Adobe Inc. (ADBE)

Adobe: A Misunderstood Leader, Priced For Busted Growth

Adobe Inc. remains a creative software leader with a strong brand, high margins, and a robust subscription-based business model. The company is aggressively integrating AI across its product suite, driving innovation and exceeding revenue and EPS targets despite market skepticism. The competition is fierce, driven by AI, thus ADBE must invest heavily in R&D to stay ahead. The moat formed by solid financials and high margins protects the business, though.

Why Adobe Systems (ADBE) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Is It Time To Buy Adobe Stock?

Adobe (ADBE) stock should be added to your watch list. Here's why – it is presently trading within the support range ($320.60 – $354.34), levels where it has previously experienced notable rebounds.

Adobe: The Forgotten AI Winner Looking Ready For A Breakout

Adobe is positioned to benefit from AI, leveraging Firefly and seamless integration to strengthen its creative software moat. Adobe's AI strategy enhances productivity, ensures commercially safe content, and expands its addressable market through usage-based monetization. Valuation is highly attractive, with shares trading at a multi-year low and a significant discount to peers despite superior margins and growth prospects.

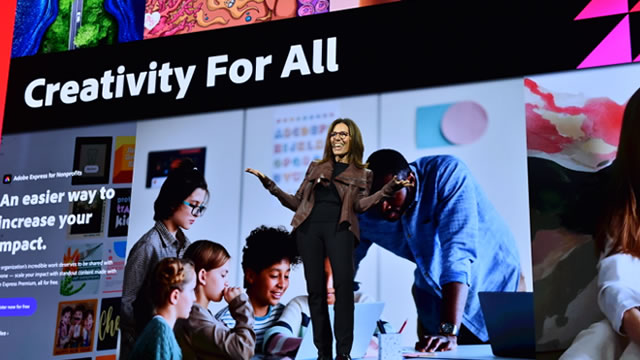

Adobe Aims to Reassure Investors as AI Transforms Markets for Creative Software

While Adobe's annual conference held this week focused on retaining the business of marketers, filmmakers and content creators, it reportedly also sought to reassure investors.

Which Stock Will Rally: Adobe Or Oracle?

Although Oracle experienced a decline of -6.7% in the past day, its counterpart Adobe might be a more favorable option. Regularly assessing alternatives is fundamental to a solid investment strategy.

Adobe Stock Dropped Yesterday, Should You Buy It Now?

Adobe's stock (NASDAQ: ADBE) experienced a significant 6.1% single-day decrease yesterday, October 29, 2025.

Adobe To Release AI-Powered Video Editing System ‘Project Frame Forward'

EXCLUSIVE: Adobe is introducing Project Frame Forward, an AI-powered system designed to improve the process of editing video. The setup will be unveiled Wednesday evening during the company's annual Max Creativity Conference, a multi-day event in Los Angeles attended by more than 10,000 people.

Adobe Inc. (ADBE) Presents at Adobe MAX - The Creativity Conference Transcript

Adobe Inc. (NASDAQ:ADBE ) Adobe MAX - The Creativity Conference October 28, 2025 4:30 PM EDT Company Participants Doug Clark Shantanu Narayen - Chairman & CEO David Wadhwani - President of Digital Media Business Anil Chakravarthy - President of Digital Experience Business Daniel Durn - CFO and Executive VP of Finance, Technology, Security & Operations Conference Call Participants Jay Vleeschhouwer - Griffin Securities, Inc., Research Division Kasthuri Rangan - Goldman Sachs Group, Inc., Research Division Saket Kalia - Barclays Bank PLC, Research Division Aleksandr Zukin - Wolfe Research, LLC Mark Murphy - JPMorgan Chase & Co, Research Division Michael Turrin - Wells Fargo Securities, LLC, Research Division Keith Bachman - BMO Capital Markets Equity Research Presentation Doug Clark Okay. Welcome, everyone.

Brokers Suggest Investing in Adobe (ADBE): Read This Before Placing a Bet

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Why Adobe Systems (ADBE) is a Top Stock for the Long-Term

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

Adobe Stock Pricing Powerhouse Now 38% Cheaper, Buy?

Adobe (ADBE) stock merits your attention. Why? Because it offers monopoly-like high margins at a discounted price.