Hudbay Minerals Inc. (HBM)

Micron Enters A Profit Supercycle

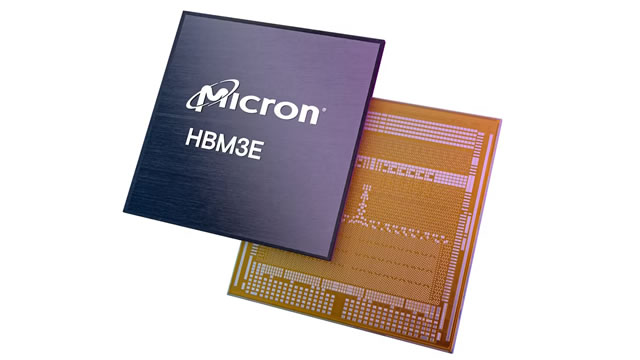

AI-driven HBM demand far exceeds supply, with Micron sold out through 2026 and customers losing pricing leverage. Micron forecasts HBM market growth near 40% CAGR, reaching roughly $100 billion and surpassing the entire 2024 DRAM market. Q2 guidance reflects pricing power, with projected $18.7 billion revenue, $8.42 non-GAAP EPS, and 68% gross margins.

Micron: 200% YTD Return, Trading At Just 12x Forward Earnings

Micron is still a cheap stock, despite the outperformance this year. HBM is the core driver of my bull case. 2026 capacity is sold out on volume and price, and management expects the tight HBM supply to persist beyond 2026. Q1 FY26 beat expectations (revenue $13.64B, EPS $4.78), and Q2 guidance shocked the Street: $18.7B revenue, $8.42 EPS, and 68% non-GAAP gross margin.

Micron: Stellar Results, But Here's Why It's A Hold And Not A Buy

Micron Technology, Inc.'s AI-driven memory boom faces hard supply ceilings, with HBM fully booked through 2026 and displacing standard DRAM, which caps incremental revenue upside despite strong demand. Major fab and advanced packaging expansions in Idaho and Singapore will add substantial MU capacity only in 2027–2028, potentially coinciding with a memory supercycle peak and increasing cycle timing risk.. Gross margins are inflecting higher on richer DRAM and HBM mix and strong pricing, and are likely to remain elevated before potentially compressing later in the decade if the cycle.

Micron: A Lever On AI Growth

Micron Technology, Inc. delivered a strong Q1 earnings beat, driven by surging Data Center demand and record high bandwidth memory, or HBM, revenue. MU's entire HBM supply for the next year is contracted, with HBM4 adoption set to accelerate alongside Data Center build-outs. The firm's gross margin expanded to 57% in Q1'26 (+11.1 PP Q/Q), with Cloud Memory margins reaching 66%, highlighting robust earnings leverage.

Micron's Q1 Print Could Ignite Christmas Rally

Micron's 2025 surge reflects re-rating from commodity cyclical importing to AI memory leader; I think Q1 2026 earnings will confirm this shift with a beat and raise. Data center now drives 56% of volume and roughly 52% gross margin, suggesting a structurally higher profitability base versus Micron's old 30–40% norm for longer. HBM revenue hit about $2B quarterly, $8B annualized; HBM3E ramps absorb wafer starts and packaging, tightening DRAM supply and sustaining broader ASP power into 2026.

Why I Am Still Bullish On Micron

I am upgrading Micron Technology to Strong Buy, driven by explosive AI-fueled demand for advanced memory chips. MU's HBM3E and HBM4 products are fully contracted for 2026, securing pricing power and multi-year growth visibility. Despite robust growth, MU trades at a steep valuation discount—FWD P/E of 9.8x vs. sector median 25x, and 46% EV/EBITDA discount.

Micron Technology: AI HBM Premium Drives DRAM Pricing And Justifies A Strong Buy

Micron Technology, Inc. remains a Strong Buy, driven by robust HBM and DRAM pricing from AI hardware demand. MU's Q1 2026 sales are expected to reach $12.7B, with 46% YoY growth and EPS at the high end of guidance. EBITDA and free cash flow estimates for MU have surged, supporting price targets with 54–81% upside potential.

Micron's HBM-Driven DRAM Demand Rises: Can AI Keep Lifting the Growth?

MU rides on the surging HBM-fueled DRAM demand as AI workloads boost shipments, pricing strength and growth momentum into 2026.

Micron: Possibly The Best Remaining AI Upside Trade

Micron continues to transition from a cyclical memory supplier to a mission-critical AI infrastructure provider, driven by its strategic DRAM, NAND and HBM roadmap. The company's dual-track roadmap for standard and customized HBM4E with TSMC support starting 2027 preserves Micron's AI share gains amid shifting GPU vs. custom ASIC adoption trends in the long-run. Tight supply-demand dynamics and accelerating pricing power across both HBM and non-HBM memory is also materially improving durability in Micron's growth outlook and margin profile.

Can HBM Sustain Its Free Cash Flow Momentum Amid Copper Price Swings?

Hudbay Minerals extends its free-cash-flow momentum through low costs and gold leverage, but volatility and geopolitical risks loom.

Micron Technology: Top Stock To Watch For 2026 From My Quant 'Dean's List'

Micron is benefiting from a major shift toward AI-grade memory with HBM and data-center DRAM driving margin expansion and record earnings into FY25. The setup for 2026 is favorable: HBM is sold out through next year, pricing is improving, and Micron offers direct exposure to the ongoing infrastructure buildout. SSRM Mining earns Top Past Performer after a breakout year driven by higher production, stronger free cash flow, and a major tailwind from rising gold prices.

Micron: Here's Why The Stock Has Been Soaring (Hint: It's Not HBM) (Downgrade)

Micron Technology, Inc. shares are soaring, up close to 100% since August. While HBM is a factor in MU's rise, DRAM and NAND prices are surging. The memory supercycle marches on and MU is poised for a record 2026.