Emerson Electric Co. (EMR)

Emerson Electric (EMR) Ascends While Market Falls: Some Facts to Note

Emerson Electric (EMR) closed at $109.22 in the latest trading session, marking a +0.29% move from the prior day.

Emerson Electric: Growing Margins At A Reasonable Valuation

Emerson Electric is down over 10% from its 52-week-high, presenting a potential buying opportunity for long-term investors. Emerson stands to gain over the medium term from improving EBIT margins and organic growth opportunities. The stock looks slightly undervalued today, with reasonable valuation multiples.

Emerson Electric (EMR) Stock Falls Amid Market Uptick: What Investors Need to Know

Emerson Electric (EMR) reachead $105.05 at the closing of the latest trading day, reflecting a -0.1% change compared to its last close.

Emerson Stock Exhibits Strong Prospects Despite Headwinds

EMR is set to benefit from healthy demand across most of its end markets. Increasing costs and expenses are concerning.

Emerson Electric (EMR) Beats Stock Market Upswing: What Investors Need to Know

In the most recent trading session, Emerson Electric (EMR) closed at $103.90, indicating a +1.47% shift from the previous trading day.

Emerson Electric Co. (EMR) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Emerson Electric (EMR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Why Emerson Electric (EMR) is a Top Value Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Emerson Electric Co. (EMR) Is a Trending Stock: Facts to Know Before Betting on It

Emerson Electric (EMR) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Emerson Electric (EMR) is a Top-Ranked Momentum Stock: Should You Buy?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

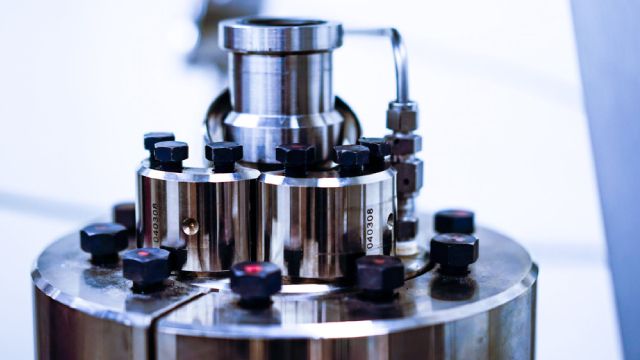

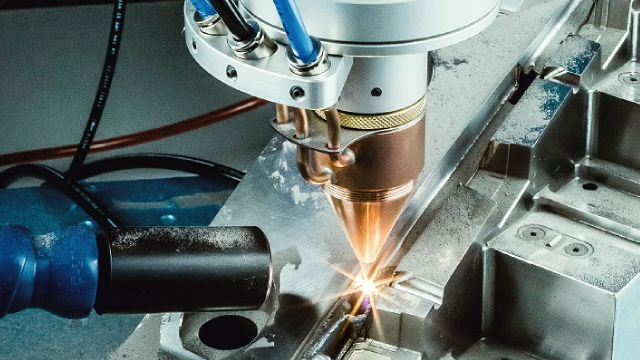

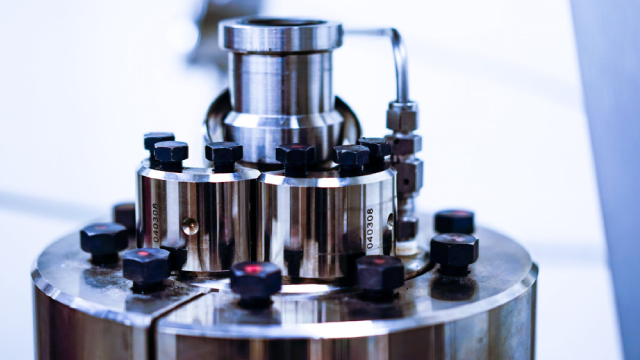

Emerson Electric: Upgrading My Portfolio With This Undervalued Dividend King

I prioritize adding stocks that enhance my portfolio's quality, and Emerson Electric meets this criterion due to its alignment with the re-industrialization trend. Emerson Electric is well-positioned to benefit from the 5th Industrial Revolution, focusing on automation, electrification, and advanced manufacturing, making it a compelling long-term investment. After a recent 13% sell-off, EMR's valuation is attractive, trading below its historical P/E ratios, with strong fundamental growth prospects.

3 Great Value Stocks That Are Screaming Buys in September

Emerson Electric is set for excellent long-term growth thanks to favorable megatrends. Water products specialist Pentair is both a restructuring play and a beneficiary of lower interest rates.

Emerson Electric Co. (EMR) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Emerson Electric (EMR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.