Advanced Micro Devices, Inc. (AMD)

Exclusive: 'Neocloud' Crusoe to buy $400 million worth of AMD chips for AI data centers

Crusoe CEO Chase Lochmiller said on Thursday the artificial intelligence data center builder planned to purchase roughly $400 million worth of AI chips from Advanced Micro Devices to add to its portfolio of computing power.

AMD CEO unveils new AI chips

Advanced Micro Devices CEO Lisa Su showed off a new crop of artificial intelligence chips that will compete with the flagship processors designed by Nvidia.

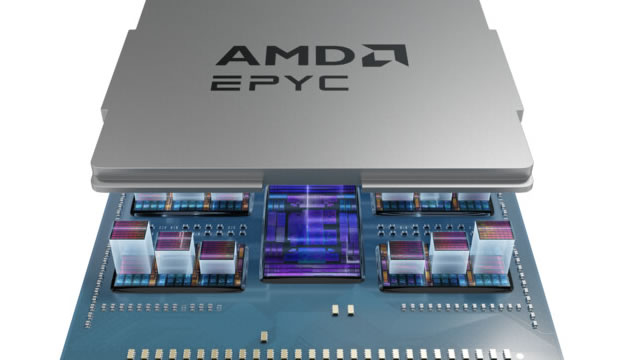

Can Advanced Micro Devices EPYC Drive Data Center Revenue Growth?

AMD gains momentum in the data center market as EPYC processor adoption expands across key tech sectors.

What You Need To Know Ahead of AMD's ‘Advancing AI' Event Tomorrow

Advanced Micro Devices (AMD) CEO Lisa Su is set to take the stage tomorrow for a keynote presentation on the chipmaker's latest developments in artificial intelligence.

What Nvidia, AMD, CoreWeave, and Nebius Stock Investors Should Know About Recent AI Updates

In today's video, I discuss recent updates impacting Nvidia (NVDA 0.86%) and other semiconductor companies. To learn more, check out the short video, consider subscribing, and click the special offer link below.

AMD: Strong EPS Growth Momentum Can Improve Valuation Multiple

Advanced Micro Devices, Inc. is showing a strong growth trajectory in Data Center segment and specifically its AI chip sales which has not been fully priced in. In 2024, AMD reported $12.6 billion in Data Center revenue, up 94% YoY, and in fiscal 2025 the Data Center revenue could easily top $20 billion. AMD is playing for the second position in AI chip business behind Nvidia, but the investment return potential for AMD are much stronger as the revenue share of AI business.

AMD: A Strong Candidate For A Collar Strategy

AMD stands out as a strong candidate for a collar strategy, offering solid fundamentals, technical momentum, and a compelling risk/reward setup in today's market. By using a collar (buying shares, selling a call, and buying a put), I can cap downside risk to about $6 per share while targeting $29 upside over 12 months. AMD's underperformance versus the Nasdaq and its attractive price trend make it a timely opportunity for risk-managed investors seeking exposure to quality tech.

AMD Stock Continues To Be A No Brainer (Technical Analysis)

AMD remains a buy as technicals show a bullish outlook, with strong support levels and an intact uptrend, despite some caution from Fibonacci Fan Lines. Q1 earnings were impressive, with 36% YoY revenue growth and 57% YoY growth in the Data Center segment, highlighting AI business strength. Q2 guidance projects continued above-average revenue growth, and gross margins would be strong if not for China's export controls.

AMD acqui-hires the employees behind Untether AI

AMD is continuing its acquisition spree.

Is Trending Stock Advanced Micro Devices, Inc. (AMD) a Buy Now?

Zacks.com users have recently been watching Advanced Micro (AMD) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

AMD: Trend Reversal In Sight

I upgraded my rating to a strong buy. Call options are expensive (high IV), so I haven't opened a long position in this stock. Q1 results show a continuation in growth, driven by the data center and (finally) the client segments. The upcoming launch of the MI350 series is a nice catalyst ahead. The partnership with Oracle and Humain is a clear indication that AI infrastructure companies are betting on AMD's GPUs and (emphasis) CPUs.

AMD vs. Semtech: Which Semiconductor Stock Is the Better Buy Now?

Advanced Micro Devices and SMTC are well-known players in the semiconductor market. Let's find out which one is a better investment option right now.