FirstEnergy Corp. (FE)

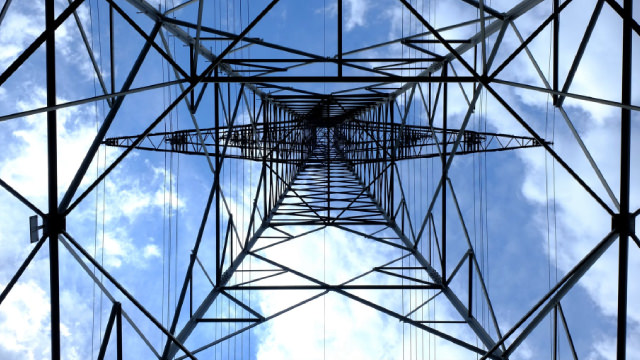

FirstEnergy unit to invest $950 million in Ohio and Pennsylvania grid upgrades

FirstEnergy said on Monday its transmission unit has been selected by grid operator PJM to modernize equipment, rebuild older lines and upgrade substations in Ohio and Pennsylvania, and that it will invest $950 million in the effort.

FirstEnergy (FE) is a Top-Ranked Value Stock: Should You Buy?

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

What Makes FirstEnergy (FE) a Strong Momentum Stock: Buy Now?

Does FirstEnergy (FE) have what it takes to be a top stock pick for momentum investors? Let's find out.

Here's Why FirstEnergy (FE) is a Strong Momentum Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

FirstEnergy Corporation (FE) Soars to 52-Week High, Time to Cash Out?

FirstEnergy (FE) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

FirstEnergy Corp. (FE) Q4 2025 Earnings Call Transcript

FirstEnergy Corp. (FE) Q4 2025 Earnings Call Transcript

FirstEnergy (FE) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for FirstEnergy (FE) give insight into how the company performed in the quarter ended December 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

FirstEnergy (FE) Q4 Earnings and Revenues Surpass Estimates

FirstEnergy (FE) came out with quarterly earnings of $0.53 per share, beating the Zacks Consensus Estimate of $0.52 per share. This compares to earnings of $0.67 per share a year ago.

Is FirstEnergy (FE) Stock Outpacing Its Utilities Peers This Year?

Here is how FirstEnergy (FE) and Telefonica Brasil (VIV) have performed compared to their sector so far this year.

3 Sales Growth Stocks to Buy Despite AI-Linked Market Turbulence

Genuine Parts, Wheaton Precious Metals and FirstEnergy stand out as sales-growth picks as investors rethink AI exposure.

Unlocking Q4 Potential of FirstEnergy (FE): Exploring Wall Street Estimates for Key Metrics

Besides Wall Street's top-and-bottom-line estimates for FirstEnergy (FE), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended December 2025.

FirstEnergy to Post Q4 Earnings: What to Expect From the Stock?

FE gears up for Q4 earnings with lower EPS expected, modest revenue growth forecast, and grid investments and data center demand in focus.