B2Gold Corp (BTG)

B2Gold (BTG) Stock Sinks As Market Gains: Here's Why

B2Gold (BTG) concluded the recent trading session at $3.15, signifying a -0.32% move from its prior day's close.

B2Gold (BTG) Ascends While Market Falls: Some Facts to Note

B2Gold (BTG) closed the most recent trading day at $3.35, moving +1.21% from the previous trading session.

B2Gold Is One Of The Cheapest Gold Mining Companies With A Near Term Catalyst

B2Gold (BTG) is poised for a strong 2025 with anticipated production growth of 20-33%, driven by the Fekola and Goose projects. Despite a challenging 2024, BTG's low valuation and rising gold prices present considerable upside potential. Given the favorable near-term outlook and attractive valuation, I rate BTG as a buy.

B2Gold (BTG) Flat As Market Sinks: What You Should Know

B2Gold (BTG) concluded the recent trading session at $2.92, signifying no movement from its prior day's close.

B2Gold (BTG) Outperforms Broader Market: What You Need to Know

B2Gold (BTG) closed at $2.92 in the latest trading session, marking a +0.69% move from the prior day.

B2Gold (BTG) Flat As Market Gains: What You Should Know

In the most recent trading session, B2Gold (BTG) closed at $3.12, indicating no shift from the previous trading day.

Why Is B2Gold (BTG) Up 14.2% Since Last Earnings Report?

B2Gold (BTG) reported earnings 30 days ago. What's next for the stock?

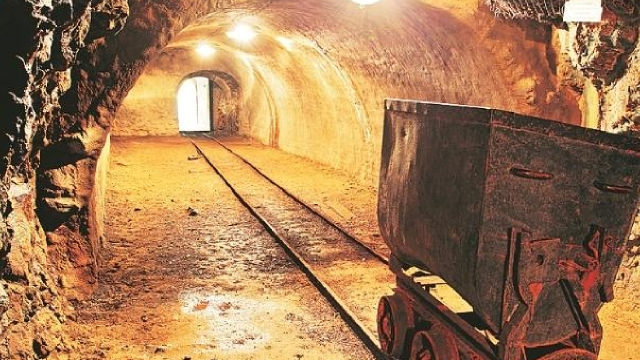

B2Gold Completes Fekola Solar Plant Expansion to Cut Fuel Costs

BTG's Fekola Solar Plant in Mali is now operational, with reduced emissions and fuel consumption.

B2Gold (BTG) Rises As Market Takes a Dip: Key Facts

B2Gold (BTG) reachead $3.28 at the closing of the latest trading day, reflecting a +1.55% change compared to its last close.

B2Gold: Momentum Meets Deep Value

I see a steady increase in trading volume and expect institutional investors to shift toward defensive assets like gold and stocks exposed to this commodity. I believe BTG may be a good candidate for institutions to allocate capital given its attractive valuation and recent price action amid volatility in the US equities markets. I'm keeping a close watch on updates regarding the Fekola expansion, Goose project, and Gramalote feasibility study, as I see them as key drivers of production and revenue growth.

A Golden Buying Opportunity

Warren Buffett said that the best time to invest aggressively is when it is "raining gold." We discuss several opportunities that are extremely attractive opportunities right now. We discuss why these opportunities could quite possibly double your money in the not too distant future.

B2Gold: Rising Gold Prices, Expanding Production, Bargain Valuation

B2Gold's underperformance in 2024 was due to uncertainty in Mali and lower production at the Fekola mine, despite high gold prices. The Goose Mine in Canada, set to start production in Q2 2025, is expected to significantly boost B2Gold's output and financial performance. B2Gold's strong balance sheet, undervaluation compared to peers, and diverse expansion projects make it a compelling investment despite jurisdictional risks in Mali.