Intel Corporation (INTC)

Wall Street Is Pounding the Drum on These Stocks Today: INTC, AMZN, COIN, MSFT, NVDA

The image featured for this article is © 24/7 Wall St.

Intel's 3Q Takeaways: NVIDIA Partnership, Government Cash, and What It Means for the Future

Intel deepens NVIDIA partnership to anchor AI inference strategy and expand its role in hybrid computing.

Nvidia Stock Rises. How Intel Is Boosting the Chips Sector.

Nvidia stock and the chip sector in general could be being boosted by upbeat results from Intel.

Here's how much Trump is up on Intel following its Q3 earnings report

Intel (NASDAQ: INTC) beat all market expectations with its third-quarter earnings report released on Thursday, October 23, which cited $13.7 billion in revenue (a 3% increase year-over-year).

Intel to Take on Broadcom: 3 Reasons the Stock is Surging 8% After Q3 Earnings

Intel (Nasdaq: INTC) reported Q3 earnings and the stock is up 8% after-hours.

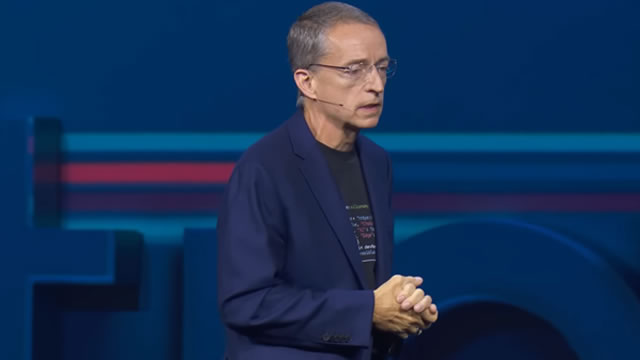

Intel Corporation (INTC) Q3 2025 Earnings Call Transcript

Intel Corporation (NASDAQ:INTC ) Q3 2025 Earnings Call October 23, 2025 5:00 PM EDT Company Participants John Pitzer - Corporate Vice President of Corporate Planning & Investor Relations Lip-Bu Tan - CEO & Director David Zinsner - Executive VP & CFO Conference Call Participants Ross Seymore - Deutsche Bank AG, Research Division Joseph Moore - Morgan Stanley, Research Division Christopher Muse - Cantor Fitzgerald & Co., Research Division Blayne Curtis - Jefferies LLC, Research Division Stacy Rasgon - Sanford C. Bernstein & Co., LLC.

Intel (INTC) Reports Q3 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Intel (INTC) give a sense of how the business performed in the quarter ended September 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Intel (INTC) Tops Q3 Earnings and Revenue Estimates

Intel (INTC) came out with quarterly earnings of $0.23 per share, beating the Zacks Consensus Estimate of $0.01 per share. This compares to a loss of $0.46 per share a year ago.

Intel surpasses Q3 earnings expectations as outlook falls short of forecasts

Intel Corp (NASDAQ:INTC, ETR:INL) reported stronger-than-expected third quarter results, with revenue and adjusted earnings per share beating Wall Street estimates, but its fourth quarter guidance came in slightly below expectations amid ongoing strategic shifts The designer and manufacturer of computer components reported Q3 revenue of $13.7 billion, up 3% from the year-ago quarter and ahead of estimates of $13.15 billion. Adjusted earnings per share (EPS) were $0.23, far ahead of the consensus $0.01 and a significant improvement from a loss per share of $0.46 in Q3 last year.

Intel's stock is climbing as earnings show a turnaround slowly taking hold

The company topped revenue expectations said it's “having a difficult time meeting all the demand that's out there” because of supply constraints.

Intel Shows Progress in First Earnings Report Since U.S. Investment

The troubled chipmaker posted third-quarter profit of $4.1 billion on improved sales.