GE Vernova Inc. (GEV)

The Big 3: GEV, NDAQ, STX

When it comes to Tuesday's economic prints, Jessica Inskip (@jessicainskip) says the labor picture gives the Fed more leeway for interest rate cuts in 2026. It's something she takes into consideration for her Big 3 picks.

GE Vernova (GEV) Ascends While Market Falls: Some Facts to Note

In the most recent trading session, GE Vernova (GEV) closed at $681.35, indicating a +1.44% shift from the previous trading day.

GE Vernova: A Deserved Tech Stock Valuation

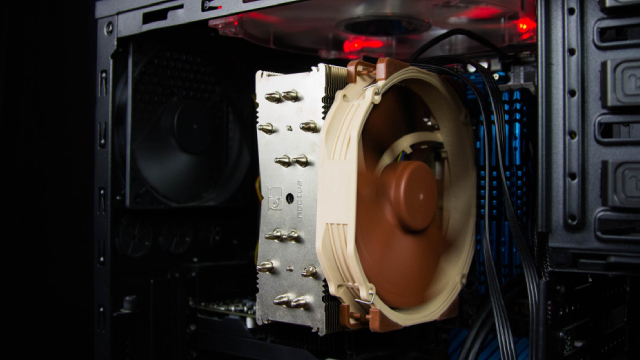

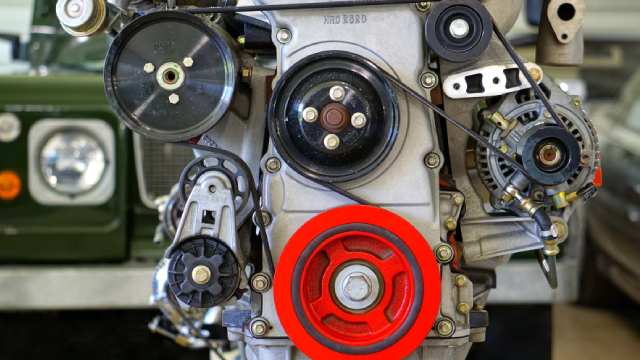

GEV investor day confirmed a high demand and earnings growth for the company through 2028 of over 30%. Electric turbines (gas, water, or nuclear) and grid expansion are strategic for AI and the data center buildout. The updated estimates and valuation lead to an increase in my YE26 price target to $907 with a longer-term $1,400 priced at 1.25x PEG.

Is Trending Stock GE Vernova Inc. (GEV) a Buy Now?

GE Vernova (GEV) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Strength Seen in GE Vernova (GEV): Can Its 15.6% Jump Turn into More Strength?

GE Vernova (GEV) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

Market Momentum: 3 Stocks Poised for Major Breakouts

Following a sharp correction in November, sparked by a tech-led pullback, concerns over AI capital expenditure payoffs and renewed anxiety about the pace of rate cuts have led to a surprising rebound in the broader market. The S&P 500 now sits just 1% below its all-time high, and with a Fed decision approaching where odds strongly favor a 25 bps cut, investors are once again positioning for upside into year-end.

GE Vernova CEO talks global energy buildout, plus how to trade options to hedge Fed volatility

Asking for a Trend host Josh Lipton looks back on the day's biggest stock market themes on December 10, 2025 GE Vernova CEO Scott Strazik joins Yahoo Finance host Julie Hyman for a discussion about the company's role in building out energy infrastructure around the world. Explosive Options technical analyst Bob Lang also comes on the program to talk about how investors can play the options trade to hedge against volatility tied to the Federal Reserve's decision to cut interest rates and any year-end volatility trends.

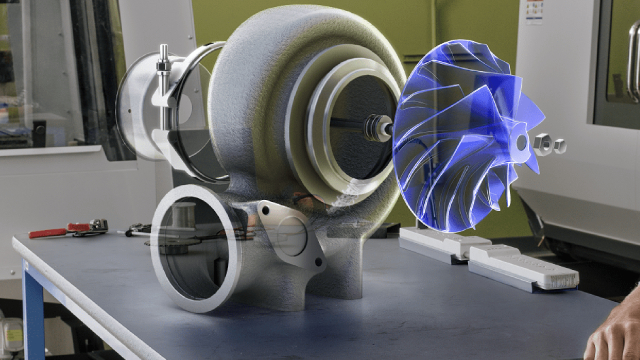

GE Vernova CEO on nuclear future

GE Vernova CEO Scott Strazik discussed the future of nuclear power as opposed to gas in the U.S..

GE Vernova shares jump as company lifts long-term financial targets

GE Vernova (NYSE:GEV) shares added 16.5% on Wednesday at about $730 after the company raised its long-term financial outlook and projected stronger revenue, margins and cash generation through 2028 at its investor update event in New York. The company now expects $52 billion in revenue and a 20% adjusted EBITDA margin by 2028, up from its prior forecast of $45 billion and a 14% margin.

GE Vernova Stock Powers to a Record High After Investor Day—Here's Why

GE Vernova (GEV) shares surged to a record high Wednesday after the company boosted its financial targets and doubled its quarterly dividend.

GE Vernova is riding the electrification wave, and the stock soars to a record

GE Vernova's stock soars into record territory after the electrification company boosts its long-term outlook for financial returns and plans to return more cash to shareholders.

GE Vernova Inc. (GEV) Discusses Financial Guidance, Multiyear Outlook, and Industry Growth Drivers Transcript

GE Vernova Inc. (GEV) Discusses Financial Guidance, Multiyear Outlook, and Industry Growth Drivers Transcript