Copart Inc. (CPRT)

Copart: Upside Hinges On Results Continuing To Surpass Market Expectations

Copart reported $1.15 billion in revenue, beating estimates by $46.9 million, reflecting 12% year-over-year growth driven by both domestic and international markets. International service revenue surged by 30%, highlighting Copart's success in expanding globally, while international gross profit increased by 44%. Copart's resilience in average selling prices, outperforming broader used vehicle market trends, further supports its competitive positioning.

Copart, Inc. (CPRT) Now Trades Above Golden Cross: Time to Buy?

Copart, Inc. (CPRT) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, CPRT's 50-day simple moving average broke out above its 200-day moving average; this is known as a "golden cross.

Copart Q1 Earnings Match Expectations, Revenues Increase Y/Y

CPRT's first-quarter earnings match the Zacks Consensus Estimate while revenues beat the same.

Copart, Inc. (CPRT) Q1 2025 Earnings Call Transcript

Copart, Inc. (NASDAQ:CPRT ) Q1 2025 Earnings Conference Call November 21, 2024 5:30 PM ET Company Participants Jeff Liaw - CEO Leah Stearns - CFO Conference Call Participants Bob Labick - CJS Securities Chris Bottiglieri - BNP Paribas Bret Jordan - Jefferies Alice Wycklendt - Baird Jash Patwa - JPMorgan Operator Good day, everyone, and welcome to the Copart Incorporated First Quarter Fiscal 2025 Earnings Call. Just a reminder, today's conference is being recorded.

Copart, Inc. (CPRT) Matches Q1 Earnings Estimates

Copart, Inc. (CPRT) came out with quarterly earnings of $0.37 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.34 per share a year ago.

Copart's first-quarter revenue beats estimates on strong salvage vehicle volumes

Online vehicle auction services provider Copart reported better-than-expected first-quarter revenue on Thursday, driven by robust volumes of salvage vehicles.

Copart, Inc. (CPRT) Rises As Market Takes a Dip: Key Facts

Copart, Inc. (CPRT) concluded the recent trading session at $52.45, signifying a +1.85% move from its prior day's close.

Copart, Inc. (CPRT) Beats Stock Market Upswing: What Investors Need to Know

Copart, Inc. (CPRT) reachead $52.18 at the closing of the latest trading day, reflecting a +0.64% change compared to its last close.

Copart, Inc. (CPRT) Registers a Bigger Fall Than the Market: Important Facts to Note

The latest trading day saw Copart, Inc. (CPRT) settling at $51.36, representing a -1.36% change from its previous close.

Is the Options Market Predicting a Spike in Copart (CPRT) Stock?

Investors need to pay close attention to Copart (CPRT) stock based on the movements in the options market lately.

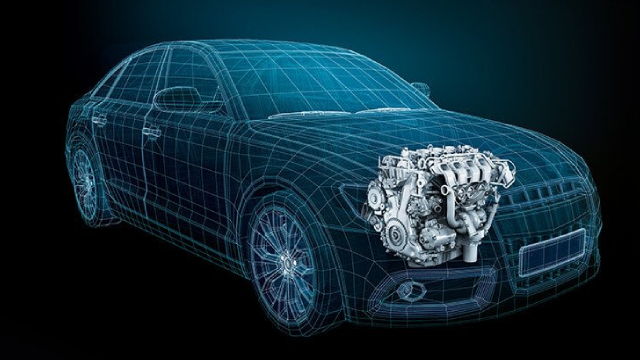

These 2 Auto Stocks Are Profiting as Used Cars and Parts Thrive

The auto/tires/trucks sector has been in a slump, as evidenced by weaker results and forecasts from manufacturers like Ford Motor Co. NYSE: F and Stellantis NYSE: STLA. High financing costs and an uncertain macroeconomic climate have caused consumers to tighten their spending, especially on big-ticket items like cars.