Eaton Corporation plc (ETN)

Here's Why Eaton (ETN) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Eaton (ETN) Sees a More Significant Dip Than Broader Market: Some Facts to Know

Eaton (ETN) reachead $340.16 at the closing of the latest trading day, reflecting a -0.4% change compared to its last close.

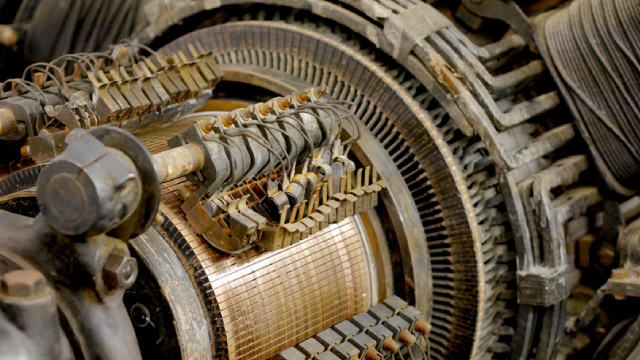

Forging Ahead: 2 Stocks Fueling the Manufacturing Revival

The manufacturing sector is a cornerstone of the American economy, and it is experiencing a revival. Technological advancements and a renewed focus on sustainability drive this revival.

Eaton (ETN) Rises As Market Takes a Dip: Key Facts

Eaton (ETN) concluded the recent trading session at $335.64, signifying a +0.16% move from its prior day's close.

3 Best Industrials Sector Picks for Long-Term Investors in 2025

The industrials sector has been in a period of contraction for most of 2023 and 2024, with sharply mixed performance among different companies during that time. Some firms have thrived, like power management giant Eaton Corp. plc NYSE: ETN, with its nearly 50% returns in the year leading to December 13, 2024.

ETN Stock Price Outperforms Industry in the Last Six Months: Time to Buy?

Eaton's wide global presence, strong ROIC and initiative to increase shareholders' value make it attractive, but our suggestion will be to hold the stock due to its premium valuation.

Eaton Vance's Core Plus Bond ETF Passes $1 Billion in AUM

It's certainly a good time to be an investor in Eaton Vance's fixed income strategies. In the past few weeks, the Eaton Vance Total Return Bond ETF (EVTR) passed $1 billion threshold in assets under management.

Eaton (ETN) is a Top-Ranked Momentum Stock: Should You Buy?

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Why Eaton (ETN) is a Top Growth Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Eaton Corporation, PLC (ETN) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Eaton (ETN). This makes it worthwhile to examine what the stock has in store.

Eaton Corporation, PLC (ETN) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Eaton (ETN). This makes it worthwhile to examine what the stock has in store.

Here's Why Eaton (ETN) is a Strong Momentum Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.