Amkor Technology Inc. (AMKR)

Summary

Amkor Technology, Inc. (AMKR) Presents at Morgan Stanley Technology, Media & Telecom Conference 2026 Transcript

Amkor Technology, Inc. (AMKR) Presents at Morgan Stanley Technology, Media & Telecom Conference 2026 Transcript

Amkor's HDFO Ramp Accelerates: Is the Growth Thesis Strengthening

AMKR's HDFO ramp is accelerating as AI and chiplet demand build, but execution across multi-customer launches remains key to the growth story.

Amkor Technology, Inc. (AMKR) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Amkor Technology (AMKR). This makes it worthwhile to examine what the stock has in store.

Amkor Technology Inc. (AMKR) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Amkor Technology Inc. ever had a stock split?

Amkor Technology Inc. Profile

| Semiconductors & Semiconductor Equipment Industry | Information Technology Sector | Kevin K. Engel CEO | NASDAQ (NGS) Exchange | 031652100 CUSIP |

| US Country | 28,300 Employees | 12 Mar 2026 Last Dividend | - Last Split | 29 Apr 1998 IPO Date |

Overview

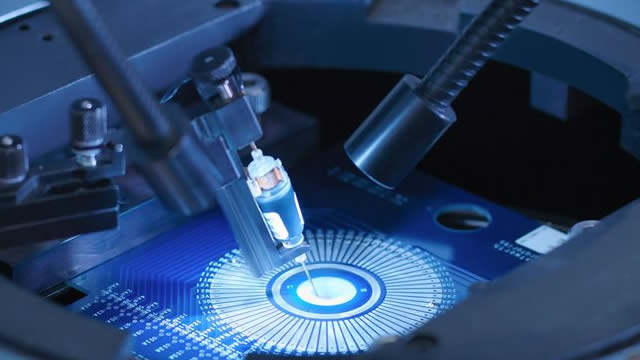

Amkor Technology, Inc. is a distinguished provider of outsourced semiconductor packaging and test services, operating across a diverse geographical landscape that includes the United States, Japan, Europe, the Middle East, Africa, and the Asia Pacific region. With a foundational year in 1968 and a corporate base in Tempe, Arizona, Amkor plays a critical role in the semiconductor industry. It caters to a wide range of clients including integrated device manufacturers, fabless semiconductor companies, original equipment manufacturers, and contract foundries. The company is renowned for its comprehensive portfolio of turnkey solutions that encompass the entire semiconductor manufacturing process, from wafer bump and probe to final testing and drop shipment.

Products and Services

Amkor Technology, Inc. offers an extensive array of products and services, meticulously designed to meet the intricate requirements of semiconductor manufacturing:

- Semiconductor Wafer and Package Services: This includes wafer bump, wafer probe, wafer back-grind, package design, and packaging services. These foundational services are crucial for preparing the semiconductor wafer for the subsequent stages of chip manufacturing.

- System-level and Final Test Services: Comprehensive testing services that ensure the functionality and reliability of the semiconductor devices before they are shipped to the client.

- Flip Chip Scale Package Products: These are essential for smartphones, tablets, and other mobile consumer electronic devices, providing high-performance packaging solutions that meet the compact and efficient requirements of modern handheld technology.

- Flip Chip Stacked Chip Scale Packages and Flip-Chip Ball Grid Array Packages: Catering to memory, networking, storage, computing, automotive, and consumer applications, these packages support the stacking of chips for enhanced performance and are vital for various technology solutions.

- Memory Products: Directly addressing the needs for system memory or data storage platforms, Amkor provides robust packaging solutions that are integral to maintaining data integrity and accessibility.

- Wafer-level CSP and Fan-out Packages: Used in applications such as power management, transceivers, and sensors, these packages are pivotal for miniaturization and efficiency enhancement in semiconductor devices.

- Silicon Wafer Integrated Fan-out Technology: An innovative approach that replaces traditional laminate substrates with a thinner structure, catering to the evolving demands for sleeker electronic devices.

- Leadframe and Substrate-based Wirebond Packages: These packages are instrumental in connecting a die to a substrate, serving a broad spectrum of electronic devices and mixed-signal applications.

- Micro-Electro-Mechanical Systems (MEMS) Packages: Facilitating the integration of miniaturized mechanical and electromechanical devices, these packages are crucial for a wide range of applications including sensors and actuators.

- Advanced System-in-package Modules: Offering solutions for radio frequency and front end modules, connectivity, and memory storage, among others, these modules are key to achieving high levels of integration and functionality in compact devices.

- Test Services: Including wafer, package, and system level test services along with burn-in test and test development services. These testing solutions ensure that each semiconductor device meets the stringent quality and performance standards before deployment.