Ford Motor Company (F)

Ford's Dividend Looks Hard to Maintain, Even With Bespoke Accounting

The automaker's payouts seem ambitious, notwithstanding a heavy adjustment of cash-flow metrics.

Ford Needs to Close Its EV Business

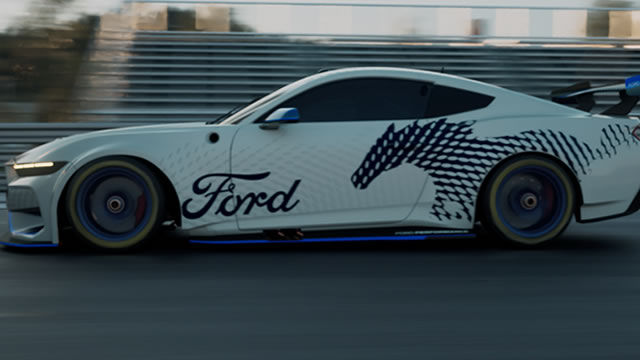

Ford Motor Co. (NYSE: F) is among the world's kings of gasoline-powered cars and light vehicles.

Ford's (F) Model T Is A Bluff

[00:00:04] Doug McIntyre: Yesterday, Ford down in Louisville where they've got a plant.

America's Worst $10 Stock

Ford Motor Co. (NYSE: F) stock has traded in a range of $8.44 to $11.97 in the past 52 weeks.

Ford (NYSE: F) Price Prediction and Forecast 2025-2030 (August 2025)

Shares of Ford Motor Company ( NYSE: F ) lost 3.70% over the past month after gaining 8.25% the month prior, pausing a rally that's seen the legacy automaker's stock gain 31.65% since April 8.

Ford: Record Revenues, Strong Balance Sheet, And An Undervalued Stock

Ford's strong Q2 2025 performance, driven by trucks, SUVs, and Ford Pro, outpaced industry growth and expanded market share despite a tough macro environment. Upcoming Fed rate cuts could unlock pent-up vehicle demand, and Ford is well-positioned to capitalize due to its affordable and popular product lineup. Robust cash reserves and undervalued stock metrics provide a margin of safety, while continued investment in EVs and cost efficiencies support future growth.

The Real Reason Ford Stock Is Rallying—Can It Keep Going?

The automotive sector has been subject to extra volatility recently, not only due to changing consumer spending and preferences but also from the macro backdrop involving tariffs and other developments in the sourcing of parts and imports. That being said, this is now the best time to find those companies that are actively (and successfully) adjusting.

Ford Motor Company (F) is Attracting Investor Attention: Here is What You Should Know

Ford Motor (F) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

With 96 Recalls, Ford's EV Plan in Doubt

Ford Motor Co. (NYSE: F) CEO Jim Farley said plans to build a new manufacturing system to produce its next-generation electric vehicle (EV) present a risk.

Ford unveils new EV platform, targets $30K pickup in 2027

Ford Motor Company (NYSE:F) has introduced its new Ford Universal Vehicle Platform, which the automaker says will underpin a new generation of electric vehicles, starting with a pickup truck expected to launch in 2027 at a starting price of about $30,000. The platform was unveiled at Ford's “Our Next Model T Moment” event, where the company likened the initiative to its early-20th-century manufacturing revolution.

Ford is readying a ‘compelling EV.' Will that be enough for the stock?

Ford plans to offer a new four-door, midsize $30,000 electric pickup truck two years from now. The new EV is to be built on a new, universal EV platform, which Ford says is expected to reduce parts by 20% and assembly time by 15%.

Is Ford Stock Worth Buying Now on its EV Strategy Shift?

F is betting big on a $30K electric pickup and streamlined U.S. battery production to revive its EV fortunes amid fierce global competition.