CVS Health Corporation (CVS)

Are Medical Stocks Lagging CVS Health (CVS) This Year?

Here is how CVS Health (CVS) and Agenus (AGEN) have performed compared to their sector so far this year.

3 High-Yield Dividend Kings Beating the S&P 500 This Year

The S&P 500 is one of the most widely known benchmarks. It contains the 500 most valuable publicly traded U.S.

CVS Health (CVS) Laps the Stock Market: Here's Why

CVS Health (CVS) closed the most recent trading day at $67.58, moving +1.15% from the previous trading session.

Why CVS Health (CVS) is a Top Value Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Investors Heavily Search CVS Health Corporation (CVS): Here is What You Need to Know

CVS Health (CVS) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Exploring CVS' Health Services Segment: A Key Growth Engine for 2025?

CVS' Health Services segment posts $43B in revenues as specialty pharmacy and Caremark deals drive 2025 growth prospects.

CVS Surges on Regulatory Relief, Medicare Advantage Push: Time to Buy?

CVS surges 53.7% YTD as regulatory relief, strong execution and Medicare Advantage momentum fuel investor confidence.

5 Low Price-to-Book Value Stocks That You Can Buy in June

The P/B ratio helps to identify low-priced stocks with high growth prospects. USNA, CVS, PFE, STNE and PSFE are some such stocks.

4 Attractive GARP Picks for Your Portfolio Based on PEG Ratio

Here are four discounted PEG stocks that qualify our screening criteria and could be good picks. These are FLEX, CVS, URBN and EXEL.

CVS Health's MBR Improves: Can It Sustain Amid Elevated Cost Trends?

CVS posts its first favorable MBR in quarters, but elevated cost trends test its ability to sustain the gains.

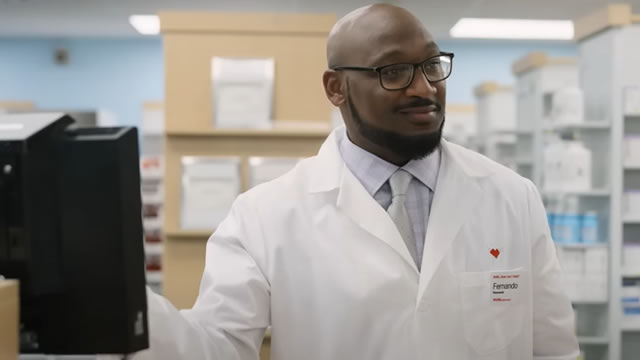

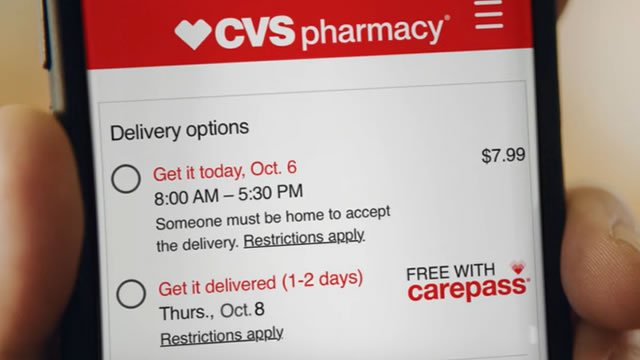

CVS Health Advances Digital Strategy: Is It the Next Revenue Pillar?

CVS unveils a $20B digital strategy to tackle healthcare gaps and reshape consumer health experiences.

Here is What to Know Beyond Why CVS Health Corporation (CVS) is a Trending Stock

CVS Health (CVS) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.