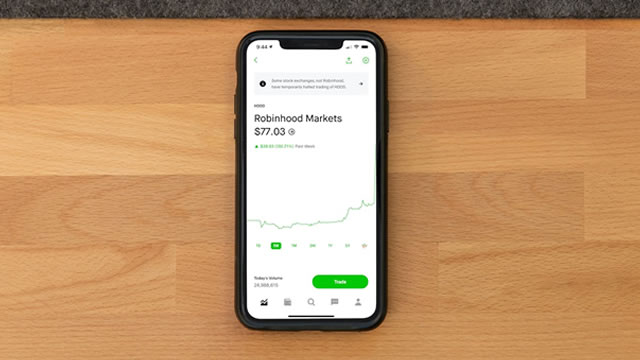

Robinhood Markets, Inc. (HOOD)

Massive News for Robinhood Investors

Robinhood's growth is taking a pause based on recent numbers.

Robinhood Stock Today: Why This Cash Secured Put Could Deliver A 53% Annualized Gain

The trader exits with a very high 5.88% return on capital at risk.

Robinhood Trading Platform to Pay $3.9M for Crypto-Withdrawal Failure

HOOD's trading platform will pay $3.9 million to settle claims that it failed to let customers withdraw cryptocurrency from their accounts from 2018 to 2022.

Robinhood reaches $3.9 mln settlement with California over crypto withdrawals

A cryptocurrency platform run by Robinhood Markets will pay $3.9 million for failing to let customers withdraw cryptocurrency from their accounts from 2018 to 2022, California Attorney General Rob Bonta said on Wednesday.

Robinhood lets Brits lend shares for extra income in bid to grow international footprint

Stock trading app Robinhood on Wednesday launched a new feature in the U.K. allowing retail traders to lend out any stocks they own outright in their portfolio to interested borrowers. Shares lent out via the Robinhood app will be treated as collateral, with Robinhood receiving interest from borrowers and paying it out monthly to lenders.

Surging Earnings Estimates Signal Upside for Robinhood Markets (HOOD) Stock

Robinhood Markets (HOOD) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

Robinhood Stock Soars 85.2% in a Year: Should You Buy HOOD Now?

HOOD stock surges 85.2% in a year. Let's analyze whether it is prudent to buy it at the current levels or wait for the dip in the price.

Robinhood Markets, Inc. (HOOD) is Attracting Investor Attention: Here is What You Should Know

Robinhood Markets (HOOD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

How to Find the Best Top-Ranked Stocks to Buy in September

Exploring how investors can use a Zacks screen to help find some of the best Zacks Rank #1 (Strong Buy) stocks to buy heading into September and the final months of 2024.

4 Bitcoin Related Stocks in Focus as Fed Readies Rate Cut

Crypto-centric stocks like NVDA, IBKR, HOOD and SQ are expected to gain once the Bitcoin rally resumes.

Best Momentum Stocks to Buy for August 22nd

NVMI, HOOD, and QFIN made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on August 22, 2024.

Robinhood: Recent Drop Is A Gift

Robinhood current price/share represents an opportunity to add shares at discount, with an upside target of $30/share. In July-August, Robinhood experienced a 43% market-related price drop and has quickly recovered to about $20/share. Q2 earnings and July monthly metrics show resilient trading activity, record revenue and EPS, record Gold subscribers, despite a deceleration in Crypto activity.