Intuitive Surgical, Inc. (ISRG)

Is Most-Watched Stock Intuitive Surgical, Inc. (ISRG) Worth Betting on Now?

Intuitive Surgical (ISRG) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

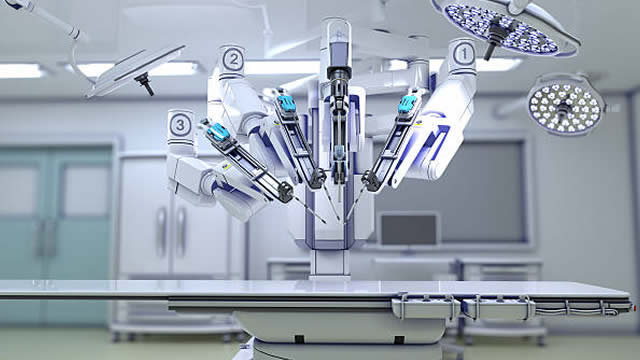

ISRG Gets FDA Clearance to Use da Vinci SP Robot for General Surgeries

Intuitive Surgical broadens its da Vinci SP system with FDA clearance for three new surgeries, expanding its role in minimally invasive care.

Intuitive Surgical, Inc. (ISRG) Declines More Than Market: Some Information for Investors

Intuitive Surgical, Inc. (ISRG) concluded the recent trading session at $566.89, signifying a -1.47% move from its prior day's close.

ISRG Stock Forms Golden Crossover: Will the Uptrend Continue?

Intuitive Surgical's golden crossover arrives amid surging procedures and rapid dV5 adoption, raising the stakes for its bullish momentum.

Intuitive Surgical: Is The Smart Money Moving In?

Intuitive Surgical (ISRG) stock may represent a worthwhile investment at present. Why? Because you receive high margins – indicative of pricing power and cash generation capability – at a discounted price.

Is It Time To Buy Intuitive Surgical Stock?

Intuitive Surgical (ISRG) stock may represent a worthwhile investment at present. Why? Because you receive high margins – indicative of pricing power and cash generation capability – at a discounted price.

Margins Face Tariff Pressure: Is ISRG's Profitability at Risk?

Intuitive Surgical's strong growth contrasts with tariff-driven margin pressure, raising questions about its ability to hold gross margins near 67%.

Here's Why Intuitive Surgical, Inc. (ISRG) Fell More Than Broader Market

In the closing of the recent trading day, Intuitive Surgical, Inc. (ISRG) stood at $567.37, denoting a -1.07% move from the preceding trading day.

Intuitive Surgical, Inc. (ISRG) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Intuitive Surgical (ISRG) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Can Intuitive Surgical Still Be A Good Buy?

Intuitive Surgical (ISRG) stock may be a solid investment at this time. Why? Because you're getting high margins – indicative of pricing power and cash generation capability – for a discounted price.

From Hospitals to ASCs: Will Refurbished Xi Systems Broaden ISRG's Reach?

ISRG leverages refurbished Xi systems to reach cost-sensitive markets and expand access beyond hospitals.

ISRG vs. MDT: A High-Tech Robotics Faceoff in the Race for Leadership

Intuitive Surgical's robotics surge and Medtronic's broad innovation push set the stage for a high-tech showdown in next-gen minimally invasive care.