Core & Main Inc. (CNM)

Core & Main (CNM) Stock Declines While Market Improves: Some Information for Investors

In the most recent trading session, Core & Main (CNM) closed at $54.48, indicating a -0.29% shift from the previous trading day.

Core & Main (CNM) Laps the Stock Market: Here's Why

In the most recent trading session, Core & Main (CNM) closed at $56.73, indicating a +1.21% shift from the previous trading day.

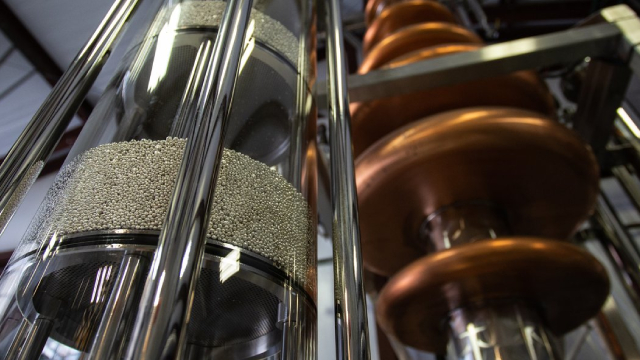

4 Manufacturing Tools Stocks to Watch on Prospering Industry Trends

The Zacks Manufacturing-Tools & Related Products industry has been gaining from strength across end markets, along with robust demand for machine tools in the industrial and automotive sectors. SWK, CNM, LECO and KMT are notable stocks in the industry.

Core & Main (CNM) Upgraded to Buy: Here's Why

Core & Main (CNM) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Core & Main (CNM) Recently Broke Out Above the 200-Day Moving Average

Core & Main (CNM) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, CNM crossed above the 200-day moving average, suggesting a long-term bullish trend.

Core & Main: Demand Outlook For FY25 Is Positive

I reiterate a buy rating for CNM due to strong 3Q24 results, upgraded FY24 guidance, and a positive demand outlook for FY25. CNM's 3Q24 revenue of $2.038 billion and adj EBITDA of $277 million beat consensus, driven by acquisitions and volume growth. The positive FY25 outlook supported by favorable macroeconomic conditions, potential interest rate cuts, and increased infrastructure investments, despite short-term margin pressures.

Core & Main: Despite A Stellar Quarter, Market-Beating Upside Is Unlikely

Core & Main's Q3 2024 results exceeded expectations, with revenue up 11.5% to $2.04 billion and EPS rising from $0.65 to $0.69. Despite strong performance, mixed cash flow metrics and high valuation justify maintaining a 'hold' rating for the stock. Management's commitment to growth is evident with 10 acquisitions this year, aiming for 2-4% annual organic and acquisition-driven revenue growth.

Core & Main Stock Soars on Strong Results, Boosted Outlook

Core & Main (CNM) shares soared 15% Tuesday as the company reported better-than-expected results and raised its outlook as it benefited from acquisitions.

Core & Main, Inc. (CNM) Q3 2024 Earnings Call Transcript

Core & Main, Inc. (NYSE:CNM ) Q3 2024 Earnings Conference Call December 3, 2024 9:00 AM ET Company Participants Robyn Bradbury - IR Steve LeClair - Chair and CEO Mark Witkowski - CFO Conference Call Participants Kathryn Thompson - Thompson Research Group. David Manthey - Baird Nigel Coe - Wolfe Research Mike Dahl - RBC Capital Markets Sam Reid - Wells Fargo Patrick Baumann - JPMorgan Joe Ritchie - Goldman Sachs Anthony Pettinari - Citigroup Matthew Bouley - Barclays David Ridley-Lane - Bank of America Operator Hello, and welcome to the Core & Main Q3 2024 Earnings Call.

Core & Main (CNM) Q3 Earnings and Revenues Top Estimates

Core & Main (CNM) came out with quarterly earnings of $0.69 per share, beating the Zacks Consensus Estimate of $0.65 per share. This compares to earnings of $0.65 per share a year ago.

Core & Main Gears Up For Q3 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Core & Main, Inc. CNM will release earnings results for the third quarter, before the opening bell on Tuesday, Dec. 3.

Wall Street Analysts Think Core & Main (CNM) Is a Good Investment: Is It?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?