The Goldman Sachs Group, Inc. (GS)

Financial CEOs are weighing in on the state of the economy

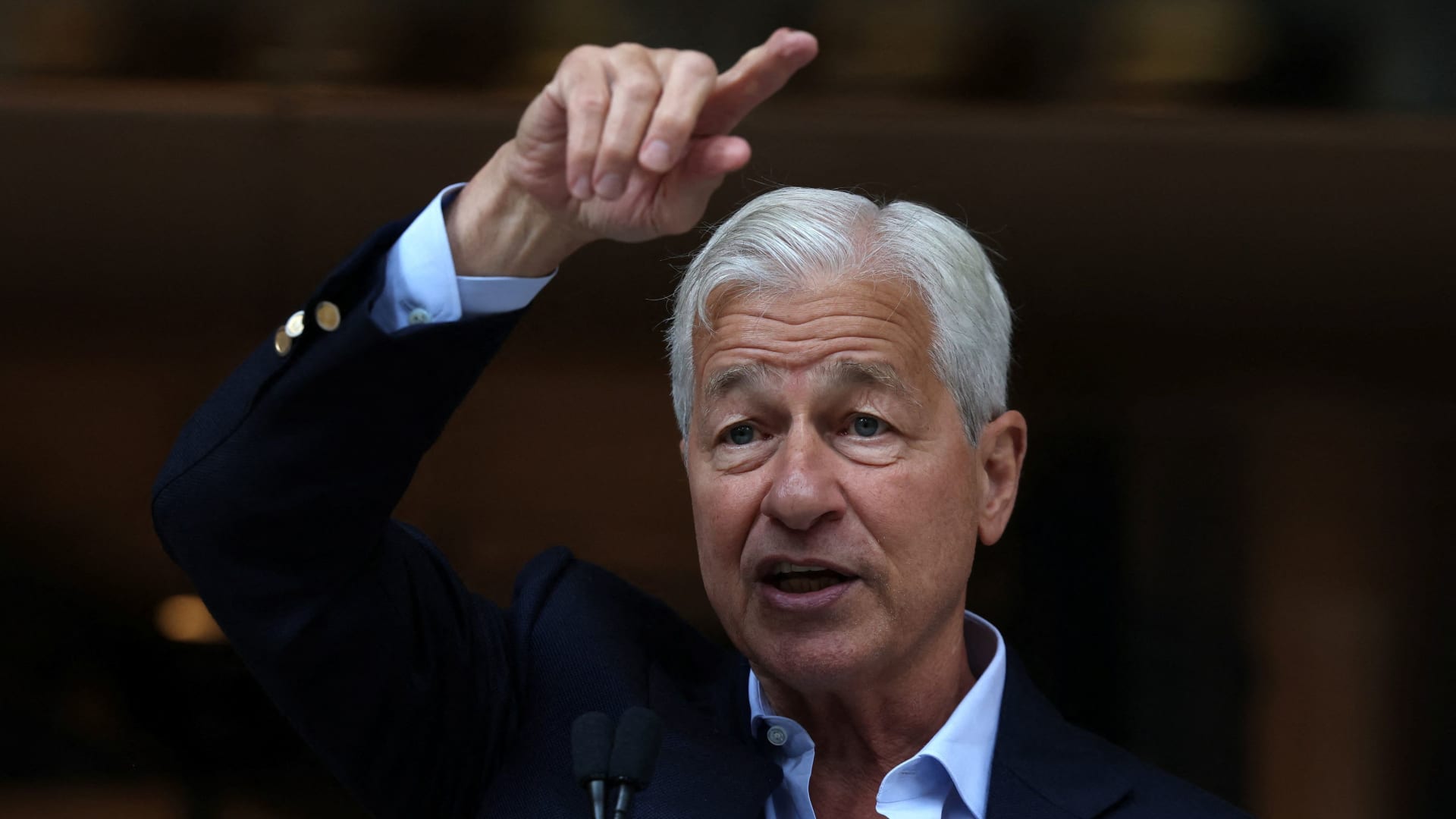

Amid economic uncertainty and a Bureau of Labor Statistics preliminary report revising down job numbers, CEOs weighed in this week on CNBC. Ranging from JPMorgan Chase CEO Jamie Dimon to PNC Financial Services CEO Bill Demchak, executives are starting to issue varying degrees of warning about slowdown.

AI excitement justified by impact technology can have, says Goldman Sachs CEO Solomon

Goldman Sachs Chairman and CEO David Solomon joins 'Closing Bell Overtime' to talk the state of AI, the state of the U.S. economy, and more.

Goldman Sachs (GS) Surpasses Market Returns: Some Facts Worth Knowing

The latest trading day saw Goldman Sachs (GS) settling at $763.92, representing a +2.97% change from its previous close.

T. Rowe Stock Jumps After Goldman Agrees to Invest $1 Billion, Partner on Private Funds

The agreement aims to give Goldman a bigger foothold in 401(k)s amid private-market push, and help T. Rowe stem fund outflows.

Goldman Sachs Adds 3 Ultra-Safe Blue Chip Dividend Stocks as Top September Picks

Founded in 1869, Goldman Sachs Group Inc. (NYSE: GS) is the world's second-largest investment bank by revenue and is ranked 55th on the Fortune 500 list of the largest U.S.

Goldman Sachs: The Big Bank You Want To Buy

Goldman Sachs delivered accelerating top and bottom line growth in Q2, with revenues up 14.6% and EPS up 27%, beating expectations. Investment banking rebounded strongly, driving flagship segment growth, while asset & wealth management saw minor declines but resilient inflows. Cost control and efficiency improvements led to higher ROE and ROTE, and the company raised its dividend, highlighting shareholder returns.

Why Goldman Sachs (GS) Dipped More Than Broader Market Today

The latest trading day saw Goldman Sachs (GS) settling at $729.78, representing a -2.08% change from its previous close.

Why Goldman Sachs (GS) is a Top Stock for the Long-Term

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

Large Cap Dividend-Paying Banks Exploding Higher on Rate Cut Hopes

One very positive item for investors when earnings season rolls around every quarter is that the big money center and investment banks are always among the first to report.

GS vs. MS: Which Stock Should Value Investors Buy Now?

Investors looking for stocks in the Financial - Investment Bank sector might want to consider either Goldman Sachs (GS) or Morgan Stanley (MS). But which of these two stocks is more attractive to value investors?

Goldman Sachs (GS) Laps the Stock Market: Here's Why

In the latest trading session, Goldman Sachs (GS) closed at $748.76, marking a +1.35% move from the previous day.

IPO & M&A Market Rebound: What it Means for Goldman's IB Business

GS is capitalizing on the rebound in global deal-making and IPOs, with IB fees rising and a strong pipeline fueling growth into 2025.