IDEX Corporation (IEX)

IDEX Corporation (IEX) Q2 2024 Earnings Call Transcript

IDEX Corporation (NYSE:IEX ) Q2 2024 Earnings Conference Call August 1, 2024 10:30 AM ET Company Participants Wendy Palacios - Vice President, Investor Relations, FP&A Eric Ashleman - Chief Executive Officer & President Abhi Khandelwal - Senior Vice President & Chief Financial Officer Conference Call Participants Mike Halloran - Baird Vlad Bystricky - Citigroup Nathan Jones - Stifel Deane Dray - RBC Capital Markets Matt Summerville - D.A. Davidson Joe Giordano - Cowen Andrew Buscaglia - BNP Paribas Rob Wertheimer - Melius Research Operator Hello, and welcome to the IDEX Corporation Q2 2024 Earnings Conference Call and Webcast.

IDEX (IEX) Q2 Earnings Top Estimates, Sales Miss, '24 View Down

IDEX's (IEX) second-quarter 2024 net sales decrease 5% due to lower sales in the Fluid & Metering Technologies and Health & Science Technologies segments.

Idex (IEX) Beats Q2 Earnings Estimates

Idex (IEX) came out with quarterly earnings of $2.06 per share, beating the Zacks Consensus Estimate of $2.04 per share. This compares to earnings of $2.18 per share a year ago.

IDEX (IEX) to Report Q2 Earnings: What's in the Offing?

Weakness in the HST and FMT segments and escalating operating expenses are likely to hurt IDEX's (IEX) second-quarter results.

Will Idex (IEX) Beat Estimates Again in Its Next Earnings Report?

Idex (IEX) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Earnings Preview: Idex (IEX) Q2 Earnings Expected to Decline

Idex (IEX) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Here's Why You Should Retain IDEX (IEX) in Your Portfolio

Strength in the FSDP segment poises IDEX (IEX) well for growth. The company's measures to reward its shareholders are promising.

IDEX: Order Moderation Illuminating A Path Forward

Order moderation in Q1 FY24 indicates initial recovery in end-markets and completion of inventory destocking. IDEX reaffirmed full-year guidance of 0%-2% organic revenue growth, anticipating end-market recovery in the second half of FY24. I predict 7% organic revenue growth from FY25 onwards, with fair value estimated at $220 per share.

IDEX (IEX) to Benefit From Business Strength Amid Headwinds

IDEX (IEX) is poised to benefit from strength across its FSDP segment, acquired businesses and shareholder-friendly policies. However, softness in its HST unit is concerning.

Vanguard Personalized Indexing Management LLC Trims Stock Position in IDEX Co. (NYSE:IEX)

