Cognex Corporation (CGNX)

Cognex Corporation (CGNX) Beats Q3 Earnings and Revenue Estimates

Cognex Corporation (CGNX) came out with quarterly earnings of $0.20 per share, beating the Zacks Consensus Estimate of $0.17 per share. This compares to earnings of $0.16 per share a year ago.

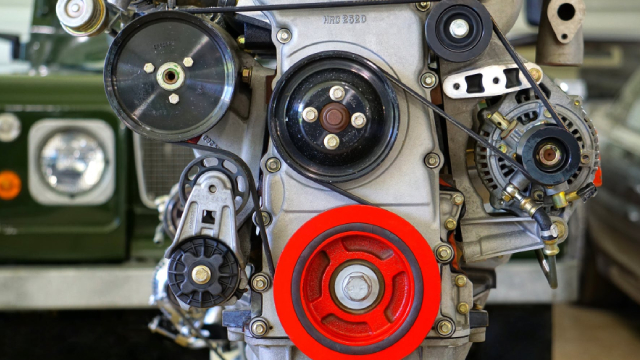

2 Top Automation and Robotics Stocks to Buy in October

Relatively high interest rates are negatively impacting automation and robotics end markets. But over time, automation should increase thanks to improved productivity, cost, quality, and analytics.

A Bull Market Is Here: 2 Incredibly Innovative Growth Stocks Down 14% and 59% to Buy Right Now

Nvidia has become a battleground stock, but its competitive position in AI remains incredibly strong. Cognex's end markets are weak in 2024, but the company's best days lie ahead.

Is the Options Market Predicting a Spike in Cognex (CGNX) Stock?

Investors need to pay close attention to Cognex (CGNX) stock based on the movements in the options market lately.

Here's Why Cognex Stock Slumped in August (and Why It's a Buying Opportunity)

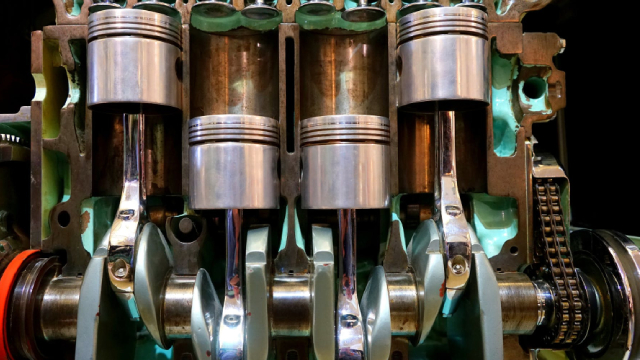

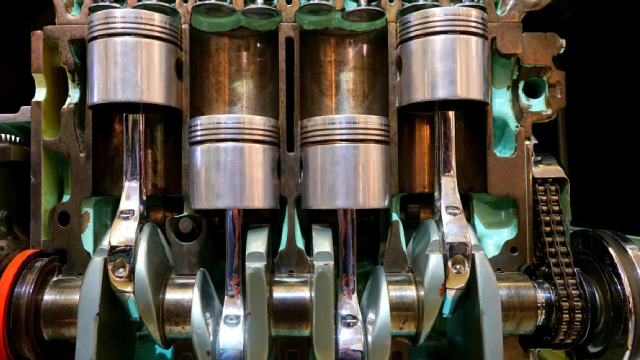

Automotive and consumer discretionary spending remain weak in 2024. Cognex's cyclical recovery in logistics and semiconductors this year points the way to the recovery path for its other major end markets.

The 3 Best Robotics Stocks to Buy in August 2024

Now could be a great time for investors to consider the best robotics stocks to buy in August. I wrote around a month ago that there could be record volatility in the market.

Take Advantage of the Dip to Buy This Unstoppable Long-Term Growth Stock

Relatively high interest rates are hitting automobile sales and consumer discretionary spending. The company's sales growth has always been volatile.

Cognex: Waiting For The Right Entry Point

Weak market conditions are driving an ongoing slowdown in Cognex's business. AI is a focus area for Cognex at the moment, but the challenging demand environment means that current investments will likely take time to pay off. Cognex's margins will recover, and AI-enabled products should ensure robust growth for many years to come.

These Analysts Cut Their Forecasts On Cognex Following Q2 Results

Cognex Corporation CGNX reported mixed second-quarter financial results, after the closing bell on Wednesday.

Cognex Corporation (CGNX) Q2 2024 Earnings Call Transcript

Cognex Corporation. (NASDAQ:CGNX ) Q2 2024 Earnings Conference Call August 1, 2024 8:30 AM ET Company Participants Nathan McCurren - Head of Investor Relations Robert Willett - President, Chief Executive Officer Dennis Fehr - Chief Financial Officer Conference Call Participants Andrew Buscaglia - BNP Paribas Tommy Moll - Stephens Inc. Piyush Avasthy - Citi.

Why Artificial Intelligence (AI) Stock Cognex Crashed More Than 20% Today

Cognex's margins slumped last quarter. The company, however, expects double-digit year-over-year growth in Q3 revenue.

Cognex Corporation (CGNX) Q2 Earnings and Revenues Top Estimates

Cognex Corporation (CGNX) came out with quarterly earnings of $0.23 per share, beating the Zacks Consensus Estimate of $0.20 per share. This compares to earnings of $0.32 per share a year ago.