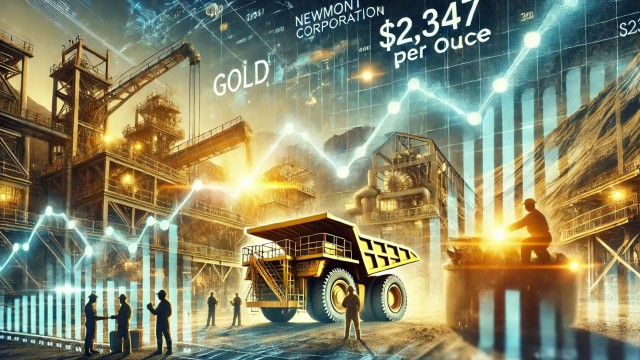

Newmont Corporation (NEM)

Mining Stock Tumbles as Oil Prices Soften

Newmont Corporation (NYSE:NEM) stock is down 3.5% to trade at $46.07 at last check, brushing off a second-quarter earnings and revenue beat as gold prices soften.

Gold Hits All-Time Highs and 5 Dividend Stocks Earnings Could Explode

24/7 Wall St. Insights Some top Wall Street strategists feel the AI tech rally is overextended.

Newmont's (NEM) Earnings and Revenues Beat Estimates in Q2

Newmont (NEM) beats respective earnings and sales estimates in the second quarter on higher gold production.

Newmont generates $594 million in free cash flow in Q2

Neils Christensen has a diploma in journalism from Lethbridge College and has more than a decade of reporting experience working for news organizations throughout Canada. His experiences include covering territorial and federal politics in Nunavut, Canada.

Newmont Corporation (NEM) Q2 Earnings and Revenues Top Estimates

Newmont Corporation (NEM) came out with quarterly earnings of $0.72 per share, beating the Zacks Consensus Estimate of $0.53 per share. This compares to earnings of $0.33 per share a year ago.

Let's Preview Newmont's Q2 Earnings

Newmont Corporation's stock has outperformed the market by almost three times over the past few months. Q1 FY2024 results showed revenue and EPS beating consensus, with improvements in margins and cash flow generation. Analysts have mixed forecasts for Q2 FY2024, providing an opportunity for Newmont to beat expectations and continue its growth trajectory.

The Top We Strike Could Be A Very Long Term Market Top - Avi Gilburt

Avi Gilburt provides technical context on market rally, recommends Treasury ETFs like TLT for trade, and discusses how the Fed follows the market. Metals are setting up for a strong second half of 2024, with potential for silver to see a parabolic rally.

Are Basic Materials Stocks Lagging Newmont (NEM) This Year?

Here is how Newmont Corporation (NEM) and SilverCrest Metals Inc. (SILV) have performed compared to their sector so far this year.

Is Newmont (NEM) Stock a Must-Buy Ahead of Q2 Earnings?

Newmont (NEM) is expected to have benefited from increased production volumes, lower unit costs and higher gold prices in the second quarter.

Will Newmont's Q2 Results Shine On Strong Gold Pricing?

Newmont Corporation (NYSE: NEM), one of the world's largest gold miners, is expected to publish its Q2 2024 results on July 25, reporting on a quarter that saw strong gold prices. We expect revenue to come in at close to $5.70 billion for the quarter, slightly ahead of consensus estimates, while earnings are likely to come in at $0.98 per share.

Wall Street Bulls Look Optimistic About Newmont (NEM): Should You Buy?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Newmont Corporation (NEM) Suffers a Larger Drop Than the General Market: Key Insights

In the latest trading session, Newmont Corporation (NEM) closed at $47.51, marking a -1.57% move from the previous day.