Freeport-McMoRan Inc. (FCX)

Freeport-McMoRan (FCX) Stock Declines While Market Improves: Some Information for Investors

In the latest trading session, Freeport-McMoRan (FCX) closed at $54.22, marking a -2.31% move from the previous day.

Freeport-McMoRan Up 30% in 3 Months: Buy, Sell or Hold the Stock?

FCX shares have surged 30% in three months, fueled by record copper prices, tightening supply concerns and strong demand from key global markets.

Why Freeport-McMoRan (FCX) is a Top Value Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

FCX's Unit Cash Costs Spike in Q3: Is It Set to Climb Further in Q4?

FCX saw Q3 unit cash costs surge 24% on lower copper volumes and the miner expects an even sharper cost jump in Q4.

Freeport EPS expected to outperform as Grasberg ramp-up delayed

Freeport-McMoRan Inc (NYSE:FCX, XETRA:FPMB) is set to report strong fourth-quarter results, driven by better-than-expected realized copper and gold prices, according to Jefferies analysts. The mining giant disclosed its provisional 4Q25 earlier this week, prompting Jefferies to update its model.

Freeport-McMoRan (FCX) Laps the Stock Market: Here's Why

In the latest trading session, Freeport-McMoRan (FCX) closed at $51.93, marking a +2.24% move from the previous day.

Freeport Stock Rises 35% in 3 Months: What's Driving the Rally?

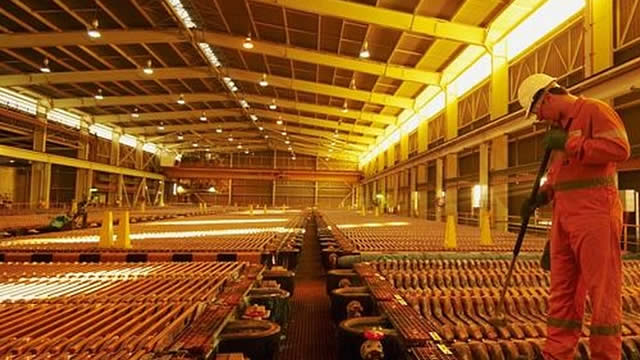

FCX stock jumps more than 35% in three months, fueled by surging copper prices and progress at the Grasberg mine in Indonesia.

Freeport-McMoRan (FCX) Increases Despite Market Slip: Here's What You Need to Know

Freeport-McMoRan (FCX) closed the most recent trading day at $53.04, moving +2.16% from the previous trading session.

Here's Why You Should Retain Freeport-McMoRan Stock in Your Portfolio

FCX is advancing major copper expansions and boasts strong liquidity, but rising unit costs and sharply lower volume guidance temper the outlook.

Freeport-McMoRan Inc. (FCX) Is a Trending Stock: Facts to Know Before Betting on It

Freeport-McMoRan (FCX) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Copper Hits $12,000 a Ton. Time to Mine Freeport-McMoRan for More Profits?

Freeport-McMoRan (NYSE:FCX) shares rose 3% yesterday to close at $50.64 per share, putting them just 8% below the May 2024 high of $54.86 and about 16% shy of the company's all-time high just above $59 per share that it hit back in 2008.

Why Freeport-McMoRan (FCX) Outpaced the Stock Market Today

In the closing of the recent trading day, Freeport-McMoRan (FCX) stood at $49.15, denoting a +2.57% move from the preceding trading day.