Hudbay Minerals Inc. (HBM)

Micron: A Dip Worth Picking Up

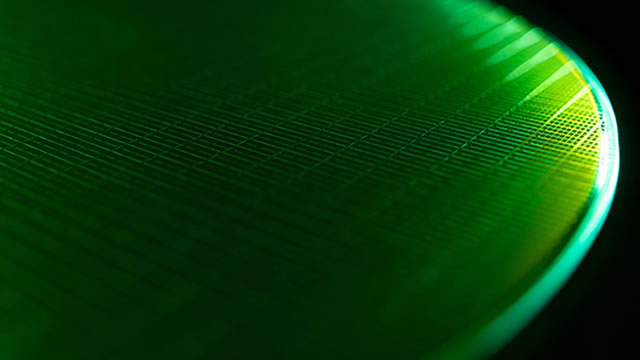

Micron is pivoting towards high-margin memory products like DDR5 and HBM, capitalizing on the surging demand from AI and data centers. Despite a 30% pullback from all-time highs in June, Micron's valuation ratios have cooled off, making it an attractive buy compared to industry peers. New 12-high HBM stacks use 20% less power than competitors' 8-stack and are set for mass production in FY25, targeting huge market growth.

HudBay Minerals (HBM) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

HudBay Minerals (HBM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

HudBay Minerals (HBM) Flat As Market Sinks: What You Should Know

In the most recent trading session, HudBay Minerals (HBM) closed at $9.06, indicating no shift from the previous trading day.

SK Hynix rallies 6.5% after Nvidia boss Jensen Huang asks firm to expedite next-generation chip

Chey Tae-won, chair of SK Group, said Nvidia CEO Jensen Huang asked him if SK Hynix could move the supply of high-bandwith memory (HBM) chips called HBM4 forward by six months. SK Hynix also announced a new 16-layer HBM product.

Nvidia's Huang asked SK Hynix to bring forward supply of HBM4 chips by 6 months, SK's chairman says

Nvidia CEO Jensen Huang asked memory chip maker SK Hynix to bring forward the supply of its next-generation high-bandwidth memory chips (HBM) called HBM4 by six months, SK Group chairman Chey Tae-won said on Monday.

These 2 Basic Materials Stocks Could Beat Earnings: Why They Should Be on Your Radar

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

HudBay Minerals (HBM) Stock Falls Amid Market Uptick: What Investors Need to Know

In the closing of the recent trading day, HudBay Minerals (HBM) stood at $9.58, denoting a -0.42% change from the preceding trading day.

Micron Technology: An Outrageous AI Growth Bargain

Micron Technology is thriving in the high bandwidth memory market, leading to a profit beat and strong forecast for the next quarter. The company's HBM3e shipments are scaling up, with expectations of significant revenue contributions by 2025 and a market share increase to 25%. Micron's 4Q24 earnings showcased a 93% YoY sales increase and a 23% operating income margin, driven by soaring HBM demand.

Micron: Why Q4 Results Didn't Get Me Excited

Micron is seeing growth in the HBM market but management's market share outlook of ~20% has negatively surprised me; I expected it to be higher given Samsung's lagging position. I believe the main positive surprise in Q4 was better gross margins delivery due to cost savings in DRAM production and better HBM yields. This is expected to continue. Micron still trades at a modest 32% premium vs its memory peers. I am not sure if this is justified as I doubt overall outperformance vs its competition.

Micron: Just Getting Started - Upgrading To A Buy

Our downgrade thesis played out into earnings, and now we're upgrading Micron Technology, Inc. stock to buy. Micron is uniquely positioned to benefit from industry demand for HBM (used in AI) and should see better top-line growth and margins because of it next year. Management is also guiding for FY25 capex to be 35% of total FY25 sales and aiming for their HBM share of the market to reflect their DRAM.

Micron's AI-Driven HBM Demand and Data Center Growth to Fuel Stock Upside, Analysts Say

Micron Technology, Inc MU stock continued its upward trajectory Thursday after reporting upbeat quarterly results after the market closed on Wednesday.

Micron's HBM Chips in High Demand Amid AI Boom

Micron Technology is reaping the benefits of the AI boom, as its high bandwidth memory (HBM) chips are experiencing soaring demand.