Caterpillar Inc. (CAT)

Caterpillar Inc. (CAT) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Caterpillar (CAT) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Take the Zacks Approach to Beat the Markets: AngloGold Ashanti, Caterpillar & Hershey in Focus

AU, CAT and HSY are standing out as Zacks' high-conviction picks, with each posting double-digit gains in recent weeks.

Caterpillar: Real Multi-Trillion Robotic Opportunity

Caterpillar is poised to lead the robotics industry with large-scale machines, leveraging its expertise in heavy machinery and global reach. The commoditization of AI "brains" will make physical engineering the key differentiator, where Caterpillar excels with its advanced, massive industrial robots. As civilization advances, the demand for colossal robots for mega-projects will likely grow, putting Caterpillar in an advantageous position.

Caterpillar (CAT) Rises Higher Than Market: Key Facts

Caterpillar (CAT) reached $417.19 at the closing of the latest trading day, reflecting a +1.74% change compared to its last close.

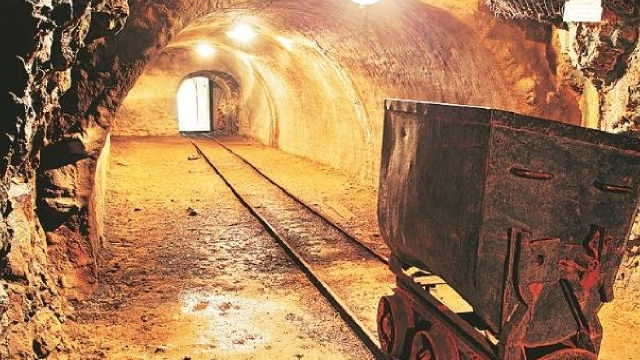

4 Stocks to Watch in the Promising Construction & Mining Equipment Industry

The prospects of the Zacks Manufacturing - Construction and Mining industry look good. Stocks like CAT, KMTUY, TEX and HY are stocks worth a look.

Caterpillar (CAT) Surpasses Market Returns: Some Facts Worth Knowing

The latest trading day saw Caterpillar (CAT) settling at $412.88, representing a +2.04% change from its previous close.

Caterpillar (CAT) Is Up 2.03% in One Week: What You Should Know

Does Caterpillar (CAT) have what it takes to be a top stock pick for momentum investors? Let's find out.

Wall Street Analysts Think Caterpillar (CAT) Is a Good Investment: Is It?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Caterpillar Inc. (CAT) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Caterpillar (CAT) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

This 3 Stock Portfolio Provides Monthly Income

While most stocks pay quarterly dividends, investors can still construct a portfolio that allows them to get paid monthly.

Caterpillar (CAT) Surpasses Market Returns: Some Facts Worth Knowing

The latest trading day saw Caterpillar (CAT) settling at $402.18, representing a +2% change from its previous close.

Fast Money: C, BA, CAT, QBTS

The final trades of the day with CNBC's Melissa Lee and the Fast Money traders.