Eaton Corporation plc (ETN)

Why Is Eaton (ETN) Down 12.9% Since Last Earnings Report?

Eaton (ETN) reported earnings 30 days ago. What's next for the stock?

Eaton Corporation plc (ETN) Presents at UBS Global Industrials and Transportation Conference Transcript

Eaton Corporation plc (ETN) Presents at UBS Global Industrials and Transportation Conference Transcript

Final Trades: FTAI, ETN, COWZ, XBI

The Investment Committee give you their top stocks to watch for the second half.

Eaton Corporation, PLC (ETN) Is a Trending Stock: Facts to Know Before Betting on It

Eaton (ETN) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Top 10 Income Funds From Eaton Vance (November Update)

Eaton Vance's top taxable closed-end funds offer attractive yields, discounts to NAV, and strong long-term returns, making them appealing for income-focused investors. Current market volatility has widened discounts to NAV, creating buying opportunities which I highlight in the article. I prioritize funds trading at an 8%+ yield and significant NAV discounts, with a preference for those using tax-advantaged strategies and diversified asset mixes.

Investors Heavily Search Eaton Corporation, PLC (ETN): Here is What You Need to Know

Zacks.com users have recently been watching Eaton (ETN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

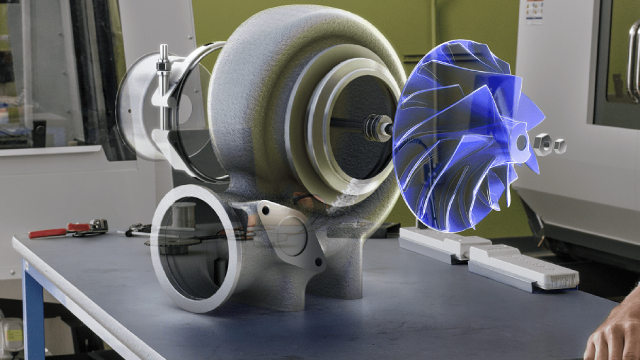

Eaton: Boyd Thermal Deal Adds Data Center Cooling Growth

Eaton Corp. is upgraded to Buy, driven by the transformative $9.5B Boyd Thermal acquisition for data center liquid cooling. The Boyd deal accelerates Eaton's 2026 sales growth to 13.9%, with EPS projected to rise 14.7% to $13.85. Boyd's high-margin, fast-growing liquid cooling business aligns with Eaton's data center offerings, supporting multi-year growth as AI demand surges.

Eaton Corporation plc (ETN) Q3 2025 Earnings Call Transcript

Eaton Corporation plc ( ETN ) Q3 2025 Earnings Call November 4, 2025 11:00 AM EST Company Participants Yan Jin - Senior Vice President of Investor Relations Paulo Sternadt - CEO, President & Director Olivier Leonetti - Executive VP & CFO Conference Call Participants Andrew Obin - BofA Securities, Research Division Andrew Kaplowitz - Citigroup Inc., Research Division Christopher Snyder - Morgan Stanley, Research Division Joseph Ritchie - Goldman Sachs Group, Inc., Research Division Nigel Coe - Wolfe Research, LLC Jeffrey Sprague - Vertical Research Partners, LLC C. Stephen Tusa - JPMorgan Chase & Co, Research Division Deane Dray - RBC Capital Markets, Research Division Scott Davis - Melius Research LLC Presentation Operator Thank you for standing by.

Eaton Q3 Earnings Beat Estimates, Organic Sales Boost Revenues

ETN's third-quarter earnings and sales outperform estimates, fueled by strong organic growth, acquisitions and solid segment gains.

Here's What Key Metrics Tell Us About Eaton (ETN) Q3 Earnings

The headline numbers for Eaton (ETN) give insight into how the company performed in the quarter ended September 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Eaton (ETN) Surpasses Q3 Earnings Estimates

Eaton (ETN) came out with quarterly earnings of $3.07 per share, beating the Zacks Consensus Estimate of $3.06 per share. This compares to earnings of $2.84 per share a year ago.

Eaton to Post Q3 Earnings: What to Expect for the Stock This Season?

ETN is set to report third-quarter results with higher revenues and earnings, fueled by electrification trends and strong order growth.