Evergy Inc. (EVRG)

Evergy, Inc. (EVRG) Q2 2025 Earnings Call Transcript

Evergy, Inc. (NASDAQ:EVRG ) Q2 2025 Earnings Conference Call August 7, 2025 9:00 AM ET Company Participants David A. Campbell - CEO, President & Chairman of the Board Peter Francis Flynn - Director of Investor Relations W.

Evergy's Q2 Earnings Beat Estimates, Revenues Decrease Y/Y

EVRG beats Q2 EPS estimates despite weather and cost pressures, though revenues slip year over year.

Evergy Inc (EVRG) Q2 Earnings Surpass Estimates

Evergy Inc (EVRG) came out with quarterly earnings of $0.82 per share, beating the Zacks Consensus Estimate of $0.76 per share. This compares to earnings of $0.9 per share a year ago.

Evergy to Report Q2 Earnings: What's in Store for the Stock?

EVRG's second-quarter results may reflect gains from grid upgrades and rising demand, despite a forecasted earnings dip.

Analysts Estimate Evergy Inc (EVRG) to Report a Decline in Earnings: What to Look Out for

Evergy (EVRG) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

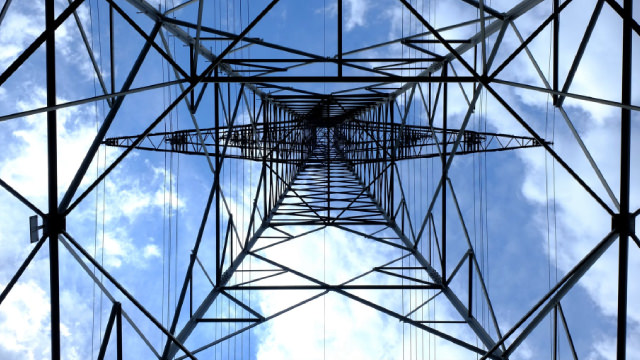

Evergy Benefits From Strategic Investments & Renewable Expansion

EVRG's strategic investment plans help it expand its operations in the transmission market. Focus on renewable expansion should boost its performance.

Is Evergy (EVRG) Outperforming Other Utilities Stocks This Year?

Here is how Evergy Inc (EVRG) and Telenor ASA (TELNY) have performed compared to their sector so far this year.

EVRG or OGE: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Utility - Electric Power sector might want to consider either Evergy Inc (EVRG) or OGE Energy (OGE). But which of these two companies is the best option for those looking for undervalued stocks?

Evergy: A Terrific Utility Pick To Sleep Well At Night

Over the last two decades, Evergy has proven itself to be a qualitative dividend grower. The electric utility reaffirmed its 4% to 6% annual adjusted EPS growth outlook, with the expectation of growth in the top half of this range. S&P awards a BBB credit rating to Evergy on a stable outlook.

Are Utilities Stocks Lagging Evergy (EVRG) This Year?

Here is how Evergy Inc (EVRG) and Sabesp (SBS) have performed compared to their sector so far this year.

Here's Why You Should Add Evergy Stock to Your Portfolio Right Now

EVRG makes a strong case for investment, given its growth prospects, improved debt management and capability to increase shareholder value.

EVRG vs. PEG: Which Stock Is the Better Value Option?

Investors with an interest in Utility - Electric Power stocks have likely encountered both Evergy Inc (EVRG) and PSEG (PEG). But which of these two stocks offers value investors a better bang for their buck right now?