JPMorgan Chase & Co. (JPM)

Summary

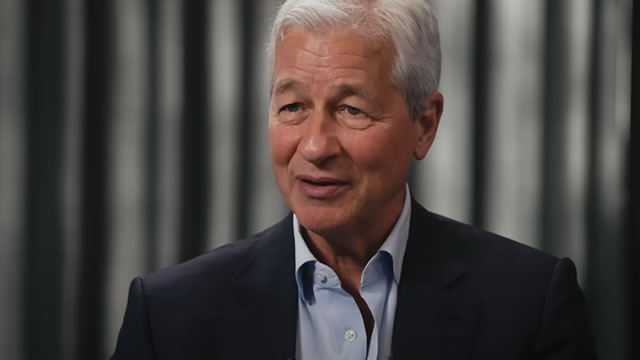

Jamie Dimon says Trump's $5 billion debanking lawsuit ‘has no merit' but he's sympathetic to concerns

JPMorgan Chase CEO Jamie Dimon said President Donald Trump's lawsuit seeking $5 billion in damages for shuttering accounts was without merit. But he said he sympathized with the president's anger over the episode.

JPM, BCS & FITB Sued by Tricolor Noteholders Over Alleged Red Flags

JPMorgan, Barclays and Fifth Third face a fresh lawsuit as Tricolor noteholders allege ignored audit red flags in ABS deals now trading at under 10 cents on the dollar.

Jamie Dimon Says His 'Anxiety is High' Over What Could Cause the Next Financial Crisis

Markets are sitting near record levels and the vibes are good, but one bank chief is ill at ease.

JPMorgan Chase & Co. (JPM) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has JPMorgan Chase & Co. ever had a stock split?

JPMorgan Chase & Co. Profile

| Banks Industry | Financials Sector | James Dimon CEO | NYSE Exchange | 46625H100 CUSIP |

| US Country | 318,477 Employees | 6 Jan 2026 Last Dividend | 12 Jun 2000 Last Split | - IPO Date |

Overview

JPMorgan Chase & Co. is a global financial services powerhouse that has been serving clients with a wide array of financial products and services since its inception in 1799. Based in New York, New York, the company operates through four main segments: Consumer & Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM). Providing a comprehensive suite of financial services to a diverse clientele, including consumers, small businesses, corporations, governments, and institutions, JPMorgan Chase & Co. continues to be a leader in the financial industry, leveraging its deep expertise and broad capabilities to meet the evolving needs of its clients.

Products and Services

JPMorgan Chase & Co. offers a wide range of financial products and services across its four operating segments:

- Consumer & Community Banking (CCB):

This segment caters to consumers and small businesses with a variety of products including deposit accounts, investment products, and lending services. It encompasses mortgage origination and servicing, credit cards, auto loans, leases, and travel services. Additionally, it offers cash management and payment services, serving customers through bank branches, ATMs, and digital and telephone banking channels.

- Corporate & Investment Bank (CIB):

The CIB segment provides comprehensive investment banking, corporate strategy advisory services, and equity and debt financing solutions. It also offers loan origination, syndication, payments, cash and derivative instruments, and prime brokerage. Moreover, this segment caters to asset managers, insurance companies, and investment funds with securities services, including custody, fund accounting, and administration.

- Commercial Banking (CB):

Targeting small and midsized companies, local governments, nonprofit clients, and large corporations, this segment delivers financial solutions such as lending, payments, investment banking, and asset management. It also serves investors, developers, and owners of diverse real estate properties, including multifamily, office, retail, and industrial spaces.

- Asset & Wealth Management (AWM):

AWM provides multi-asset investment management solutions across equities, fixed income, alternatives, and money market funds for both institutional clients and retail investors. It also offers a range of retirement products and services, brokerage and custody services, estate planning, and lending, catering specifically to high-net-worth individuals with a comprehensive array of investment management products.