Airbnb, Inc. (ABNB)

3 Cash Cow Stocks Leading Their Sectors in Free Cash Flow Margins

Evaluating stocks involves considering many crucial factors, but the ability to generate cash is of uniquely paramount importance. At the end of the day, a business centers around the idea of generating cash over net income.

Should You Buy Airbnb Stock Right Now?

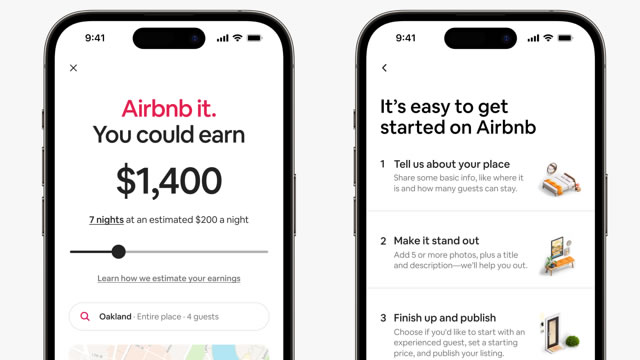

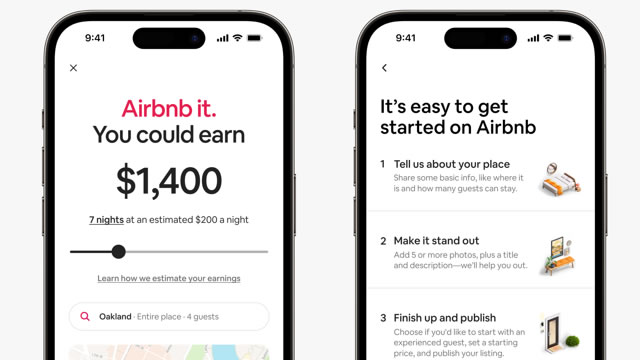

Airbnb's (ABNB 2.92%) asset-lite business model generates a growing annual free cash flow figure, fueling stock buybacks.

The S&P 500 Just Hit Correction Territory: Here Are 5 Stocks That Are Simply Too Cheap to Ignore Right Now

On March 13, the S&P 500 finished the day down 10% from its previous all-time high. This officially pushed the stock market into what's known as "correction" territory, even if this is a misnomer.

Airbnb Boosts Marketing and Hiring Ahead of Push Into New Businesses

Online property rental company's new initiatives focused on experiences and other services are set to launch in May.

2 Brilliant Growth Stocks to Buy Now

The stock market has had a bumpy start to the year, with the S&P 500 down about 6% year to date at the time of writing. While it can be unnerving to watch your investments lose value, market volatility is the price investors have to pay to experience large gains down the road.

AirBnb: An Outstanding Business Now At A Reasonable Price

AirBnb's business model is exceptional, generating significant cash flow with minimal capital expenditures, making it a strong long-term investment despite its stock volatility. The company's ability to earn interest on customer prepayments and its strong cash position highlight its financial strength and operational efficiency. Expansion into new markets and adjacent businesses, while risky, offers substantial growth potential, similar to Amazon's early strategy.

Airbnb: We're Obsessed With This Profitable, Growing Travel Juggernaut

Airbnb's asset-light, high-margin business model and strong financials - including $10B in cash and 24% net margins - make it a compelling long-term investment. Despite a recent growth slowdown, Airbnb's strategic focus on core services, global expansion, and new offerings positions it for continued revenue growth and market share gains. At 7x sales and 18x free cash flow, Airbnb shares are attractively priced, offering potential for significant compounded returns as the company scales.

Disney, Airbnb Stocks Are Falling. Airlines' Guidance Cuts Unnerve Investors.

Wall Street has started to worry about a slump in consumer spending—and that would be bad news for the tourism sector.

Airbnb CBO: AI Will Enable a ‘Concierge in Your Pocket'

Airbnb is planning to embed artificial intelligence (AI) throughout its operations to transform guest and homeowner experiences, enabling a “concierge in your pocket,” according to its chief business officer. AI is an “incredibly high priority,” said Airbnb's Dave Stephenson, at the Human[x] conference in Las Vegas on Monday (March 10).

From Big Tech to private equity, early Airbnb investor Rick Heitzmann sees more market ‘chop' ahead

Rick Heitzmann, FirstMark Capital founder & partner, joins 'Fast Money' to talk Big Tech's market struggle this week and why more pain may be on the horizon.

Is Most-Watched Stock Airbnb, Inc. (ABNB) Worth Betting on Now?

Airbnb (ABNB) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

5 Top Stocks to Buy in March

2025 has gotten off to a choppy start as some of the most valuable U.S.-based companies are dragging down the major stock market indexes. But getting caught up in short-term market movements is a mistake.