JPMorgan Chase & Co. (JPM)

Fed Alert: If Rates Come Down, These Are 3 Stocks Are Going to Soar

The Federal Reserve was unlikely to cut rates next week, but Wall Street anticipates a September reduction.

JPMorgan Says U.S. Recession Probability Up to 35%

JPMorgan Chase has joined the masses in voicing their concerns over an impending recession following the release of the July jobs report. Indeed, the investment banking firm has recently raised the U.S. recession probability to 35% for an economic downturn by the end of this year, up from 25%.

JPMorgan Launches AI Assistant for 60,000 Employees

JPMorgan Chase & Co. (JPM) is giving its employees access to a generative AI assistant built by the makers of OpenAI. More than 60,000 employees already have access to the program, known as LLM Suite, according to a CNBC report that was confirmed by a spokesperson to Investopedia.

JPMorgan Chase & Co. (JPM) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching JPMorgan Chase & Co. (JPM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Stock Of The Day: Is JPMorgan About To Head Lower?

Many practitioners misunderstand technical analysis. They look for patterns on charts without understanding the price action that makes these patterns form.

3 Promising Value Stocks to Buy This Month

With the month of August kicking off, now is a great time to find the most promising value stocks to buy. These companies typically are market leaders in their industry that may be trading at a discount to their intrinsic value.

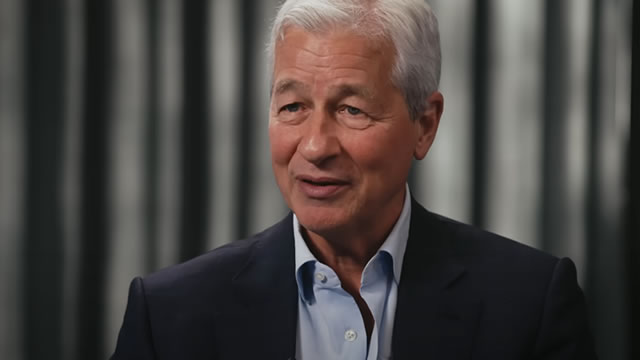

JPMorgan's Jamie Dimon thinks people overreact too much about market fluctuations

Monday's stock plunge started to stoke fears of a potential recession. Meanwhile, the Federal Reserve is eyeing a potential interest rate cut in September.

JPMorgan, big banks facing probe over Zelle scams: report

Banks have argued that covering the cost of scams will encourage more fraud and potentially cost billions of dollars.

3 Stocks From the Prospering Major Regional Banks Industry

High funding costs and weakening asset quality will hurt Zacks Major Regional Banks. Yet, interest rate cuts, modest loan demand, decent economic growth and business restructuring efforts are likely to aid industry players like JPMorgan (JPM), U.S. Bancorp (USB) and Truist (TFC).

JPMorgan cautious on deal-making rebound over uncertainty surrounding who will take White House

Two of the bank's top executives told the Reuters news agency that uncertainty surrounding the race for the White House was weighing on deal-making sentiment

JPMorgan Chase & Co. (JPM) Could Be a Great Choice

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does JPMorgan Chase & Co. (JPM) have what it takes?

JPMorgan CEO contenders cite intense competition during market revival

As JPMorgan Chase investors puzzle over who will eventually replace Jamie Dimon as CEO, two of the contenders say they are more focused on winning market share and developing the bank's future leaders.