Broadcom Inc. (AVGO)

Top 5 ETFs to Own Now and Into 2025

Buy-and-hold ETFs give investors an easy way to quickly broaden their exposure to a sector, investment theme, or even the market as a whole. Further, they minimize the effort and attention required of an investor, making them an appropriate choice for retail investors of all levels.

AVGO vs. SMCI: Which AI Stock Is the Best Buy Now

The AI and semiconductor trade found itself under a great deal of pressure this summer.

AVGO Does the "Same Thing" NVDA Does, Trading MSTX & LLY

Sylvia Jablonski, CEO of Defiance ETFs, talks about the Defiance Daily Target ETF (MSTX) that began public trading last month. She talks about why it's "a bang for your buck" for tactical traders.

2 Artificial Intelligence (AI) Stocks to Buy Instead of Nvidia

Broadcom could be the next big AI winner with its custom AI chips. TSMC, meanwhile, benefits no matter who is winning the AI chip race.

Billionaire David Shaw Is Selling Nvidia and Buying This Other Artificial Intelligence (AI) Chip Stock Instead

Hedge fund D. E. Shaw reduced its stake in Nvidia by 51% last quarter.

Wall Street's 2 Newest Artificial Intelligence (AI) Stock-Split Stocks Are Stealing the Spotlight Next Week

More than a dozen sensational businesses have announced or completed a forward split since 2024 began. Nvidia and Broadcom have, arguably, been Wall Street's most-anticipated stock splits this year.

Broadcom: Huge Stock Price Upside Ahead (Rating Upgrade)

Broadcom's stock price surged 30% due to AI advancements and industry optimism, prompting a reevaluation of its valuation using a reverse DCF model. Market-implied revenue growth for Broadcom is higher than our projections, driven by strong Networking segment performance and VMWare acquisition. Despite intensified competition from Nvidia, Broadcom's AI-related chip growth and software integration with VMWare support a Strong Buy rating.

Broadcom to tap corporate bond market for funds to pay down debt

Semiconductor company last issued bonds in July, when it raised $5 billion to refinance loans taken on to pay for its $69 billion acquisition of VMware Inc.

3 Tech Stocks You Can Buy and Hold for the Next Decade

Nvidia is an AI leader whose chips are still in high demand. Broadcom is tapping into a niche AI market.

Qualcomm, Broadcom, Marvell Stocks Rise. The AI Run Gets Boost After Micron's Strong Outlook.

Chip stocks rose Thursday on the back of Micron's AI demand outlook.

Should You Buy Super Micro Computer Stock Before Oct. 1?

Super Micro Computer is following in the footsteps of Nvidia and Broadcom with a 10-for-1 stock split. Investing in Nvidia and Broadcom around the times of their respective splits has produced mixed results.

Broadcom (AVGO) Price Prediction and Forecast 2025-2030

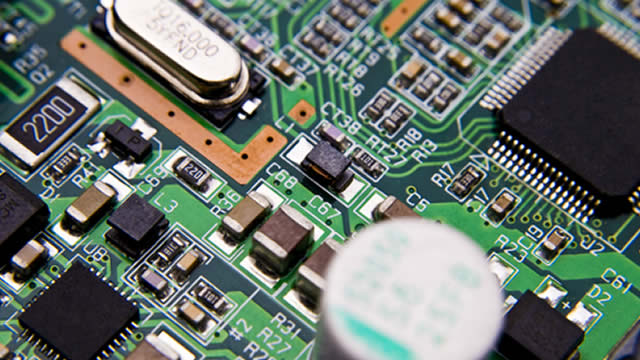

The explosive demand for semiconductors and microchips has grabbed news headlines and led the market higher over the past few years.