Flowserve Corporation (FLS)

Are You Looking for a Top Momentum Pick? Why Flowserve (FLS) is a Great Choice

Does Flowserve (FLS) have what it takes to be a top stock pick for momentum investors? Let's find out.

Why Flowserve (FLS) is a Top Momentum Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

FLS or NDSN: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Manufacturing - General Industrial sector might want to consider either Flowserve (FLS) or Nordson (NDSN). But which of these two companies is the best option for those looking for undervalued stocks?

Why Flowserve (FLS) is a Top Value Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Reasons Why Investing in Flowserve Stock Seems Prudent Now

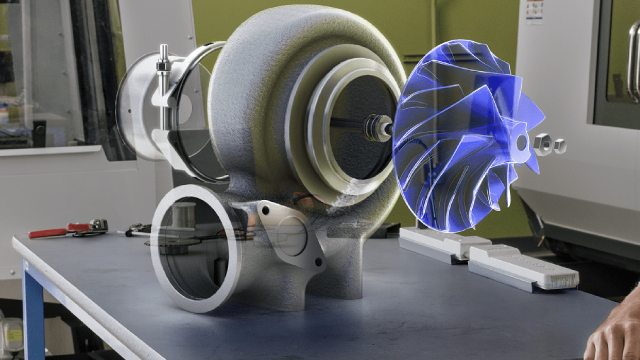

FLS benefits from strength across its Flowserve Pump Division and Flow Control Division segments and accretive acquisitions.

Flowserve Corporation (FLS) Hit a 52 Week High, Can the Run Continue?

Flowserve (FLS) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Flowserve (FLS) Soars 7.3%: Is Further Upside Left in the Stock?

Flowserve (FLS) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

FLS vs. NDSN: Which Stock Is the Better Value Option?

Investors with an interest in Manufacturing - General Industrial stocks have likely encountered both Flowserve (FLS) and Nordson (NDSN). But which of these two stocks is more attractive to value investors?

Is the Options Market Predicting a Spike in Flowserve (FLS) Stock?

Investors need to pay close attention to Flowserve (FLS) stock based on the movements in the options market lately.

Here's Why Flowserve (FLS) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Here's Why You Should Consider Investing in Flowserve Stock Now

FLS is likely to benefit from strength across its end markets, solid backlog level, acquired assets and shareholder-friendly policies.

Here's Why Flowserve (FLS) is a Strong Value Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.