Emerson Electric Co. (EMR)

Here is What to Know Beyond Why Emerson Electric Co. (EMR) is a Trending Stock

Emerson Electric (EMR) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Emerson Electric (EMR) Beats Stock Market Upswing: What Investors Need to Know

Emerson Electric (EMR) concluded the recent trading session at $139.57, signifying a +1.87% move from its prior day's close.

Emerson Gains From Business Strength Amid Persisting Headwinds

EMR's strong Intelligent Devices and Software and Control growth, plus full AspenTech ownership, fuels sales momentum despite pockets of weakness.

Emerson Electric Has Raised Its Dividend for 68 Years and the Streak Looks Secure

Emerson Electric (NYSE: EMR) has paid dividends for 68 consecutive years, but can the industrial automation giant maintain that streak?

Emerson & Prevalon Partner to Develop Data-Center Storage Solutions

EMR's partnership with Prevalon aims to deliver smarter, integrated energy systems that boost reliability for data centers.

Why Is Emerson Electric (EMR) Up 3.9% Since Last Earnings Report?

Emerson Electric (EMR) reported earnings 30 days ago. What's next for the stock?

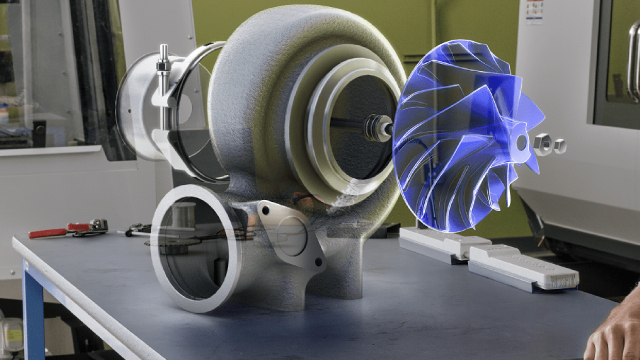

Intelligent Devices Segment Drives Emerson: Can the Momentum Sustain?

EMR's Intelligent Devices strength, led by Final Control and regional gains, fuels growth despite softness in Safety and Productivity.

Is Trending Stock Emerson Electric Co. (EMR) a Buy Now?

Recently, Zacks.com users have been paying close attention to Emerson Electric (EMR). This makes it worthwhile to examine what the stock has in store.

Emerson Electric Co. (EMR) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Emerson Electric (EMR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Emerson Electric Co. (EMR) Discusses Portfolio Transformation and Segment Reorganization Strategy Transcript

Emerson Electric Co. ( EMR ) Discusses Portfolio Transformation and Segment Reorganization Strategy November 20, 2025 9:00 AM EST Company Participants Colleen Mettler - Vice President of Investor Relations Surendralal Karsanbhai - President, CEO & Director Ram Krishnan - Executive VP & COO Michael Baughman - Executive VP, Chief Accounting Officer & CFO Conference Call Participants Andrew Kaplowitz - Citigroup Inc., Research Division Julian Mitchell - Barclays Bank PLC, Research Division Nigel Coe - Wolfe Research, LLC Deane Dray - RBC Capital Markets, Research Division Andrew Obin - BofA Securities, Research Division Brett Linzey - Mizuho Securities USA LLC, Research Division Andrew Buscaglia - BNP Paribas, Research Division Nicole DeBlase - Deutsche Bank AG, Research Division Christopher Glynn - Oppenheimer & Co. Inc., Research Division Joseph O'Dea - Wells Fargo Securities, LLC, Research Division Jairam Nathan - Daiwa Securities Co. Ltd., Research Division Presentation Colleen Mettler Vice President of Investor Relations Good morning.

Emerson Electric Co. (EMR) Is a Trending Stock: Facts to Know Before Betting on It

Zacks.com users have recently been watching Emerson Electric (EMR) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Emerson Q4 Earnings Match Estimates, Software and Control Sales Rise

EMR posts solid Q4 results with stronger margins and upbeat FY26 guidance, driven by Software & Control growth.