DoorDash, Inc. (DASH)

It's All About Partnerships In DoorDash - Bringing More Upside

I am maintaining my buy on DoorDash after management announced the new partnership with H Mart on Thursday. The news backs my belief that DoorDash's next leg of growth will come from its partnerships and expansion to international markets. In my opinion, this partnership in specific reflects Dash's efforts to seriously expand into the grocery business, but it doesn't come without competition from Uber and InstaCart.

DoorDash Leads 5 Stocks Near Buy Points As Market Drops

DoorDash is trading near a buy point, one of five stocks for your watchlists with the market struggling.

DoorDash Leads 5 Stocks Near Buy Points As Market Drops

DoorDash is trading near a buy point, one of five stocks for your watchlists with the market struggling.

DASH Gains 26.4% YTD: Should You Buy, Hold or Sell the Stock?

DoorDash shares soar 26.4% year to date, fueled by robust total orders and strong Marketplace GOV growth.

DoorDash Stock Sprints Higher on EPS Beat and Raised Guidance

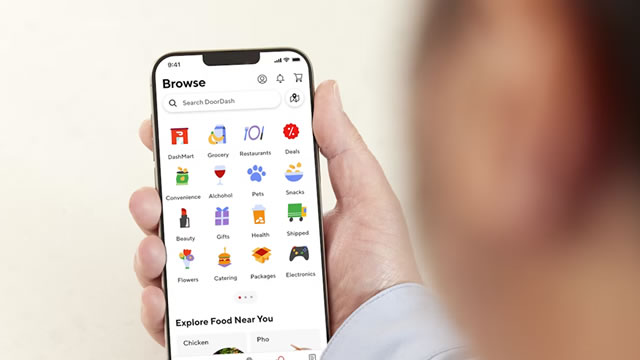

DoorDash Inc. NASDAQ: DASH is the largest food delivery platform in the United States, with over 550,000 restaurants and grocery stores in its network. Like Uber Technologies Inc. NYSE: UBER, DoorDash plays the role of the middleman connecting local restaurants with customers and Dashers (delivery drivers) to deliver the food.

Tech Stocks Lead Stock Market Lower As Wall Street Braces For Powell Speech

Tech stocks led the stock market lower Thursday, as Wall Street braced for Fed Chair Jerome Powell's speech on Friday morning.

DoorDash Adds Max Streaming Service to DashPass Membership Program

DoorDash's DashPass membership program now includes offers from Warner Bros. Discovery's Max streaming service.

DoorDash to offer Max streaming to members in the US as competition intensifies

DoorDash on Tuesday said it had partnered with Warner Bros Discovery's Max to provide the streaming service at no extra cost to its membership program subscribers in the United States.

DoorDash Delivers: Earnings Review - Reiterating A Buy

I'm reiterating my buy rating on Dash after its 2Q24 report and confirm my belief that the company is now in its next leg of growth. In my opinion, Dash will continue seeing strong momentum in its grocery offering and I expect it to further improve the top-line in the near term. Management's focus is on 1. Introducing new merchants to the U.S. marketplace in the grocery, beauty, home, etc and 2. Expanding International markets, which should pay off big time in FY24.

Market Crash? No Problem for DoorDash Stock's Impressive Earnings

Investors are now worried about the market crashing, with the U.S. 10-year treasury bond finally breaking below a 4% yield for the first time since the Federal Reserve (the Fed) started hiking interest rates to combat inflation and a red-hot economy. The S&P 500 is trading lower by up to 1.5% as weak economic data starts coming in for August.

DoorDash (DASH) Reports Q2 Loss, Beats Revenue Estimates

DoorDash's (DASH) second-quarter 2024 results reflect strength in total orders and Marketplace GOV.

DoorDash Stock Pops After Earnings. It's More Than a Food Delivery Company.

Analysts predict more gains for the shares.