SPDR S&P Semiconductor ETF (XSD)

Summary

XSD Chart

Is State Street SPDR S&P Semiconductor ETF (XSD) a Strong ETF Right Now?

Designed to provide broad exposure to the Technology ETFs category of the market, the State Street SPDR S&P Semiconductor ETF (XSD) is a smart beta exchange traded fund launched on 01/31/2006.

Should You Invest in the State Street SPDR S&P Semiconductor ETF (XSD)?

If you're interested in broad exposure to the Technology - Semiconductors segment of the equity market, look no further than the State Street SPDR S&P Semiconductor ETF (XSD), a passively managed exchange traded fund launched on January 31, 2006.

XSD ETF: Upside Is Exhausted At This Point, But Stay On (Rating Downgrade)

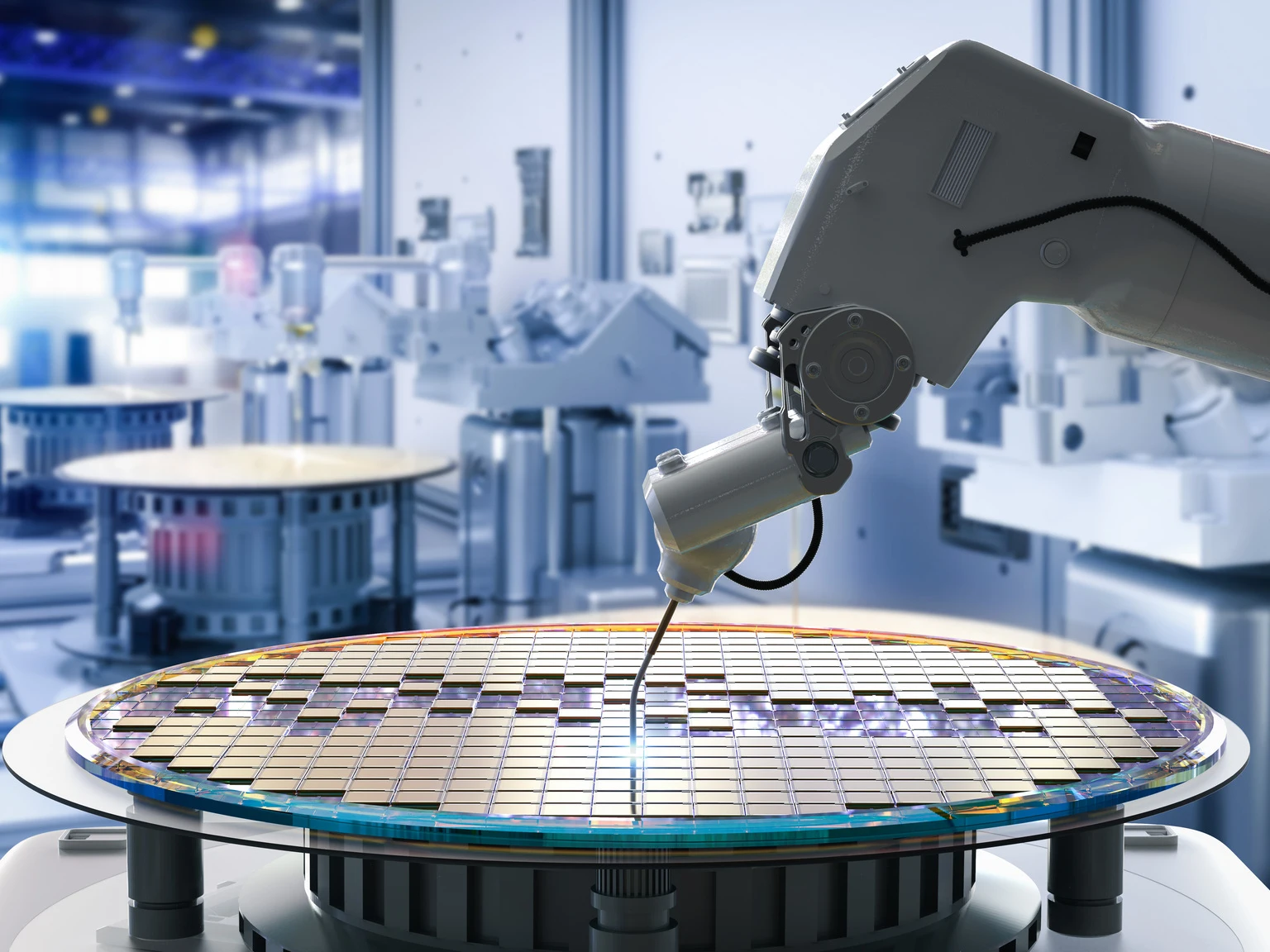

XSD ETF provides a balanced exposure to the U.S. semiconductor market. The fund omits the overweight positions in top-tier chipmakers for the benefit of new disruptive technologies. XSD offers no meaningful upside at this point, but the AI market is evolving faster than expected.

SPDR S&P Semiconductor ETF (XSD) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

Has SPDR S&P Semiconductor ETF ever had a stock split?

SPDR S&P Semiconductor ETF Profile

| ARCA Exchange | US Country |

Overview

The company in question is focused on mirroring the performance of the S&P Semiconductor Select Industry Index, which is an indicator of the semiconductors sector within the broader S&P Total Market Index (S&P TMI). This endeavor is pursued through a strategy known as sampling, where the company invests most, if not all, of its assets into the securities that comprise the index. Specifically, it commits at least 80% of its total assets to these securities, demonstrating a significant dedication to closely following the index's movements. The index itself is a representation of the semiconductor industry's segment, highlighting the company's specialized investment focus within the technology sector.

Products and Services

- Sampling Strategy Investment

This service involves the strategic investment of substantially all, and at a minimum 80%, of the company’s total assets into the securities that make up the S&P Semiconductor Select Industry Index. The goal here is to replicate the index's performance as closely as possible, which in turn represents the semiconductor sector's performance within the broader market. This method allows the company to make informed investment decisions based on a broad analysis of the sector's performance.