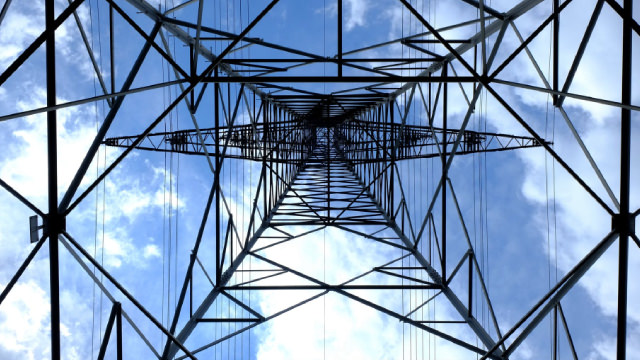

VST and PEG continue to efficiently serve their customers, the power generated from the nuclear power plants allows them to provide a large volume of emission-free electricity.

Here's Why Vistra Corp. (VST) Fell More Than Broader Market

In the latest trading session, Vistra Corp. (VST) closed at $162.58, marking a -1.85% move from the previous day.

Vistra's Growth Trajectory: Why The Stock Is Poised To Rise, But Better Plays Exist

Vistra Corp is positioned for sustained growth through recent acquisitions, notably Energy Harbor and Cogentrix, bolstering its generation capacity and nuclear footprint. VST expects EBITDA above $7.4 billion by 2027, with nearly all 2026 generation hedged. Capital allocation through 2027 targets $10 billion, prioritizing buybacks over dividends, with modest dividend growth and ongoing debt reduction to maintain financial flexibility.

Vistra: Pullback Driven By Accounting Optics, Not Fundamentals

Vistra Corp. (VST) is undervalued due to market misperceptions of earnings volatility, despite disciplined hedging and robust cash generation. Recent share price weakness reflects non-cash GAAP hedge losses and not fundamental deterioration; management reaffirmed guidance and introduced strong 2026 EBITDA/FCF growth targets. Vistra's capital allocation framework targets $10 billion in deployment through 2027, blending aggressive buybacks, balance sheet optimization, and high-return reinvestments.