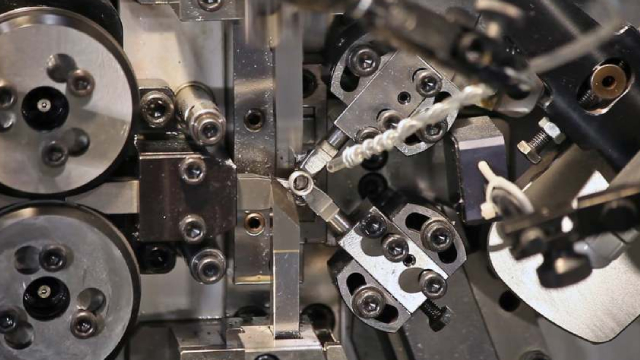

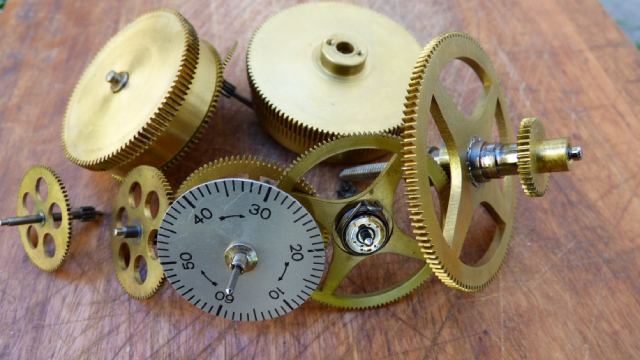

Vanguard Personalized Indexing Management LLC cut its holdings in IDEX Co. (NYSE:IEX – Free Report) by 7.5% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund owned 4,839 shares of the industrial products company’s stock after selling 391 shares during the period. Vanguard Personalized Indexing Management LLC’s holdings in IDEX were worth $1,051,000 at the end of the most recent reporting period. Other hedge funds also recently added to or reduced their stakes in the company. Commonwealth Equity Services LLC grew its holdings in shares of IDEX by 1.3% during the 3rd quarter. Commonwealth Equity Services LLC now owns 4,289 shares of the industrial products company’s stock worth $892,000 after purchasing an additional 53 shares during the period. Jacobson & Schmitt Advisors LLC boosted its stake in IDEX by 5.0% during the third quarter. Jacobson & Schmitt Advisors LLC now owns 1,242 shares of the industrial products company’s stock worth $258,000 after buying an additional 59 shares during the period. Guinness Asset Management LTD increased its position in shares of IDEX by 2.8% during the third quarter. Guinness Asset Management LTD now owns 2,360 shares of the industrial products company’s stock valued at $491,000 after acquiring an additional 65 shares during the last quarter. DB Fitzpatrick & Co Inc raised its stake in shares of IDEX by 2.4% in the 4th quarter. DB Fitzpatrick & Co Inc now owns 2,833 shares of the industrial products company’s stock valued at $615,000 after acquiring an additional 67 shares during the period. Finally, Desjardins Global Asset Management Inc. boosted its position in shares of IDEX by 25.6% during the 4th quarter. Desjardins Global Asset Management Inc. now owns 388 shares of the industrial products company’s stock worth $84,000 after purchasing an additional 79 shares during the period. 97.96% of the stock is currently owned by hedge funds and other institutional investors. IDEX Stock Up 0.0 % Shares of NYSE IEX opened at $222.33 on Monday. The company has a debt-to-equity ratio of 0.37, a current ratio of 3.37 and a quick ratio of 2.45. IDEX Co. has a 1 year low of $183.76 and a 1 year high of $246.36. The company has a market capitalization of $16.83 billion, a price-to-earnings ratio of 29.25, a price-to-earnings-growth ratio of 2.23 and a beta of 0.99. The business has a 50-day moving average of $232.47 and a two-hundred day moving average of $219.73. IDEX (NYSE:IEX – Get Free Report) last announced its quarterly earnings results on Tuesday, April 23rd. The industrial products company reported $1.88 EPS for the quarter, beating the consensus estimate of $1.76 by $0.12. The company had revenue of $801.00 million for the quarter, compared to analyst estimates of $807.52 million. IDEX had a net margin of 17.89% and a return on equity of 17.60%. The firm’s revenue was down 5.3% on a year-over-year basis. During the same period in the prior year, the firm posted $2.09 earnings per share. On average, analysts forecast that IDEX Co. will post 8.31 earnings per share for the current fiscal year. IDEX Increases Dividend The company also recently declared a quarterly dividend, which will be paid on Friday, May 31st. Investors of record on Friday, May 17th will be paid a dividend of $0.69 per share. This represents a $2.76 dividend on an annualized basis and a yield of 1.24%. The ex-dividend date of this dividend is Thursday, May 16th. This is an increase from IDEX’s previous quarterly dividend of $0.64. IDEX’s dividend payout ratio (DPR) is currently 36.32%. Analyst Upgrades and Downgrades A number of research firms have commented on IEX. Oppenheimer upped their price target on IDEX from $245.00 to $252.00 and gave the stock an “outperform” rating in a research note on Thursday, April 18th. Robert W. Baird cut their price target on shares of IDEX from $260.00 to $256.00 and set an “outperform” rating on the stock in a research note on Thursday, April 25th. Royal Bank of Canada reiterated an “outperform” rating and set a $255.00 target price on shares of IDEX in a report on Thursday, March 21st. StockNews.com raised IDEX from a “hold” rating to a “buy” rating in a research report on Saturday. Finally, Citigroup lifted their target price on IDEX from $254.00 to $277.00 and gave the company a “buy” rating in a report on Monday, April 8th. One research analyst has rated the stock with a hold rating and seven have given a buy rating to the company’s stock. According to MarketBeat.com, the stock presently has a consensus rating of “Moderate Buy” and a consensus target price of $250.71. Read Our Latest Stock Report on IDEX IDEX Company Profile (Free Report) IDEX Corporation, together with its subsidiaries, provides applied solutions worldwide. The company operates through three segments: Fluid & Metering Technologies (FMT), Health & Science Technologies (HST), and Fire & Safety/Diversified Products (FSDP). The FMT segment designs, produces, and distributes positive displacement pumps, valves, small volume provers, flow meters, injectors, and other fluid-handling pump modules and systems, as well as flow monitoring and other services for the food, chemical, general industrial, water and wastewater, agricultural, and energy industries.

IDEX Co. (NYSE:IEX) Shares Sold by Panagora Asset Management Inc.

