Flowserve Corporation (FLS)

Flowserve (FLS) Is Up 4.57% in One Week: What You Should Know

Does Flowserve (FLS) have what it takes to be a top stock pick for momentum investors? Let's find out.

Here's Why Flowserve (FLS) is a Strong Momentum Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Flowserve Corporation: Capitalize On Booming End-Market Trends And Solid Execution

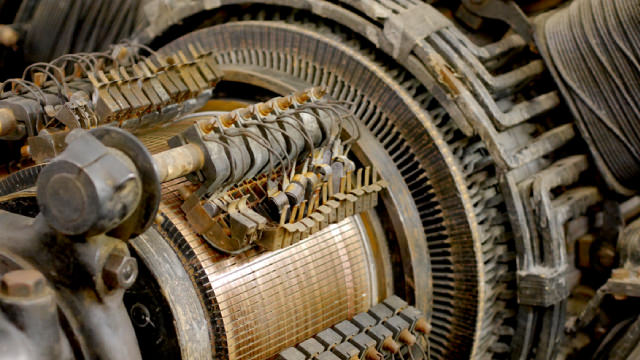

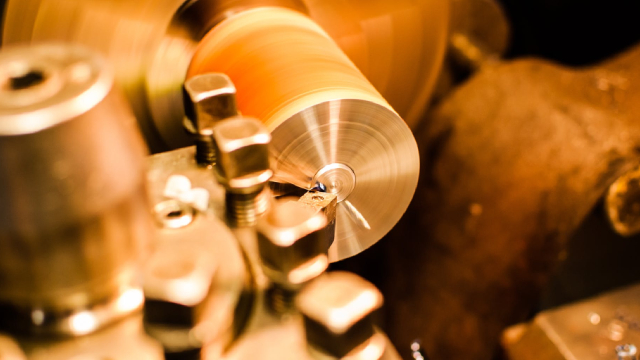

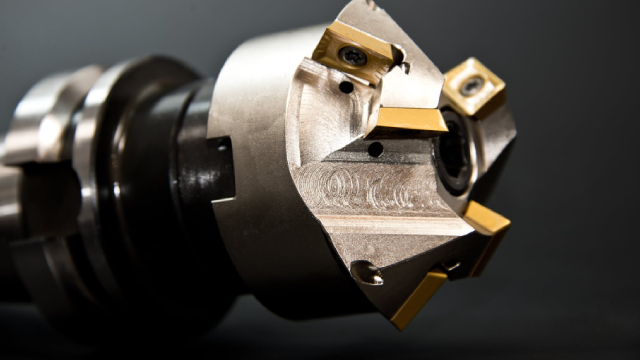

Flowserve, a $7.2 billion leader in flow control systems, is essential for optimizing fluid management in key industries like oil and gas, water management, and power production. FLS's Q2 results reveal topline growth to $1.16 billion, driven by strong demand in oil and gas, chemicals, and power generation, with a robust backlog of $2.7 billion. Internally, margin expansion continues, supported by the Company's 'excellence program,' aiming for a 200 basis point improvement by 2027. This is coupled with a sound strategy of widening the equity-debt gap.

Flowserve: More Room To Run Despite The Stock's Recent Rally

I expect the MOGAS acquisition and the strong revenue and profitability growth to sustain Flowserve's momentum, despite cash flow concerns. Free cash flow dropped by 480% in Q2, but management projects 80%+ cash flow conversion by year-end. Net debt declined 11%, showing a healthy balance sheet with decent liquidity ratios, including a current ratio of 2.0 and a quick ratio of 1.4.

Flowserve Acquires MOGAS Industries & Enhances Product Portfolio

FLS' acquisition of MOGAS is set to strengthen its product offerings and boost its position in the mining, mineral extraction and process industries.

Flowserve (FLS) Earnings Expected to Grow: Should You Buy?

Flowserve (FLS) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Flowserve Corporation (FLS) Hits Fresh High: Is There Still Room to Run?

Flowserve (FLS) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

4 Industrial Manufacturing Stocks to Gain on Promising Industry Trends

The Zacks Manufacturing - General Industrial industry gains from strength across prominent end-markets and technological progress. PH, IR, XYL and FLS are some promising stocks in the industry.

2 AI Energy Stocks to Buy Now Before They Breakout

Two stocks--NextEra Energy and Flowserve--to buy to play the AI-spurred energy transition, spanning nuclear, electrification, and beyond.

Why Flowserve (FLS) is a Top Growth Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Are You Looking for a Top Momentum Pick? Why Flowserve (FLS) is a Great Choice

Does Flowserve (FLS) have what it takes to be a top stock pick for momentum investors? Let's find out.

Why Flowserve (FLS) is a Top Momentum Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.