General Electric Company (GE)

GE Aerospace secures $1.8 billion U.S. Air Force contract

GE Aerospace said on Friday it had secured a contract from the U.S. Air Force valued up to $1.8 billion.

GE Aerospace to invest nearly $1B in US manufacturing

GE Aerospace is the latest company to announce an investment in the U.S. economy under the Trump administration. GE said the funds are nearly double last year's commitment.

GE Aerospace to invest about $1 billion in US manufacturing this year

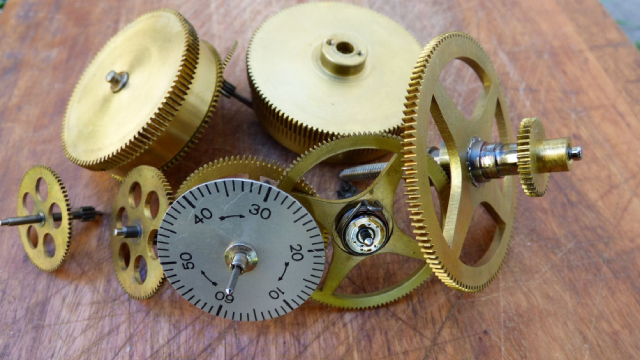

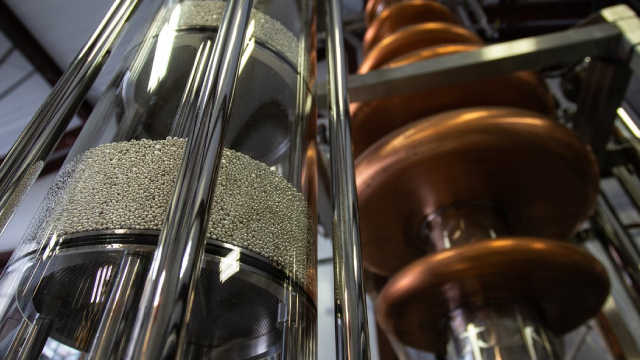

GE Aerospace said on Wednesday it would invest nearly $1 billion in its U.S. factories and supply chain in 2025, as it looks to increase the use of new parts and materials in its operations.

Billionaire Nelson Peltz Has 67% of His Hedge Fund's $3.9 Billion Portfolio Invested in Just 3 Stocks

2024 was quite a year for Nelson Peltz's hedge fund, Trian Fund Management.

3 Of My Highest-Conviction Dividend Ideas With A Special Tailwind

Air travel is a modern miracle, yet I have a love/hate relationship with it. While flying can be uncomfortable, the ability to cross continents in hours is astounding. The aerospace industry is booming, with strong demand and innovation driving growth. I've invested heavily in this sector, betting on its long-term potential. My portfolio focuses on companies with durable moats, strong growth, and dividend potential. Despite risks, I believe aerospace will remain a cornerstone of global connectivity and my investments.

1 Wall Street Analyst Thinks GE Aerospace Stock Is Going to $250. Is It a Buy?

A Redburn Atlantic analyst recently initiated coverage of GE Aerospace (GE 0.20%) with a buy recommendation and slapped a $250 price target on the stock.

GE Aerospace Stock Lifts Off With a New Bull: ‘Winner Takes All'

The jet engine maker stands out for sustained earnings growthand good cash conversion, writes Olivier Brochet of Redburn Atlantic.

GE Aerospace Rewards Shareholders With 28.6% Dividend Increase

GE's measures to consistently reward shareholders through dividends and share buybacks hold promise.

GE Aerospace Stock Is a Buy. It Has No Comparison.

GE Aerospace stock is expensive. Deutsche Bank explains why that's just fine.

India expects stable delivery of GE-powered fighter jets next fiscal year after delays

India expects stable delivery of a domestically-made light combat aircraft powered by a GE engine in the upcoming fiscal year after a delay of nearly 12 months, a top government official said on Sunday.

What's a Fair Price to Buy General Electric (GE) Stock?

The industrial powerhouse has passive income investors interested in owning its shares.

Why GE Aerospace Stock Soared in January

For years, the aerospace business housed inside the General Electric conglomerate was considered a crown jewel. Now on its own, GE Aerospace (GE -0.70%) is proving its mettle.