Panagora Asset Management Inc. decreased its holdings in shares of IDEX Co. (NYSE:IEX – Free Report) by 4.5% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 13,345 shares of the industrial products company’s stock after selling 622 shares during the period. Panagora Asset Management Inc.’s holdings in IDEX were worth $2,897,000 as of its most recent SEC filing. A number of other institutional investors and hedge funds also recently modified their holdings of the business. Impax Asset Management Group plc grew its position in shares of IDEX by 4.0% during the 4th quarter. Impax Asset Management Group plc now owns 2,190,741 shares of the industrial products company’s stock valued at $475,632,000 after buying an additional 84,502 shares during the last quarter. Barclays PLC grew its holdings in shares of IDEX by 3.3% during the third quarter. Barclays PLC now owns 1,143,583 shares of the industrial products company’s stock valued at $237,890,000 after purchasing an additional 36,928 shares during the last quarter. Northern Trust Corp raised its position in shares of IDEX by 6.1% during the 3rd quarter. Northern Trust Corp now owns 785,716 shares of the industrial products company’s stock worth $163,445,000 after purchasing an additional 45,120 shares during the period. Alecta Tjanstepension Omsesidigt lifted its holdings in shares of IDEX by 420.8% in the 4th quarter. Alecta Tjanstepension Omsesidigt now owns 781,172 shares of the industrial products company’s stock worth $169,600,000 after purchasing an additional 631,172 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. boosted its position in IDEX by 2.6% during the 4th quarter. Charles Schwab Investment Management Inc. now owns 608,744 shares of the industrial products company’s stock valued at $132,164,000 after purchasing an additional 15,202 shares during the period. 97.96% of the stock is owned by institutional investors and hedge funds. Analysts Set New Price Targets Several equities research analysts have weighed in on the company. StockNews.com raised IDEX from a “hold” rating to a “buy” rating in a research report on Saturday. Oppenheimer lifted their price objective on shares of IDEX from $245.00 to $252.00 and gave the company an “outperform” rating in a research report on Thursday, April 18th. Royal Bank of Canada restated an “outperform” rating and issued a $255.00 target price on shares of IDEX in a research report on Thursday, March 21st. Stifel Nicolaus raised IDEX from a “hold” rating to a “buy” rating and lifted their price target for the company from $215.00 to $265.00 in a report on Thursday, February 8th. Finally, Robert W. Baird decreased their price objective on IDEX from $260.00 to $256.00 and set an “outperform” rating for the company in a report on Thursday, April 25th. One analyst has rated the stock with a hold rating and seven have assigned a buy rating to the company’s stock. Based on data from MarketBeat, the company has a consensus rating of “Moderate Buy” and an average target price of $250.71. Get Our Latest Stock Analysis on IEX IDEX Price Performance NYSE IEX opened at $222.33 on Monday. The firm has a market capitalization of $16.83 billion, a PE ratio of 29.25, a P/E/G ratio of 2.23 and a beta of 0.99. The company has a debt-to-equity ratio of 0.37, a current ratio of 3.37 and a quick ratio of 2.45. IDEX Co. has a 12 month low of $183.76 and a 12 month high of $246.36. The company’s 50 day simple moving average is $232.47 and its 200 day simple moving average is $219.73. IDEX (NYSE:IEX – Get Free Report) last issued its quarterly earnings results on Tuesday, April 23rd. The industrial products company reported $1.88 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.76 by $0.12. IDEX had a return on equity of 17.60% and a net margin of 17.89%. The company had revenue of $801.00 million for the quarter, compared to analysts’ expectations of $807.52 million. During the same period last year, the firm earned $2.09 EPS. The firm’s revenue for the quarter was down 5.3% on a year-over-year basis. As a group, equities research analysts forecast that IDEX Co. will post 8.31 EPS for the current fiscal year. IDEX Increases Dividend The firm also recently disclosed a quarterly dividend, which will be paid on Friday, May 31st. Stockholders of record on Friday, May 17th will be given a dividend of $0.69 per share. This is a positive change from IDEX’s previous quarterly dividend of $0.64. The ex-dividend date of this dividend is Thursday, May 16th. This represents a $2.76 annualized dividend and a dividend yield of 1.24%. IDEX’s dividend payout ratio (DPR) is 36.32%. IDEX Profile (Free Report) IDEX Corporation, together with its subsidiaries, provides applied solutions worldwide. The company operates through three segments: Fluid & Metering Technologies (FMT), Health & Science Technologies (HST), and Fire & Safety/Diversified Products (FSDP). The FMT segment designs, produces, and distributes positive displacement pumps, valves, small volume provers, flow meters, injectors, and other fluid-handling pump modules and systems, as well as flow monitoring and other services for the food, chemical, general industrial, water and wastewater, agricultural, and energy industries.

Here's Why Hold Strategy is Apt for IDEX (IEX) Stock Now

Strength in the fire and safety businesses within the FSDP segment and accretive acquisitions augur well for IDEX (IEX). The company's measures to reward its shareholders are encouraging.