Intel Corporation (INTC)

When Will Intel Rebound?

Intel (NASDAQ:INTC) stock jumped by nearly 8% during Tuesday's trading session. While there weren't many stock-specific factors to justify such a significant move, tech stocks overall have been on an upward trend, driven by positive sentiment regarding the generative artificial intelligence phenomenon.

Intel: A Deep Dive Into The Turnaround Potential

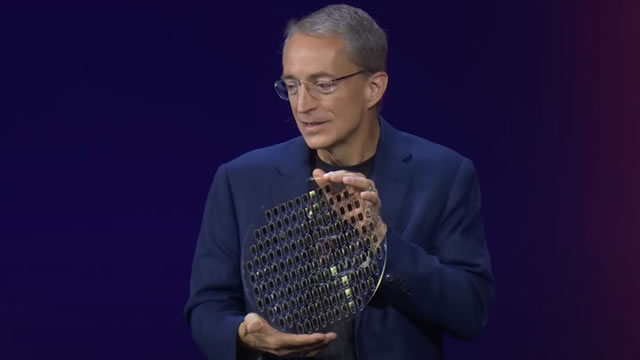

Intel is a turnaround play, attractively priced for long-term investors willing to bet on recovery under new, experienced leadership. The company faces fierce competition, margin pressure, and technological lag, but has strong assets, government support, and a solid balance sheet. AI and foundry opportunities, cost-cutting, and strategic investments could drive future growth, though risks remain significant and execution is critical.

Is Intel the Turnaround Stock of 2025 and a Buy Now?

INTC stock jumps 10% amid Lip-Bu Tan's CEO debut and optimism for a 2025 rebound, despite recent foundry setbacks.

Buy Intel Low Before It Explodes Higher

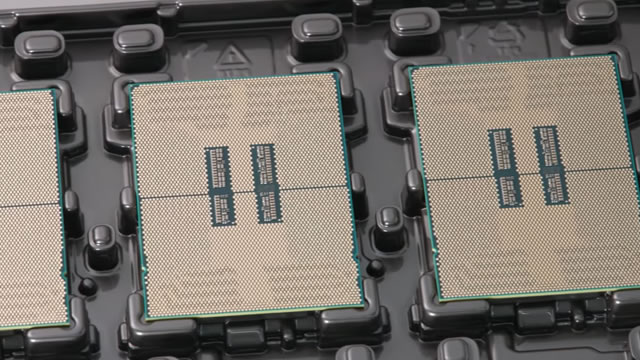

I maintain my 'Buy' rating on Intel, seeing recent recovery as insufficient given ongoing undervaluation and positive corporate changes. New CEO Lip-Bu Tan's cost-cutting and restructuring initiatives are driving improved margins and free cash flow, with further upside potential. While Q2 guidance is cautious, underlying demand from AI PCs, Windows 10 end-of-life, and server upgrades, plus the 18A process ramp, offer significant top-line potential.

Intel Is Positioned For A Heroic Comeback

Intel is making a grand comeback, and this time, it's not messing around. With lessons learned and management's heart in check, the company is poised for an AI-era resurgence. I'm an investor who buys a stock before the waves build. While others try to get their surfboards on top of the tsunami, I'll have risen with it. Don't treat this like a short-term trade. It's a long-term commitment. Now is the best time to buy, and investors who hold through rain or shine won't regret it.

INTC Plunges 35% in the Past Year: Should You Dump the Stock?

INTC stock plunges 35% in a year as margin pressures, China risks and AI missteps cloud its turnaround efforts.

Intel's Dual Gamble: AI Innovation Now, Foundry Fortunes Later?

Intel Corporation NASDAQ: INTC continues pursuing a demanding dual strategy to revitalize its market standing and financial health. The company's stock price is hovering near $20.25 in early June 2025, reflecting a significant investor evaluation of its turnaround prospects.

Intel: Wall Street Is Asleep At The Wheel

I am reiterating my "Buy" rating on Intel, believing the market is overly pessimistic. New CEO Lip-Bu Tan is the right leader to execute a successful, sustainable turnaround. Tan's strategy focuses on cutting bureaucracy, selling non-core assets to reduce debt, and fostering an engineer-driven culture that prioritizes R&D to restore Intel's innovation engine. Intel's strategic moves in AI, including the Saimemory partnership and product roadmap, position it well to regain share in key markets.

Intel: A Potential Generational Buying Opportunity Under Lip-Bu Tan

I remain bullish on Intel Corporation, viewing the new CEO Lip-Bu Tan as a catalyst for a generational turnaround and long-term growth. Tan's proven track record and early strategic moves—cost cuts, renewed focus, and AI initiatives—position Intel for success in emerging tech sectors. Intel is poised to benefit from onshoring, AI, quantum computing, and humanoid robotics, with the market underestimating these future opportunities.

Intel Corporation (INTC) BofA Securities 2025 Global Technology Conference (Transcript)

Intel Corporation (NASDAQ:INTC ) BofA Securities 2025 Global Technology Conference June 3, 2025 5:40 PM ET Company Participants Michelle Johnston Holthaus - CEO Conference Call Participants Vivek Arya - Bank of America Vivek Arya Vivek Arya, from BofA's semiconductor semicap equipment research team, and I'm really delighted to have the team from Intel join us today, Michelle Johnston Holthaus or MJ, as most people refer to her as -- really happy that you could join us. Michelle Johnston Holthaus Thanks for having me.

Intel Corporation (INTC) Is a Trending Stock: Facts to Know Before Betting on It

Intel (INTC) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Intel's Turnaround May Be the Best Bet No One's Watching

Recent semiconductor sector news from late May indicates that Intel Corporation NASDAQ: INTC has discovered an alleged embezzlement, which media outlets have dubbed the "chip bandit." Over $840,000 was reportedly involved in the embezzlement at its Israeli operations.