Coinbase Global, Inc. - Class A (COIN)

Coinbase Global, Inc. (COIN) Stock Dips While Market Gains: Key Facts

Coinbase Global, Inc. (COIN) closed the most recent trading day at $167.69, moving -0.73% from the previous trading session.

COIN SHAREHOLDER ALERT: Bronstein, Gewirtz and Grossman, LLC Announces that Coinbase Global, Inc. Shareholders with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK CITY, NY / ACCESSWIRE / October 8, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Coinbase Global, Inc. ("Coinbase" or "the Company") (NASDAQ:COIN) and certain of its officers. Class Definition This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Coinbase securities between April 14, 2021, and July 25, 2024, inclusive (the "Class Period").

COIN INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Announces that Coinbase Global, Inc. Stockholders with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK CITY, NY / ACCESSWIRE / October 7, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Coinbase Global, Inc. ("Coinbase" or "the Company") (NASDAQ:COIN) and certain of its officers. Class Definition This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Coinbase securities between April 14, 2021, and July 25, 2024, inclusive (the "Class Period").

COIN INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Announces that Coinbase Global, Inc. Shareholders with Substantial Losses Have Opportunity to Lead Class Action Lawsuit!

NEW YORK CITY, NY / ACCESSWIRE / October 6, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Coinbase Global, Inc. ("Coinbase" or "the Company") (NASDAQ:COIN) and certain of its officers. Class Definition This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Coinbase securities between April 14, 2021, and July 25, 2024, inclusive (the "Class Period").

Coinbase CEO Brian Armstrong on the rise of the crypto voting block

Coinbase CEO Brian Armstrong, who has spent years lobbying lawmakers on the importance of the crypto industry, weighs in on the rise of the crypto voting bloc in the 2024 election cycle. Crypto businesses and individuals have raised more than $190 million so far, with Armstrong himself giving over $1.3 million to a mix of PACs including the bipartisan, pro-crypto Fairshake and JD Vance for Senate Inc., as well as directly to Democrats and Republicans running for both House and Senate seats.

How Coinbase is looking to drive crypto voters to the polls

Crypto World's MacKenzie Sigalos reports from Washington on Coinbase's efforts to get crypto investors signed up to vote ahead of the general election, as the digital assets exchange battles the U.S. Securities and Exchange Commission in court.

Should Investors Buy Coinbase Stock on the Dip?

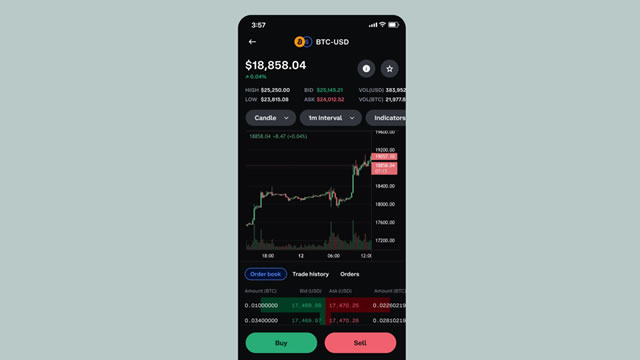

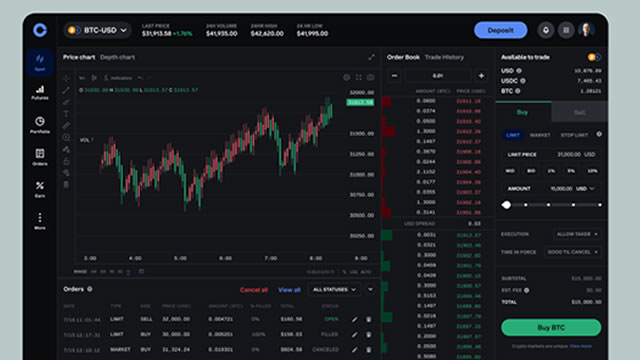

The platform brings together buyers and sellers of cryptocurrencies.

Coinbase to delist some stablecoins in Europe ahead of new regulations

Coinbase will delist certain stablecoins in the European Economic Area by year's end, the cryptocurrency exchange said on Friday, as the industry braces for tougher regulation in the region.

Coinbase Global, Inc. (COIN) Stock Falls Amid Market Uptick: What Investors Need to Know

Coinbase Global, Inc. (COIN) reachead $164.47 at the closing of the latest trading day, reflecting a -0.33% change compared to its last close.

COIN INVESTOR ALERT: Bronstein, Gewirtz and Grossman, LLC Reminds Investors of Coinbase Global, Inc. to Contact the Firm Today!

NEW YORK CITY, NY / ACCESSWIRE / October 2, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Coinbase Global, Inc. ("Coinbase" or "the Company") (NASDAQ:COIN) and certain of its officers. Class Definition This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Coinbase securities between April 14, 2021, and July 25, 2024, inclusive (the "Class Period").

Here is What to Know Beyond Why Coinbase Global, Inc. (COIN) is a Trending Stock

Coinbase Global (COIN) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

COIN Stockholders Have Opportunity to Lead Coinbase Global, Inc. Class Action Lawsuit – Contact Bronstein, Gewirtz and Grossman, LLC Today!

NEW YORK CITY, NY / ACCESSWIRE / October 1, 2024 / Bronstein, Gewirtz & Grossman, LLC, a nationally recognized law firm, notifies investors that a class action lawsuit has been filed against Coinbase Global, Inc. ("Coinbase" or "the Company") (NASDAQ:COIN) and certain of its officers. Class Definition This lawsuit seeks to recover damages against Defendants for alleged violations of the federal securities laws on behalf of all persons and entities that purchased or otherwise acquired Coinbase securities between April 14, 2021, and July 25, 2024, inclusive (the "Class Period").