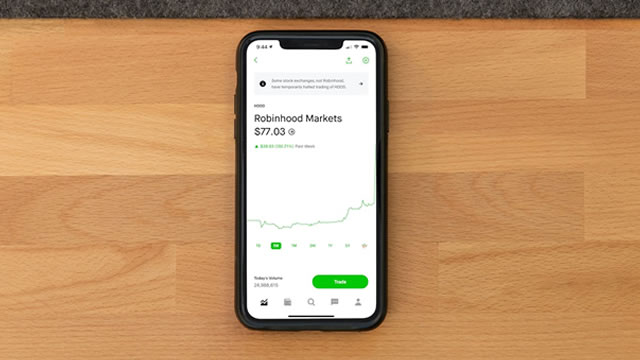

Robinhood Markets, Inc. (HOOD)

Robinhood: 2026 Should Be As Lucrative As Last Year, As New Products Take Off

Robinhood (HOOD) surged nearly 200% in 2025, driven by robust trading activity and aggressive feature rollouts. I reiterate a buy rating, viewing the recent pullback from ~$150 as a renewed buying opportunity. HOOD's acquisition of Bitstamp doubled its crypto volumes, significantly expanding market share and growth potential.

Why Robinhood Markets, Inc. (HOOD) Dipped More Than Broader Market Today

The latest trading day saw Robinhood Markets, Inc. (HOOD) settling at $118.13, representing a -1.92% change from its previous close.

Is Robinhood a Buy, Sell, or Hold in 2026?

Robinhood's revenue doubled in the third quarter, and its stock has made significant gains during the past few years. However, Robinhood is highly dependent on an active trading market, particularly in riskier options and cryptocurrencies.

Investors Heavily Search Robinhood Markets, Inc. (HOOD): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Robinhood Markets (HOOD). This makes it worthwhile to examine what the stock has in store.

Prediction markets are ‘best we've got' for forecasting, Robinhood CEO says

Robinhood Markets CEO Vlad Tenev explains how prediction markets have become the ‘fastest growing business of all time' and discusses their future on ‘Making Money.' #fox #media #breakingnews #us #usa #new #news #breaking #foxbusiness #makingmoney #robinhood #vladtenev #predictionmarkets #markets #stocks #finance #business #economy #trading #forecasting #tech #innovation #growth #analysis

Robinhood Markets, Inc. (HOOD) Surpasses Market Returns: Some Facts Worth Knowing

In the closing of the recent trading day, Robinhood Markets, Inc. (HOOD) stood at $117.16, denoting a +1.17% move from the preceding trading day.

Robinhood's chief brokerage officer on its prediction markets bet

CNBC's "The Exchange" team discusses how Robinhood is betting big on prediction markets with Steve Quirk, chief brokerage officer at Robinhood.

Robinhood expands prediction markets as event trading becomes the next retail battleground

CNBC's MacKenzie Sigalos reports on Robinhood's new slate of prediction markets features, including parlay-style combos and live prop-style contracts for NFL games and players.

What Robinhood's prediction markets push means for fintech industry

CNBC's "The Exchange" team discusses Robinhood's expansion into prediction markets and what it means for the broader fintech industry with Dan Dolev of Mizuho.

Robinhood CEO Talks Prediction Markets, 'Trump Accounts'

Robinhood Chair and CEO Vlad Tenev says prediction markets could be at the beginning of a supercycle. Speaking on "Bloomberg Markets," Tenev also says the company is standing ready to help with "Trump accounts.

3 Brokerage Stocks Up More Than 20% in 2025 to Watch for Next Year

HOOD leads a brokerage rally in 2025, followed by SCHW and IBKR, as digital trading, rising volumes and new accounts push stocks up.

How Much Upside is Left in Robinhood Markets (HOOD)? Wall Street Analysts Think 30.14%

The mean of analysts' price targets for Robinhood Markets (HOOD) points to a 30.1% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.