Cisco Systems, Inc. (CSCO)

Cisco: Remaining Bullish Despite Low Expectations For Q4 Earnings

Cisco Systems is set to report earnings this Wednesday. I have low expectations for this quarter given recent layoffs and the weak IT spending cycle. I remain optimistic in the longer term thanks to a high-quality business model, attractive valuation, and growing software and cybersecurity operations.

Wall Street Brunch: Price Perturbation Replaces Jobs Jitters

CPI data expected to show modest rise, potentially impacting Fed rate cut decision. What to make of crypto volatility.

Can Cisco (CSCO) Stock Regain Momentum After 9.3% YTD Dip?

Cisco (CSCO) has been suffering from sluggish networking sales due to lackluster demand and stiff competition offset by a strong and innovative portfolio as well as partner base.

Cisco axing thousands of jobs in second round of layoffs amid shift to AI: report

The layoffs are the latest in the tech industry, which has been cutting costs this year to offset big investments in AI.

Exclusive: Cisco to lay off thousands more in second job cut this year, sources say

Cisco will cut thousands of jobs in a second round of layoffs this year as the U.S. networking equipment maker shifts focus to higher-growth areas, including cybersecurity and AI, people familiar with the matter said.

Countdown to Cisco (CSCO) Q4 Earnings: A Look at Estimates Beyond Revenue and EPS

Beyond analysts' top -and-bottom-line estimates for Cisco (CSCO), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended July 2024.

3 Tech Stocks to Sell in August Before They Crash & Burn

The tech sector has been an area of strength for many years. It's propelled the S&P 500 and the Nasdaq Composite to new heights.

Two Stocks I'm Buying This Month With Attractive Dividends Offering Double-Digit Upside Potential

In my opinion, it's likely both companies can achieve analysts' growth estimates despite recent headwinds. Both companies have been aggressively pursuing additional investments, CSCO in AI and SBUX with partnerships. I recently purchased shares in Cisco Systems and Starbucks due to their attractive valuations and double-digit upside potential over the next 12-18 months. Both companies have strong fundamentals, strong earnings growth potential, and undervalued compared to their 5-year averages, presenting buying opportunities.

3 Internet of Things Stocks That May Connect the Future

Tech stocks, including Internet of Things (IoT) stocks, are having a very tough time lately. Increased market tension is powered by a highly unstable geopolitical environment that has led to a sharp market selloff.

Here's Why Cisco Systems (CSCO) Gained But Lagged the Market Today

In the latest trading session, Cisco Systems (CSCO) closed at $45.16, marking a +0.94% move from the previous day.

The Single Best Dividend Stock to Buy Under $50

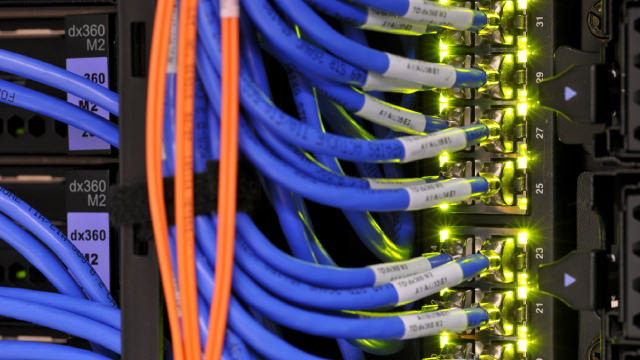

Since the explosion of personal computing that started in the late 1970s and 1980s, San Jose headquartered Cisco Systems (NASDAQ: CSCO) has been an integral part of creating the means for computers to communicate with each other.

Investors Heavily Search Cisco Systems, Inc. (CSCO): Here is What You Need to Know

Cisco (CSCO) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.