Abbott Laboratories (ABT)

MedTechs Adjust 2025 Outlook Amid Tariffs: What Investors Need to Know

Most of the MedTech players have adjusted their 2025 forecasts in response to rising tariff pressure.

Tariffs Cast a Shadow on Abbott's 2025 View: Time to Sell ABT Stock?

With certain devices being imported into the United States from overseas, tariff-induced cost pressure is set to rise for Abbott from the third quarter of 2025.

Investors Heavily Search Abbott Laboratories (ABT): Here is What You Need to Know

Abbott (ABT) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Abbott Labs' Rally Is Well Deserved - Fade The Rally For Now

ABT continues to offer a compelling high-growth investment thesis, driven by the GLP-1 tailwinds on its Continuous Glucose Monitoring and adult nutrition offerings. This is significantly aided by the management's ability to reiterate its ambitious FY2025 guidance, despite the supposed hundreds of millions in tariff impact. Combined with the richer Free Cash Flow generation, healthier balance sheet, and high single-digits dividend per share growth, we believe that ABT remains well positioned to outperform ahead.

Abbott Q1: Flexible Supply Chain And Strong Growth In Medical Devices

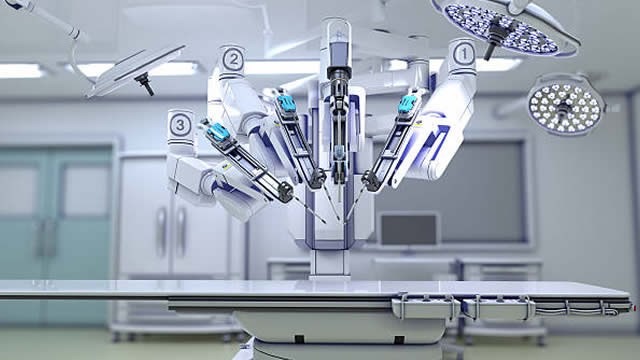

I reiterate a "Strong Buy" rating on Abbott Laboratories, driven by strong growth in medical device and pharma markets, with a fair value of $160 per share. Abbott reported 6.9% organic revenue growth and 8.3% growth excluding COVID testing, driven by 12.6% growth in medical devices and 7.8% in pharma. Abbott's diversified global supply chain and 25 new products in the pipeline position it well to navigate tariff impacts and drive future growth.

Abbott Laboratories (ABT) Q1 2025 Earnings Call Transcript

Abbott Laboratories (NYSE:ABT ) Q1 2025 Earnings Conference Call April 16, 2025 9:00 AM ET Company Participants Mike Comilla - VP, IR Robert Ford - Chairman and CEO Phil Boudreau - EVP, Finance and CFO Conference Call Participants Robert Marcus - JPMorgan Larry Biegelsen - Wells Fargo Travis Steed - BofA Securities David Roman - Goldman Sachs Vijay Kumar - Evercore ISI Joanne Wuensch - Citi Josh Jennings - TD Cowen Marie Thibault - BTIG Operator Good morning, and thank you for standing by. Welcome to Abbott's First Quarter 2025 Earnings Conference Call.

Abbott Laboratories shares gain on first quarter earnings beat

Abbott Laboratories (NYSE:ABT) reported a profit beat for the first quarter driven by growth in its medical devices and diabetes care segments, as revenue fell short of estimates. The healthcare company beat earnings estimates by $0.02 with earnings per share (EPS) of $1.09 as revenue of $10.36 billion missed expectations of $10.41 billion.

Compared to Estimates, Abbott (ABT) Q1 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Abbott (ABT) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Abbott (ABT) Q1 Earnings Beat Estimates

Abbott (ABT) came out with quarterly earnings of $1.09 per share, beating the Zacks Consensus Estimate of $1.07 per share. This compares to earnings of $0.98 per share a year ago.

Abbott Labs Profit Jumps on Gains in Nutrition, Medical Devices

Abbott Labs recorded higher earnings and revenue in the first quarter as strong demand for its nutritional products and medical devices offset weakness in other segments.

Tap Into the Silver Economy Boom With These Aging Demographics Stocks

The global demographic shift is reshaping healthcare demand, driving long-term investment in pharmaceuticals, medical devices, home care and digital health.

Seeking Clues to Abbott (ABT) Q1 Earnings? A Peek Into Wall Street Projections for Key Metrics

Looking beyond Wall Street's top -and-bottom-line estimate forecasts for Abbott (ABT), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended March 2025.