Eaton Corporation plc (ETN)

Summary

Eaton Corporation, PLC (ETN) is Attracting Investor Attention: Here is What You Should Know

Eaton (ETN) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Wall Street Analysts See Eaton (ETN) as a Buy: Should You Invest?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Eaton (ETN) Ascends While Market Falls: Some Facts to Note

Eaton (ETN) concluded the recent trading session at $343.39, signifying a +1.7% move from its prior day's close.

Eaton Corporation plc (ETN) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Eaton Corporation plc ever had a stock split?

Eaton Corporation plc Profile

| Machinery Industry | Industrials Sector | Paulo Ruiz Sternadt CEO | NYSE Exchange | G29183103 CUSIP |

| IE Country | 94,443 Employees | 6 Nov 2025 Last Dividend | 1 Mar 2011 Last Split | 1 Jun 1972 IPO Date |

Overview

Eaton Corporation plc functions globally as a comprehensive power management company. Since its establishment in 1911, it has focused on enabling customers to manage electrical, hydraulic, and mechanical power more efficiently, safely, and sustainably. Headquartered in Dublin, Ireland, Eaton delves into a variety of sectors, offering a wide array of products and services. The company operates through distinct segments including Electrical Americas and Electrical Global, Aerospace, Vehicle, and eMobility, each catering to different market needs but unified in pushing for technological advancement and innovation.

Products and Services

- Electrical Components & Industrial Components: This involves the supply of power distribution assemblies, residential products, as well as single and three-phase power quality products. Eaton focuses on enhancing the efficiency and reliability of electrical power management.

- Wiring Devices & Circuit Protection Products: Offering solutions for wiring device needs along with circuit protection products to ensure electrical safety and operational reliability.

- Utility Power Distribution & Power Reliability Equipment: Specialized products for utility power distribution that enhance power reliability and safety, catered to utility and industrial sectors.

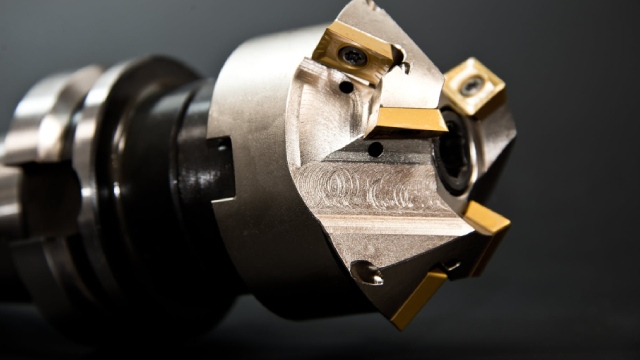

- Aerospace Equipment: Eaton provides a variety of products for commercial and military aircraft, including pumps, motors, hydraulic power units, valves, cylinders, and electro-hydraulic pumps, along with air-to-air refueling systems, and thermal management products. These offerings serve to optimize the performance and safety of aircraft operations.

- Vehicle Drive Systems: The portfolio includes transmissions, clutches, and hybrid power systems designed to improve vehicle performance and efficiency. Eaton’s vehicle segment is particularly noted for its innovation in superchargers and engine valves that contribute to superior vehicle dynamics.

- eMobility Solutions: Responding to the surge in electric and hybrid vehicle production, Eaton’s eMobility segment provides critical components such as voltage inverters, converters, fuses, and circuit protection units. This sector underscores Eaton’s commitment to sustainable transportation solutions.