Global Technologies Ltd. (GTLL)

What Role Do Global Partnerships Play in Advancing Boeing's Strategy?

BA taps global partners to expand market reach, boost innovation and strengthen performance across key divisions.

Artisan Global Discovery Fund: Q3 Delivers Strong Results Amid Trimming And Exits

The portfolio generated a modestly positive absolute return in Q3, but it trailed the MSCI All Country World Small Mid Index. The Q3 underperformance was driven by stock selection in the IT, financials and consumer discretionary sectors. On the positive side, stock selection in the health care and industrials sectors was the strongest contributor to performance.

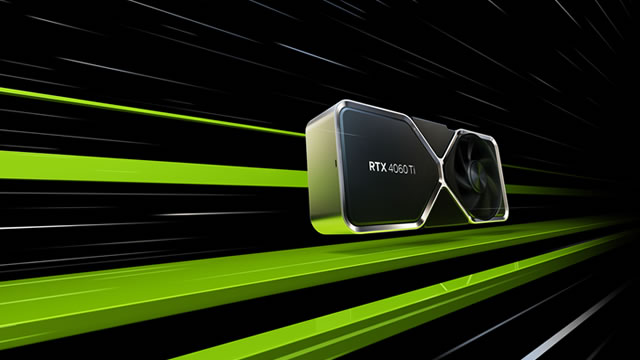

Global tech stocks climb as Nvidia results spark relief rally soothing AI bubble concerns

AI-related stocks in Europe and Asia made gains on Thursday. It comes as investor appetite for AI appeared to be cooling amid bubble concerns.

IBKR Opens Taipei Exchange Access: Another Step in Global Expansion?

Interactive Brokers expands global reach by opening access to the Taipei Exchange, adding new equity, ETF and depositary receipt trading for clients.

M2i Global, Volato Group sign MOU with Nimy Resources for access to Western Australia gallium

M2i Global Inc (OTC:MTWO) and Volato Group have signed a memorandum of understanding (MOU) with Nimy Resources to pursue a supply agreement for gallium sourced from Western Australia, the companies announced on Wednesday. Under the non-binding MOU, Nimy and M2i plan to work toward commercially binding terms for the sale and purchase of gallium from Nimy's Mons Project.

Global Markets Mixed; Dollar Eases, Gold Recovers

U.S. stock futures stabilized after another losing session on Wall Street as investors' focus turned to Nvidia's earnings after the bell.

iShares Global Timber & Forestry ETF: The Worst May Be Yet To Come

I am concluding my research on the forest industry with the iShares Global Timber & Forestry ETF. The companies I have previously covered account for ~25% of WOOD's 225.6 million AUM. The Invesco MSCI Global Timber ETF is WOOD's closest competitor, with a $41.2 million AUM. Smaller size is synonymous with thinner liquidity, as reflected by a higher median bid-ask spread. Despite lower liquidity, CUT's total expense ratio of 1.02% is ~2.5x higher than WOOD's 0.40%. Considering their highly similar portfolios, it is difficult to justify such a spread.

Global stocks sell-off as AI valuation concerns persist ahead of Nvidia earnings

A stock sell-off is underway but experts told CNBC it's a healthy correction. It comes after weeks of chatter about an artificial intelligence-fueled bubble, while Nvidia is also set to report third-quarter earnings this week.

Is Teladoc Health Accelerating Growth Through Global Expansion?

TDOC accelerates global growth as expanding international operations and rising overseas revenues bolster its profitability outlook.

Will Coinbase Business' Debut in Singapore Drive Global Expansion?

Coinbase's Singapore debut for its new Business platform deepens its global push as it scales digital-asset services across Asia.

Should You Look Abroad? Global Equity ETFs to Consider

Stretched U.S. valuations and AI bubble fears have investors looking abroad and are driving interest in international equity and emerging market ETFs.

U.S. Futures Rise, Global Markets Mixed, Nvidia Earnings Eyed

U.S. futures were up after last week's tech selloff on valuation concerns and artificial-intelligence spending.