Adobe Inc. (ADBE)

Adobe: Generative Credits Capped And The Path To AI Monetization Finally Becomes Clear

ADBE had a strong Q1 with revenue and EPS beats, but the stock fell nearly 14% due to conservative guidance. The company is making progress in AI monetization, introducing new Firefly plans and reporting $125 million in standalone AI-driven ARR. Despite weak momentum, ADBE is undervalued with a forward PEG ratio of 1.36, suggesting significant upside potential.

Adobe's AI-Fueled Growth Could Power A 38% Upside - Here's Why JPMorgan Is Bullish

Adobe Inc ADBE just gave investors a masterclass in AI-driven growth at its annual Summit and JPMorgan analyst Mark R. Murphy is taking note.

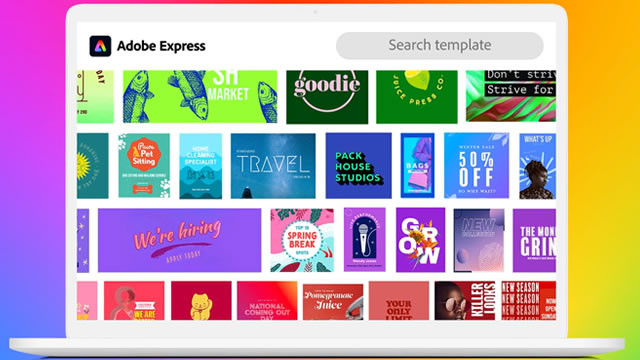

Adobe rolls out AI agents for online marketing tools

Adobe on Tuesday said it is rolling out artificial intelligence "agents" that brands can use to help consumers navigate their websites.

Adobe Launches AI Agents For Its Marketing Platform

Software firm Adobe on Tuesday unveiled its strategy and product offerings for agentic AI at a company conference. The post Adobe Launches AI Agents For Its Marketing Platform appeared first on Investor's Business Daily.

1 Fantastic Growth Stock Down 30% You Can Buy Now in March

In this video, I will cover the recent updates regarding Adobe (ADBE -1.22%) and its latest earnings report. Watch the short video to learn more, consider subscribing, and click the special offer link below.

Adobe Inc. (ADBE) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Adobe (ADBE). This makes it worthwhile to examine what the stock has in store.

Adobe Earnings Are In: Should You Buy, Sell, or Hold Now?

Every investor has a reasonable and often justified fear when it comes to trading a stock around its earnings announcement since most of the volatility and uncertainty will still be centered on the company as markets and analysts digest what truly happened and how the results might affect valuations moving forward. However, every once in a while, there are companies whose results are so clear that investors just can't help but trade their views.

Adobe Stock Tumbled on Thursday Despite Record Revenue. Is the AI Growth Stock a Buy Now?

Adobe (ADBE -13.85%) fell 13.9% on March 13 in response to its first-quarter fiscal 2025 results and full-year guidance.

S&P 500 Gains and Losses Today: Index Falls Into Correction Amid Economic Uncertainty

Major U.S. equities indexes lost ground Thursday amid worries about the economy and political uncertainty.

Adobe Has Become A GARP Play (Rating Upgrade)

Adobe Inc.'s GenAI tools, including Firefly, offer significant growth potential by streamlining marketing workflows, potentially allowing for growth during a time of budgetary constraints across marketing departments. Adobe's integrated Firefly subscription and One Adobe platform aim to enhance creative and marketing collaboration, driving strong growth prospects. Despite being a late mover in GenAI, ADBE's focus on safety and enterprise integration provides a competitive edge in the crowded AI market.

The Estee Lauder Companies Boosts Digital Strategy With Adobe Firefly

EL integrates with Adobe to enhance digital marketing, streamlining content creation with AI-powered tools for faster, more engaging campaigns.

3 Software Stocks Under Pressure

Software stocks are facing heightened volatility this week, with Adobe Inc (NASDAQ:ADBE) , Datadog Inc (NASDAQ:DDOG) , and Dynatrace Inc (NYSE:DT) all struggling due to disappointing earnings guidance, market-wide headwinds, and sector-specific pressures.