The Boston Beer Company Inc. (SAM)

Do Strong Volume Warrant Q2 Earnings Beat for Boston Beer (SAM)?

Boston Beer's (SAM) Q2 results are expected to reflect gains from favorable volume trends, robust pricing and improved margins amid slowed hard seltzer trends.

Boston Beer (SAM) Reports Next Week: Wall Street Expects Earnings Growth

Boston Beer (SAM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Can Boston Beer's (SAM) Beyond Beer Expansion Aid Growth?

Boston Beer (SAM) gains from its pricing efforts, Beyond Beer strategy, premiumization and strong twisted tea brand amid softness in depletions and challenges in the hard seltzer category.

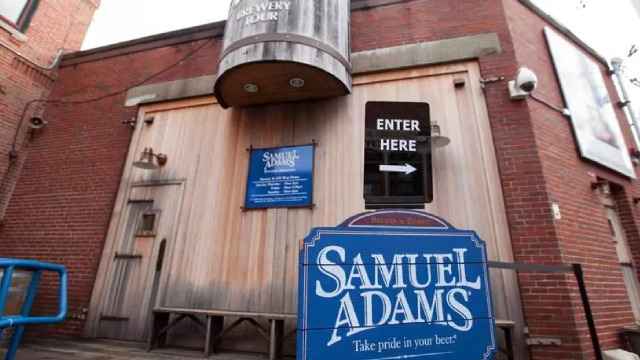

California brewery named winner of Samuel Adams' craft beer competition

The newest champion of Sam Adam's annual craft beer competition, the Brewing & Business Experienceship, has been named. The brewers will be privy to capital and mentorship.

Marijuana grower interested in merging with Sam Adams beer owner: report

Green Thumb's CEO wrote in a letter that he would be able to make a superior offer for Boston Beer, the maker of Sam Adams lager, and that while young people are drinking less alcohol, the US cannabis market is ballooning.

Why Boston Beer Stock Is Turning Sour Today

Boston Beer stock surged on Friday on reports of a potential buyout bid, but are falling back after the rumored suitor dismissed the reports. Boston Beer is in the early stages of a transformation, and still could seek to sell itself.

Boston Beer Stock Slips as Buyout Rumors Disappear

Boston Beer Company Inc (NYSE:SAM) stock jumped 22.3% on Friday, after rumors that Japanese beverage company Suntory Holdings was in early negotiations to buy the company.

Boston Beer Stock Jumps. Suntory Is in Talks to Buy the Sam Adams Maker, WSJ Reports.

The Japanese whiskey maker has expanded its portfolio in recent years, acquiring Jim Beam.

Boston Beer in Talks to Sell Itself to Jim Beam Owner Suntory

Japanese whisky-maker Suntory is in talks to acquire Boston Beer, the American brewer known for its Samuel Adams brand.

Why Boston Beer (SAM) is a Top Value Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Do Boston Beer's (SAM) Strategies Position It Well Among Peers?

Boston Beer (SAM) is likely to retain its long-standing market position with its solid brand portfolio, the Beyond Beer strategy, innovation and pricing actions amid a troubled hard seltzer category.