Super Micro Computer, Inc. (SMCI)

SMCI Stock To $60?

Super Micro Computer (SMCI) stock has declined by 28.4% in under a month, dropping from $58.68 on 10/8/2025 to $42.03 currently. The selloff was driven by disappointing first-quarter fiscal 2026 earnings results released in early November 2025.

Super Micro Computer: Growth Without Leverage (Rating Downgrade)

Super Micro Computer is downgraded to hold due to disappointing execution despite strong AI demand and capacity expansion narratives. SMCI reported two consecutive quarters of revenue and EPS misses, with weak guidance and falling profitability amid intensifying competition. The company's revenue growth is not translating into proportional EPS gains, raising concerns about operational leverage and cost control.

Supermicro shares fall on fiscal first quarter earnings miss

Super Micro Computer Inc (NASDAQ:SMCI) shares fell more than 7% after it reported fiscal first quarter 2026 results that came in below Wall Street expectations, with both revenue and earnings down from the prior year. For the quarter ended September 30, 2025, the company posted net sales of $5 billion, down from $5.9 billion in the year-ago quarter and below analyst estimates of around $6 billion.

Super Micro: The Company I'll Never Trust (Rating Upgrade)

Super Micro Computer (SMCI) has persistent earnings misses, and this quarter is not an exception. SMCI's management has a history of overpromising and underdelivering, with shrinking margins and heavy reliance on NVIDIA as a major risk. Despite strong revenue growth potential and large NVIDIA-related orders, SMCI's lack of pricing power and management trust remain concerns.

Super Micro shares slip as delivery delays stall AI momentum

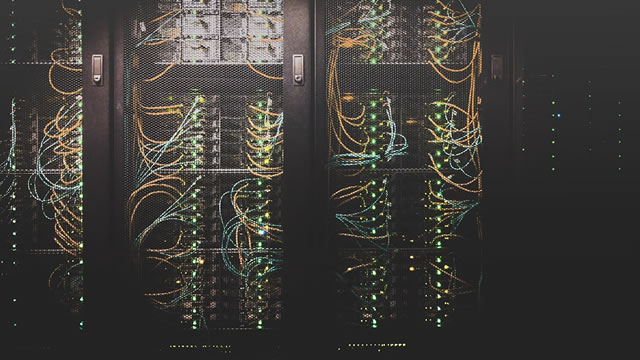

Super Micro Computer's shares slipped more than 9% in premarket trading on Wednesday after the artificial intelligence (AI)-focused server maker missed quarterly profit and revenue estimates, citing delayed deliveries tied to design changes.

Super Micro Computer: Driving Sales At The Expense Of Margins - Sell

While Super Micro Computer reported Q1/FY2026 results in line with the company's October 23 preannouncement, results came in well short of management's original expectations. However, with recent large-scale project wins expected to ramp up in the current quarter, revenues are expected to more than double on a sequential basis. Unfortunately, the company's recent order momentum has come at the expense of margins, which are expected to drop by another 300 basis points this quarter.

Super Micro Computer, Inc. (SMCI) Q1 2026 Earnings Call Transcript

Super Micro Computer, Inc. ( SMCI ) Q1 2026 Earnings Call November 4, 2025 5:00 PM EST Company Participants Michael Staiger - Senior Vice President of Corporate Development Charles Liang - Founder, Chairman of the Board, President & CEO David Weigand - Senior VP, CFO, Company Secretary & Chief Compliance Officer Conference Call Participants Asiya Merchant - Citigroup Inc., Research Division Ananda Baruah - Loop Capital Markets LLC, Research Division Ruplu Bhattacharya - BofA Securities, Research Division Nehal Chokshi - Northland Capital Markets, Research Division Shadi Mitwalli - Needham & Company, LLC, Research Division Jonathan Tanwanteng - CJS Securities, Inc. Mark Newman - Sanford C. Bernstein & Co., LLC.

Super Micro stock drops on slumping sales, weak earnings

Super Micro Computer reported weaker-than-expected results for the fiscal first quarter. The stock plummeted in extended trading even though the company issued preliminary results last month to prepare investors for what was coming.

Super Micro Raises Revenue Outlook as Order Book Expands

The server maker now expects revenue for fiscal 2026 to hit at least $36 billion amid rising AI-related demand for Nvidia-equipped servers.

Why Super Micro's stock is falling after earnings — even as guidance moves higher

Super Micro continued to exhibit margin pressure in the latest quarter, reflecting a competitive server market.

Q3 Earnings: Top-Performing AI Stock Set to Report Results

Given the positivity of the Q3 cycle so far, is it reasonable to expect the AI player to keep the momentum rolling? Sales growth is forecasted to be negative for the first time in years.

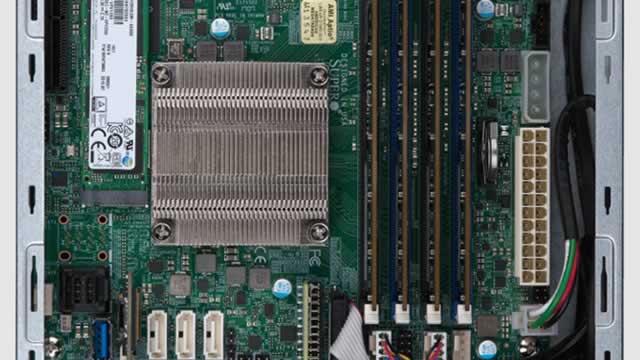

Super Micro Computer: Optimistic Heading Into Q1, But Can't Rule Out An EPS Miss

Despite the October 23 8-K cutting preliminary FQ1 revenue to $5B, Super Micro Computer, Inc. management reiterated ≥$33B FY26 and cited >$12B in new FQ2 design wins. The SMCI downgrade was due to a timing issue and not a cancellation of GB300 rack orders. The Street is still optimistic on the top-line growth from FQ2 onwards. On the execution front, I'll look for reported capacity above 30MW, to confirm throughput sufficient to deliver contracted racks.